The post How to Read and Trade Japanese Candlesticks appeared first on Index Fundings.

]]>How to Read Japanese Candlesticks

Japanese candlesticks come in different sizes and shapes, all affirm different sentiments in the market. In addition, it is essential to familiarize oneself with the candlestick's color, body and wick.

In most cases, the color will tell whether the prevailing market condition is bullish or bearish, signaling who has the upper hand. The body displays the opening and closing prices, while the wicks show the highest and lowest ranges.

In most price charts, it is common to find green Japanese candlesticks associated with upward movement or bullish momentum. The candlesticks signal buyers are in control and looking to push prices higher. On the other hand, red candlesticks are associated with downward movement or bearish momentum. The candlestick underscores sellers or bears in control and looks to push prices lower.

How to Trade Japanese Candlesticks

In addition to the color coding, the bigger the body of the candlestick, the stronger the momentum. For instance, if the green candlestick has a big body with small wicks, it signals strong bullish momentum affirming bulls in control. Likewise, a red candlestick with a big body affirms strong bearish momentum, implying sellers are in control and likely to push prices lower.

Source: Ig.com

On top of the candlestick, the body is the opening price affirming the level at which the price is opened at a given period. The bottom of the candlestick body signals the closing price or the level at which the price closed at a given period.

The highest point of the wick on either bearish or bullish candlestick signals the highest price level reached at a given time, while the lowest point of the wick signals the lowest point.

Whenever the wick is bigger than the body of the Japanese candlestick, it implies heightened volatility during the given period. Therefore, buyers and sellers were vying for control. On the other hand, if the long wick occurs at the top of the candlestick body, it implies that users tried to push the price higher but came under pressure from bears who pushed the price lower.

Similarly, if the long wick occurs below the candlestick body, it implies sellers tried to push the price lower but came under pressure from bulls. Consequently, the bulls pushed the price higher, resulting in a small body and a long wick to the downside.

Types of Japanese Candlesticks

Japanese candlesticks are broadly classified into three types:

- Single candlestick

- Double candlestick

- Tipple Candlestick

Japanese Candlesticks Explained

Single Candlestick

They are the simplest forms of Japanese candlestick patterns made up of one candlestick that forms the building blocks of longer patterns. Below are some of the top single candlestick patterns.

Spinning Tops

It is a candlestick with a long wick on either side and a small or narrow body. The candlestick can be bullish and bearish, depending on where it occurs.

The occurrence of the candlestick implies a fierce tug of war between buyers and sellers, resulting in price opening and closing almost at the same level. However, the canceling action between buyers and sellers results in little or no actual movement.

Source: Ig.com

If the spinning top were to occur at the top of an uptrend, it would imply the upward momentum is fading as buyers come under pressure. Instead, price opening and closing almost at the same level imply sellers are pilling pressure and that a reversal could be in the offing.

Similarly, if the spinning top occurs at the base of a downtrend, it would imply waning downward momentum as bulls enter the market and pile pressure on sellers. Consequently, the prospect of price bouncing back with the entry of buyers into the market is usually high.

Marubozu

A Marubozu is a candlestick with no wick on either side. In the case of a bullish candlestick, the price opens at its lowest level and closes at its highest level. Likewise, a bearish candlestick price opens at its highest level and closes at its lowest level.

Source: Howtotradeblog.com

A green Marubozu candlestick implies solid momentum upward, with bulls pushing the price higher against little or no seller resistance. If it occurs as part of an uptrend, the price will likely continue increasing. Similarly, if it occurs in a downtrend, it implies that the price is about to reverse as bulls flock to the market.

A red Marubozu candlestick implies sellers are in control and pushing the price lower with little or no buyer resistance. If it occurs in a downtrend, it suggests price will likely continue moving lower. If it happens in an uptrend, the price is expected to reverse and move lower as short sellers flock to the market.

Doji

Another popular candlestick appears as a very thin line with no body but long wicks. The lack of body implies a balance in the market as bears and bulls cancel each other's actions. The occurrence of a Doji is usually an early indication of an upcoming reversal.

Source: dailyfx.com

Consequently, if the price was in an uptrend and a Doji occurred, it implies waning upward momentum and the prospect of price reversing and moving lower. Likewise, if it occurs in a downtrend, it implies a weakening downward momentum and higher prospects of price correcting and moving up.

Other popular single Japanese candlestick patterns include Hammer and invested Hammer, hanging man and shooting star.

Double Candlestick Patterns

Double Japanese candlesticks generate a trading signal or share sentiments on price action from two candlesticks instead of one. While such patterns mostly hint at potential reversals, they may also affirm continuation.

Bullish and Bearish Engulfing

They are the most popular double candlestick patterns that affirm potential price reversal. For example, a bullish engulfing candlestick is characterized by a large bullish candlestick that engulfs the previous bearish candlestick. The pattern indicates that bulls have overwhelmed bears and are ready to drive prices higher.

Source: Forextraininggroup.com

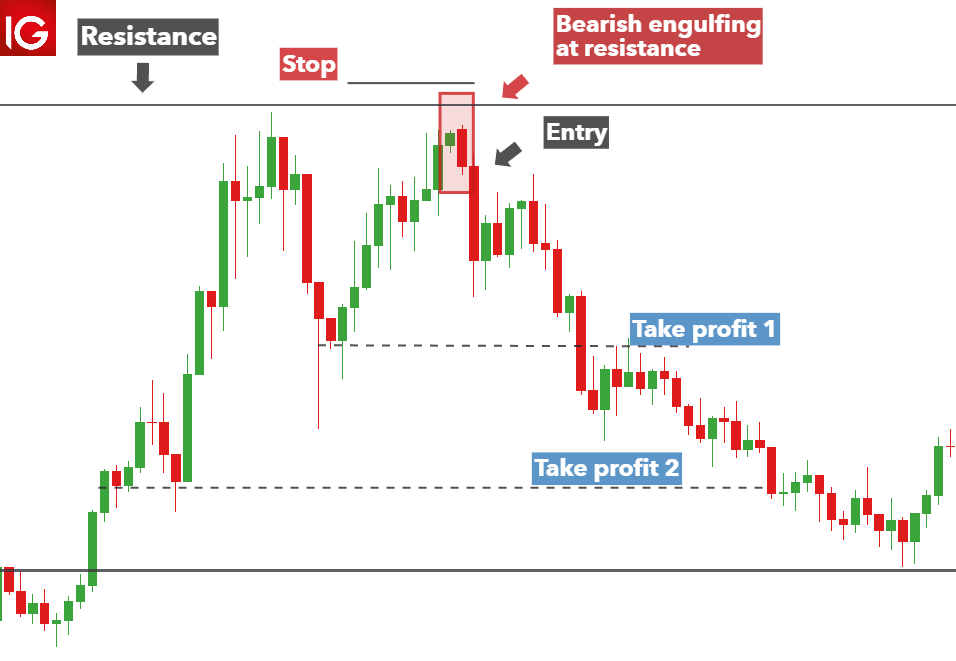

The bearish engulfing occurred at the top of an uptrend and was characterized by a large bearish candlestick engulfing the previous bullish candlestick. The pattern suggests that bears have dominated bulls and are ready to push prices lower.

Harami

It is a backward engulfing pattern whereby a large bullish or bearish candlestick is followed by a smaller one in the opposite direction. A bullish harami pattern comprises a large bearish candlestick followed by a small bullish candlestick that opens and closes within the body of the bearish candlestick.

Source: dailyfx.com

The emergence of the small bullish candlestick contained within the bearish candlestick implies the downtrend momentum is waning, and a reversal to the upside could be in play.

A bearish harami comprises a large bullish candlestick followed by a small bearish candlestick contained within the body of the first. The smaller bullish candlestick implies the bearish momentum is waning, and that price will likely bounce back and edge higher.

Tweezers

It comprises two identical candlesticks in opposite directions. The emergence of the candlesticks implies the prospects of an upcoming reversal.

Source: Ig.com

If it were to happen in an uptrend, it would appear as a green candlestick with a small wick at the top, followed by a red bearish candlestick of the same size and the same wick. The prospect of price edging lower is usually high.

Source: Ig.com

In a downtrend, the tweezer will appear as a red candlestick with a small wick at the bottom, followed by a green candlestick with a small wick at the bottom. The prospect of the price bouncing back is usually high following the pattern.

Triple Candlestick Patterns

Tipple Japanese candlestick patterns are made across three consecutive periods. Therefore, they consist of three candlesticks used to provide trading signals. They stand out as they provide some of the strongest signals.

Morning Star

It occurs after the price has moved lower significantly to the point of indecision. The first candlestick is usually bearish, signaling bears are in control and likely to lower prices. However, it is followed by an indecision candlestick, such as a spinning top or doji, that implies exhaustion to the downside.

Source: Ig.com

The appearance of a third bullish candlestick affirms bulls have overpowered bears and are now poised to push prices higher.

Evening Star

It occurs at the top of an uptrend. It starts with a large bullish candlestick that affirms bulls are in control and likely to push prices higher. The candlestick is followed by an indecision candlestick, such as a spinning top or doji, implying waning upward momentum.

Source: Ig.com

The appearance of a large bearish candlestick implies bears have overpowered bulls and are poised to lower prices.

Three White Soldiers and Three Black Crows

Three white soldiers appear after an extended downtrend followed by consolidation. It comprises three candlesticks. The first opens within the previous bear candlestick and closes slightly above. The second candlestick opens above the first and closes above with a bigger body than the first. Finally, the third candlestick, with a much bigger body than the first two, opens and closes slightly above.

Source: Ig.com

The appearance of three consecutive bullish candlesticks affirms a buildup in upward momentum. Consequently, the prospect of price edging higher is usually high.

Source: Ig.com

Three black crows are the opposite of the Three white soldiers, comprising three bearish candlesticks, each opening and closing below the previous one. Additionally, their sizes keep on increasing. Their appearance affirms a buildup in selling pressure, suggesting it is time to short eye positions.

Understanding Japanese Candlesticks

Japanese candlesticks stand out for their ability to provide valuable information on price action better than traditional line charts. Their ability to show the high and low points and the opening and closing price levels allows traders to understand market sentiments.

Traders rely on these candlestick patterns to ascertain the market's direction based on previous price action. While trading Japanese candlesticks, traders look at the patterns and shapes created by the candlesticks as they oscillate up and down.

Bottom Line

Japanese candlesticks are vital trading tools that display data to traders that affirm the state of the market. Based on the various patterns, traders can better understand the prevailing trend and which side has the upper hand. Consequently, technical traders use them to predict future price action on understanding the prevailing market sentiment.

The post How to Read and Trade Japanese Candlesticks appeared first on Index Fundings.

]]>The post How to Trade Bullish and Bearish Flag Patterns appeared first on Index Fundings.

]]>Bulls Flag vs. Bear Flag

When the market is trending, traders are looking to “ride the trend”. The way to do that is to find a continuation pattern. A bull flag is a continuation pattern for when the market is trending up and a bear flag is a continuation pattern for when the market is trending down.

Even when the market is clearly trending, it never moves in one direction only. A trending chart is a series of impulse moves and pullbacks. The big jumps in the market are the impulse moves that either start a trend or continue it. But “what goes up eventually has to come back down”, and the market typically retraces part of the move before continuing in the trend’s direction.

The trick to trading the bull flag or the bear flag is to wait for the pullback to come to an end and trade the continuation of the trend.

Bull Flags

Although flag patterns come in all different shapes and sizes, every flag pattern has two parts: a flagpole and the flag. There are three main types of flag. In a bullish chart, the three main bull flags are:

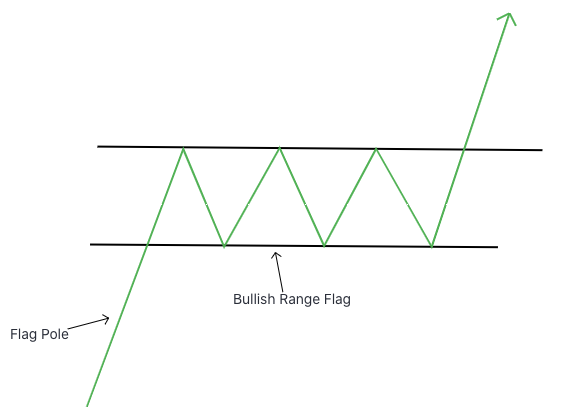

- A bullish range flag.

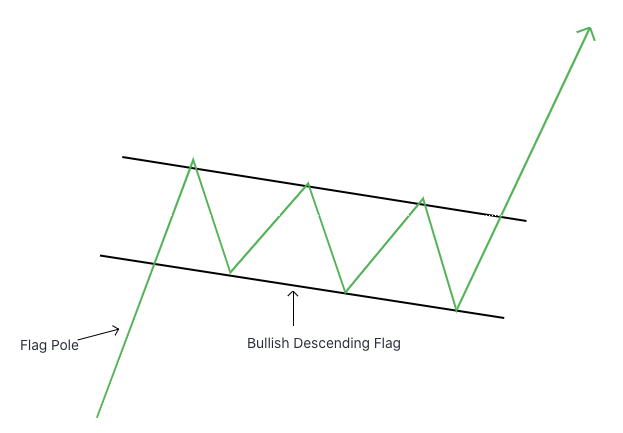

- A descending channel flag.

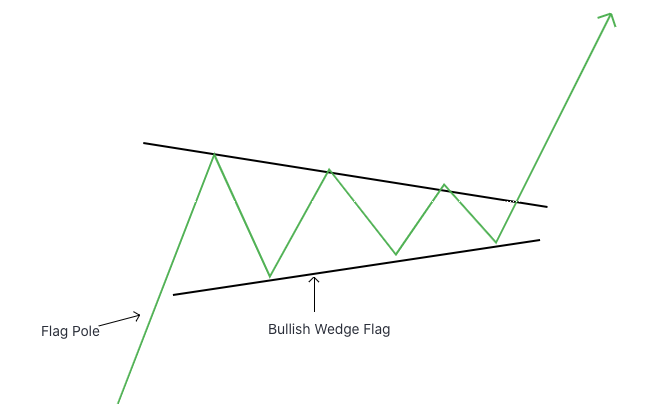

- A bullish wedge flag.

- Bullish range flag: Notice how the old price action on the left looks like an ascending pole. That is the impulse trend of the market. The price then begins to range sideways before it continues moving upward. That is the flag that signals a temporary pause in the upward trend. Once the price action breaks past the range’s resistance and continues higher, that's the signal to hit buy in continuation of the trend.

- The next bullish flag is the descending channel flag: Here we have another ascending flagpole on the left but this time the pause in the uptrend is more drastic, as we start to see lower highs and lower lows. But with the lower highs and lower lows, we’re still noticing a symmetrical channel that's descending. This descending channel is the flag. Once the price action breaks up past the resistance of the channel, we have a signal to hit buy in continuation of the uptrend.

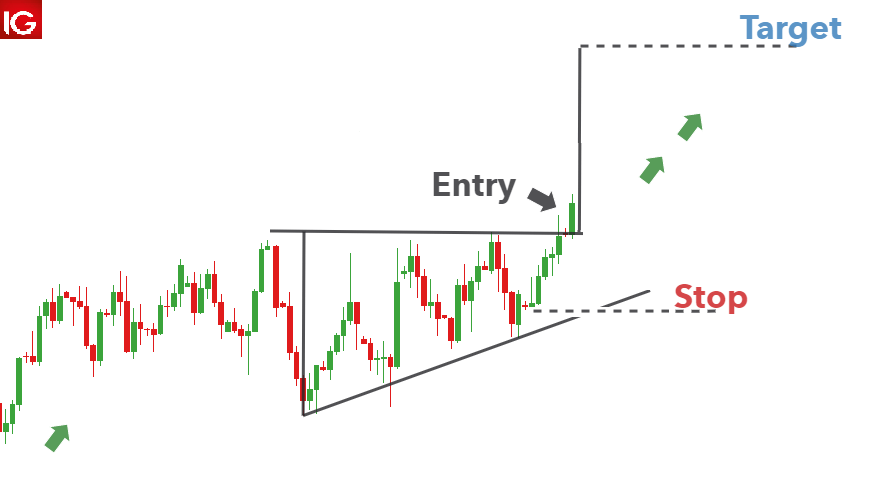

- Finally, we have the bullish wedge flag. In this pattern we will notice the same impulse move upward, which is represented by the ascending flagpole. Then price action pauses and starts to cluster, seemingly unsure if it will go higher or lower. In the wedge, the highs are getting lower and the lows are getting higher. This type of price action is a sign of building pressure. Once the price action breaks upward, we have a signal to buy in continuation of the trend.

Bear Flags

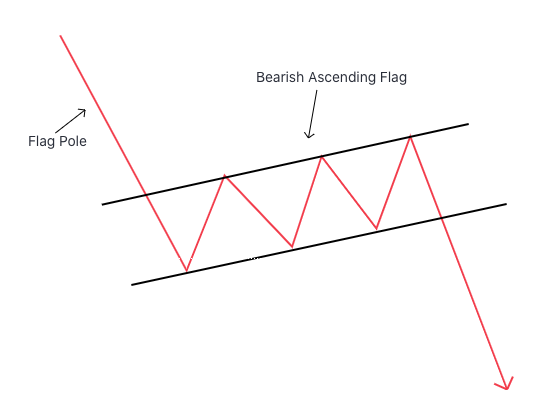

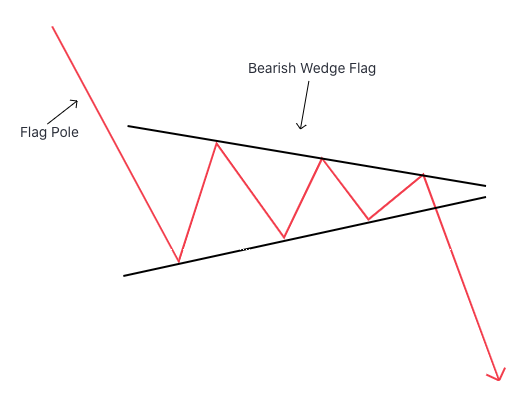

Now let's examine bear flags. There are three main types of bear flags:

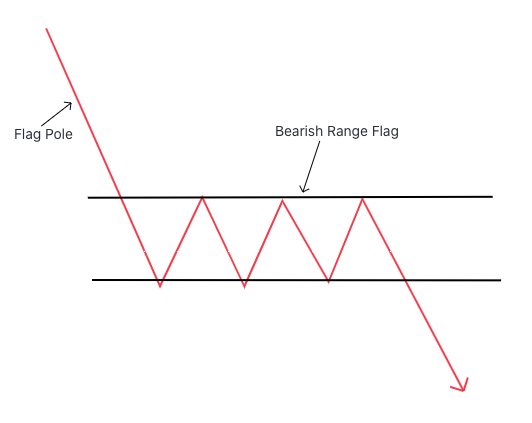

- A bearish range flag.

- An ascending channel flag.

- A bearish wedge flag.

- Bearish range flag: Notice here how the old price action on the left looks like a descending flagpole. That is the impulse down-trending move of the market. Then price action starts to range sideways before it continues moving downward. This range is the flag that signals a temporary pause in the downward trend. Once the price action breaks past the range's support and continues lower, we have a signal to hit sell, in continuation of the trend.

- The next bear flag is the ascending channel flag: Here we have another descending flagpole on the left, but this time the pause in the downtrend is more drastic, as we start to see higher highs and higher lows. But with the higher highs and higher lows, we’re still noticing a symmetrical channel that's ascending. This ascending channel is the flag. Once the price action breaks down past the support of the channel, we have a signal to sell in continuation of the down-trend.

- Then we have the bearish wedge flag. In this pattern we have the same impulse move down that is represented by the descending flagpole. Then the price action pauses and starts to cluster, not sure if it will go higher or lower. In the wedge, the highs are getting lower and the lows are getting higher. This type of price action is a sign of building pressure. Once the price action breaks downward, we have a signal to sell if the trend continues.

It’s important to note that a setup always needs a confirmation signal. In other words, even after identifying a flag pattern a good trader has a signal - either a specific candle or maybe a set of candles - that he's looking for before executing the trade.

How to trade the Bearish Flag Pattern

Take a look at this bear flag on the Daily chart of the EUR/USD: Notice the flagpole and the channel. Note how the last 4 candles in the channel before the price action continued downward were all small candles. The market was clearly indecisive for those last four days before it broke out. That “pressure” might be a signal for a trader that the channel is coming to an end and the market will continue downward.

What is a Bullish Flag

Here’s another example of a bullish descending channel flag from the CAD/JPY 5M chart. Here again you see the ascending flagpole followed by the descending channel flag and then the breakout:

Let’s take a closer look at the breakout and we can see some clues of it coming. Notice how the lows in the channel were ascending. Then there was a big wicked candle showing bullish pressure. After that wick, there was clear indecision in the market right at the top of the channel followed by the breakout.

Identifying these patterns is the first step in trading them, but for a higher winning percentage a trader wants to find clues and signals within the candles themselves to give himself a better edge.

We hope this lesson in bull flags and bear flags helps you develop that edge you’re looking for. Always remember that the trend must take a pause before continuing. Successful traders don’t chase the trend but wait for pullbacks. Then they identify patterns, like these flag patterns and finally they see a confirmation candle, or set of confirmation candles, before triggering and opening their winning positions.

Happy trading!

The post How to Trade Bullish and Bearish Flag Patterns appeared first on Index Fundings.

]]>The post Top 4 Continuation Candlestick Patterns appeared first on Index Fundings.

]]>Candlestick charts are a benchmark of Forex trading, one that you must familiarize yourself with to make informed decisions. Continuation patterns occur over some time to indicate asset price movements, market pressures, and volatility.

By displaying how an asset's price moves, candlestick bars and charts relay that information to FX traders as technical analysis. A trader can decrypt fluctuations by reading a few patterns and recognizing significant resistance and support levels.

Why Should You Use Candlestick Patterns When Trading?

To correctly read the market landscape and asset price movements, a trader relies on candlestick bars, which form charts and patterns. It's one of the easiest ways to plot the prices of equities, recognize trends, and predict the market's direction.

Unlike other indicators, namely area, figure, line, and point, candlesticks tell a lot more about aspects of the trend, such as opening and closing prices. Above all, with candlestick charts, you'll gain valuable market psychology insights, especially on investor and trader behavior.

You'll achieve a profitable edge once you understand the market's psychology and that of its participants, which improves your entries and exits.

Contrary to what you may think, candlestick patterns aren't a modern trading innovation, though, as they're thought to have originated in Japan. A rice trader named Munehisa Homma became very wealthy using candlestick patterns in the 1700s.

Steve Nison, the author of 'Japanese Candlestick Charting Techniques, 1991,' is credited with introducing the technical analysis method to the west.

Source: https://www.ig.com/en/trading-strategies/japanese-candlestick-trading-guide-200615

How Are Candlestick Patterns Read?

One of the advantages of using candlestick patterns as opposed to other technical analysis measures is that they show you more than an asset's opening and closing prices.

Besides doji, dragonfly, and gravestone bars, candlesticks bars are rectangular. With the color green indicating bullish bars while red is bearish.

You can also read the high and low status of a price opening and closing by the line sticking out. Each end of the candlestick is known as a wick or shadow. These horizontal lines stick out at each of the bar's top and bottom sections, except in the case of Marabozu or shaven head candlesticks.

While it's essential to know the names of different types of candlesticks, you can benefit your trading results by learning the significance of various candlestick charts. To read candlestick bars,

- The top of the body represents the opening price on bearish bars, while the bottom denotes the same on a bullish candlestick. It's also true for the closing price, which is reflected by the bar's top part in bullish candlesticks and the bottom in bearish ones.

- The bar's top wick denotes the highest trading price for the asset in any given session. While the bottom reflects the lowest price traded.

- A candle's location and color will indicate the price direction and the distance between the highest and lowest price. Thus showing that asset's sessional price range.

What is a Continuation Pattern?

An individual candlestick bar makes a chart which ultimately results in a pattern in which a trader leverages insight into market selling and buying pressures along with any indecision. Forex traders are naturally inclined to spot price reversals. So they'll ride a trend further, and skill in using continuation candlesticks comes in handy.

A continuation candlestick pattern is recognizable as it shows a continual current price trend. And you’ll notice attributes such as when an asset skips a price point. These gaps in prices can gap up or down by skipping points forward or downward. Essentially indicating areas of support or resistance.

You must recognize and spot gaps caused by selling and buying interests during market closing hours, over weekends, and after important news events. As such, a gap candlestick pattern indicates the direction of the market plus the sentiments of investors and traders regarding the open-close prices of an asset.

Continuation, one type of gap among others like breakaway and exhaustion. Shows that the price skip occurred in the middle of the trend and closed within two days. In essence, these gaps happen while the asset price is on an uptrend, but only for assets that don't trend for months.

Source: https://forexbee.co/bearish-continuation-candlestick-patterns/

What Are the Top Continuation Candlestick Patterns?

The continuation candlestick pattern signals a prevailing trend once the breakout is confirmed and after a temporary trading pause in the market. It’s the opposite of price reversal points, as they indicate the likelihood of trends continuing in the same, higher direction.

Buyers control the price action as long as an uptrend happens. And bullish continuation candlestick patterns will show a series of higher highs and higher lows. For instance, you can continue holding your position when bullish continuation patterns occur above the market price.

Variety in continuation candlestick patterns means different gaps or market pauses from which to read sideways market movement. You can determine whether the pause in market activity or a short-term trend will resume in its current direction, allowing you to ride it further.

There are several types of continuation patterns.

Gaps

As short-term trading patterns, gaps represent the primary use of Japanese candlesticks alongside other traditional bar charts. When the buyers outnumber sellers during close market hours, a gap will occur at the beginning of the trading session.

While a bearish gap is this configuration but the other way round, there are several types of gap candlestick patterns:

The Tasuki Gap

Known as the upside Tasuki gap, it's a bullish continuation candlestick pattern made up of three bars, with the third bar partially closing the gap. The second candlestick opening is higher than the first one’s closing, and the third opens lower than the second’s closing.

While the third candlestick in a Tasuki gap continuation falls short of closing the gap, the two wicks before the first bar represent the previous trend's price range. The gap is bullish because it signals an uptrend despite the color change from green to red on the last bar.

Besides signaling the asset's uptrend nature, another psychology behind this continuation candlestick pattern is that the bears step in. That's when a downside Tasuki gap happens after bulls have been in firm price point control. The bulls, however, return in force after the third candlestick price pushdown. And the market closes higher than its lowest point.

Source: https://forexbee.co/downside-tasuki-gap-candlestick-pattern/

Gapping Play

A gapping pattern involves a large-bodied candlestick followed by two or three small-bodied candles. Whether high in an uptrend or low in a downtrend, the last candlestick is another long-bodied bar in that same direction after a gap.

Side By Side, White Lines

The side-by-side white lines gap continuation pattern features a similar 3-candle arrangement as the upside Tasuki gap, but the third candlestick follows the direction of the last two. All the bars in this technical analyzer are green, signifying the bulls control the asset's price points.

Two white lines before the side-by-side continuation pattern reflect the price range on that uptrend. The psychology behind the third candlestick gapping up slightly is that bears have stepped in to test the bull’s strength, but they weren't ready to relinquish price point control.

Three White Soldiers and Three Black Crows

An easy-to-spot pattern features three short wicked candles in a row, and the 3 white soldiers are bullish while the black crows are bearish. The three white soldiers pattern is interpreted to mean the trend has strong momentum and is likely to continue, despite showing signs of exhaustion.

Source: https://www.adigitalblogger.com/chart-patterns/three-white-soldiers/

Three soldiers' pattern is also called the three-line strike. A bullish gap that appears when the second candle’s opening is higher than the previous candle’s closing. However, its low doesn't reach the level of the first candlestick.

The Rising Three and Falling Three Method

One large bullish candle followed by three bearish bars in the opposite direction signifies a rising or falling-three method of continuation patterns. A third large-bodied candle matches the first one in size, color, and directio. And the variation of this pattern is called the Mat Hold.

Separating Lines Pattern

Separating lines patterns features a first candlestick opening against a prevailing trend, while another candle opens at the first's price. It is also called the Thrusting Line method with variations, such as reversal and continuation candlestick patterns create an internal gap. And two lines before the bars represent the asset's price range.

Bottom Line

You'll often use candlestick patterns alongside technical analyzers like moving averages to support your buying or selling decisions. Continuation candlesticks patterns will help you identify the gaps in the market on which you can read the price movement and indecision on neutral.

After robust directional moves, a gap or continuation candlestick pattern may indicate the acceleration of a trend. While not prone to false signals, trends often last longer and offer buy or sell opportunities than reverse patterns.

The post Top 4 Continuation Candlestick Patterns appeared first on Index Fundings.

]]>The post Top 6 Reversal Patterns in Forex appeared first on Index Fundings.

]]>What is a Reversal Pattern?

A reversal pattern is a price pattern that marks a turning point between rising and falling prices. It hints at potential changes in the direction of price movements. For example, if prices were increasing, the appearance of reversal patterns signifies that a change in direction to the downside could be in the offing. Similarly, if prices were dropping and a top reversal pattern occurred, it might as well signal that the price is about to bottom out and start increasing.

How Do Chart Reversal Patterns Occur?

Candlestick reversal patterns occur whenever there is a significant change in market momentum. For example, if the prevailing momentum were bullish, resulting in prices making higher highs, a shift in momentum from bullish to bearish would eventually result in prices dropping and starting to make lower lows.

Likewise, if prices were dropping, signifying strong bearish momentum, whenever reversal candlesticks occur, they imply a change in momentum from bearish to bullish. Consequently, prices will eventually bottom out and start moving up, making higher highs.

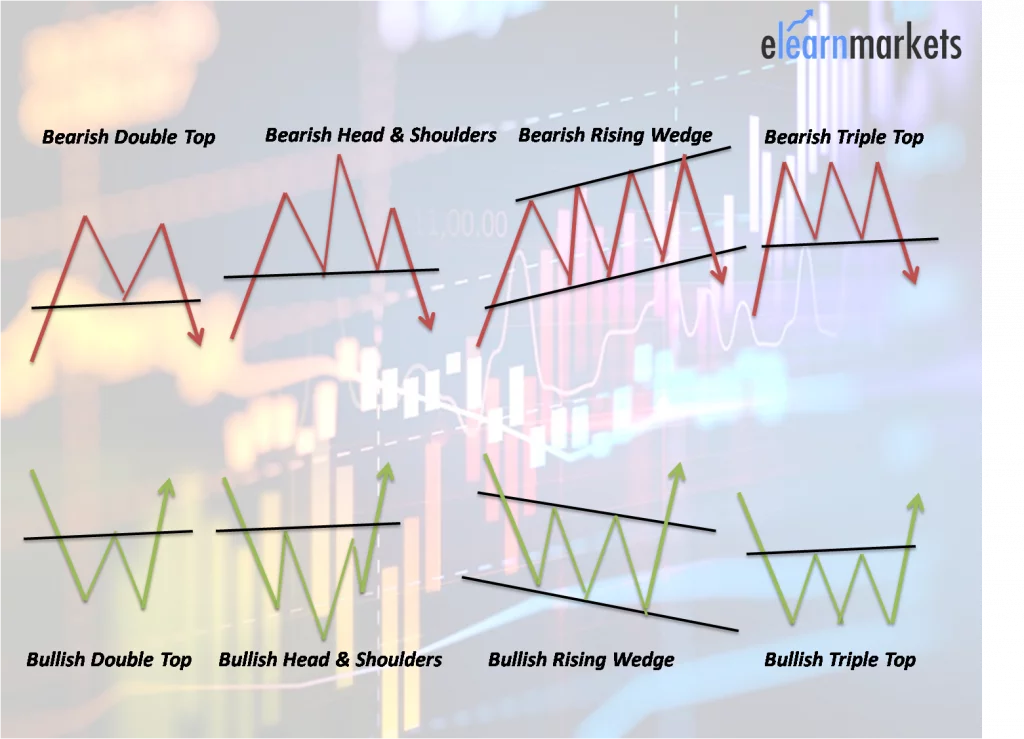

Reversal patterns are classified into two categories. Bearish Reversal Patterns occur whenever prices increase and start moving lower, affirming a change in momentum from bullish to bearish. Bullish Reversal Patterns occur whenever prices are moving lower and start moving up, confirming a shift in momentum from bearish to bullish.

Below are some of the top reversal patterns in forex

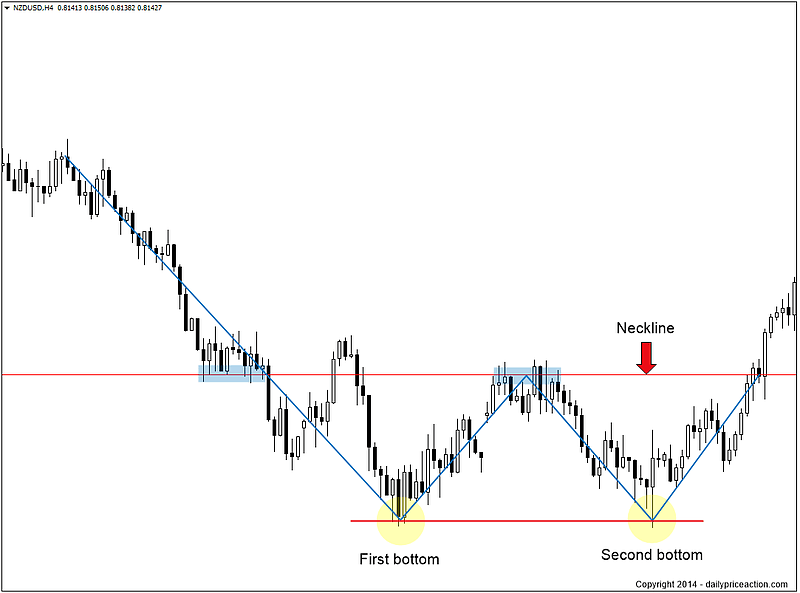

Double Top and Double Bottom

A double-top reversal pattern occurs when the price has increased significantly to levels where overbought conditions kick in. Once the price hits a strong resistance level, it struggles to move up further, resulting in the first top.

Afterward, prices drop, but buyers come into the fold and try to push prices up. However, failure to push the price above the previous high results in strong rejection from short sellers, who push the price lower.

Source: Tradingview.com

The emergence of two tops at the resistance level affirms a buildup in selling pressure confirming the prospects of price edging lower as short sellers have overpowered bulls. Once the price breaks the neckline or support level, it affirms a double top signaling price is well poised to drop.

Double bottom, on the other hand, occurs after the price has dropped significantly, triggering oversold conditions. Once the price hits a strong support level, buyers flock to the market and try to buy at the new lows. The result is a bounce back in price from the recent lows.

Source: Tradingview.com

Nevertheless, short sellers don't lose hope and try to push prices lower after the bounce back. Failure to push the price below the previous low results in the formation of two bottoms at the same level. Once buyers notice short sellers are struggling to push prices lower, they flock to the market and push prices higher following the double bottom formation.

Once the price breaks above the resistance level above the two bottoms, it affirms a breakout, signaling the price is likely to increase. Consequently, it presents an opportunity for traders to open buy positions.

The double bottom is complete once the price breaks above the trigger line.

Bullish and Bearish Candlestick Reversal Patterns

Bullish and Bearish engulfing patterns are the most popular and common chart reversal patterns. The two stand out as they are easy to detect and are made up of two candlesticks.

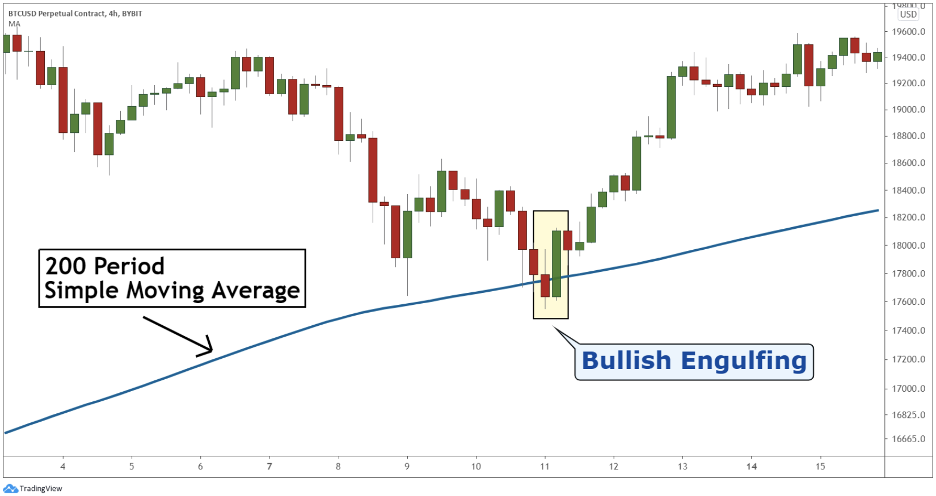

The Bullish Engulfing reversal price patterns occurs during a downtrend as short sellers continue to push prices lower. However, after the price has tanked significantly, the short-selling pressure tends to wane as buyers start to flock to the market.

Source: Tradingview.com

Once the price hits a strong support level, buyers flock to the market, buying the new lows and pushing the price higher. The result is the formation of a large bullish candlestick that engulfs the previous bear candlestick.

The formation of a large bullish candlestick that engulfs the bearish candle affirms bulls have overpowered bears and are poised to push prices higher away from the underlying downtrend.

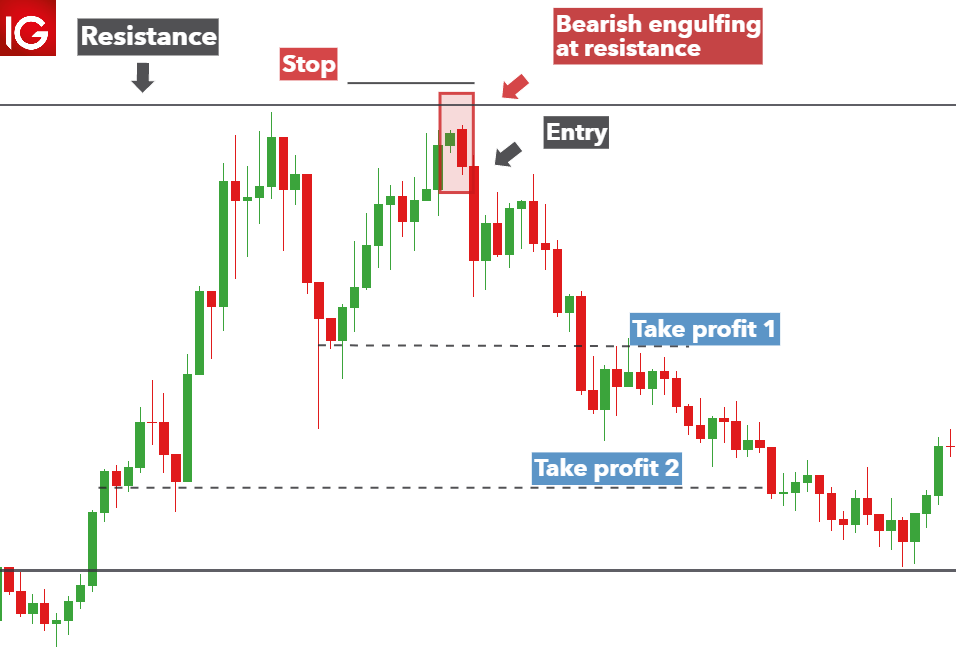

The bearish engulfing is a top reversal pattern that occurs after the price has increased significantly. There reaches a point where buyers start to exit due to waning upward momentum. As the upward momentum fades, bears flock to the market and try to sell at the new highs.

Source: Tradingview.com

The formation of a large bearish candle that engulfs the previous bullish candle affirms a change in momentum from bullish to bearish. Price often drops as short sellers enter the market and sell after the large bearish candlestick closes.

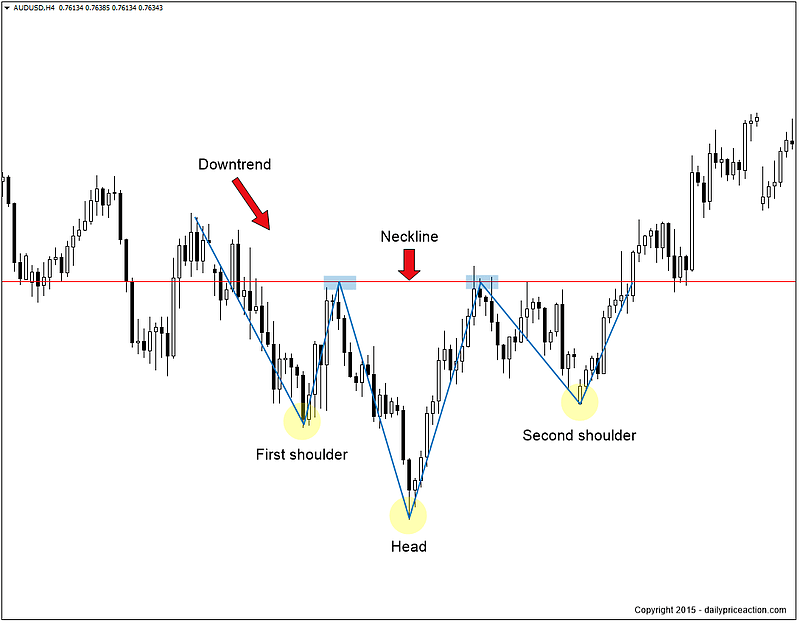

Head and Shoulder Reversal Trading Pattern

The head and shoulder pattern occurs when prices are rallying with significant momentum. It comprises the first peak, the first shoulder, followed by a slight pullback, after which the price rises and forms a new peak or the head. However, the price pulls back from the new peak to the initial support.

Source: Tradingview.com

The price bounces back from the neckline but does not rise a the new peak. Instead, it faces strong resistance at the same level as the first peak resulting in the second shoulder. In the end, one ends up with a head, the peak, and two shoulders on either side of the peak at the same level.

Whenever this pattern forms, it affirms waning upward momentum. Consequently, sellers use the opportunity to enter a short position as soon as the price breaks the neckline or support level and starts moving lower.

The Inverse Head and Shoulder Pattern

It is one of the best reversal candlestick patterns for anyone looking to buy low and benefit from prices bouncing back and moving up. It occurs during a downtrend when the price drops, forming the first shoulder on the left. Once the price bounces back, it is immediately followed by a strong sell-off which results in the price falling and forming a new low, which is the head.

Nevertheless, the price bounces back and is immediately followed by a strong sell-off at the neckline. Short seller's failure to push the price below the previous shoulder confirms waning bearish momentum. The formation of the right shoulder is at the same level as the left shoulder.

Price powering through the neckline from the right shoulder confirms the change in momentum from bearish to bullish. Consequently, bulls use this opportunity to buy low in anticipation of prices increasing.

Bottom Line

Reversal patterns are some of the best chart patterns that allow traders to open positions when a new trend is just starting. The bullish and bearish reversal patterns occur at support and resistance levels, signifying the underlying trend's waning momentum. While looking to profit from reversal candlestick patterns, it is vital to deploy risk management strategies to avoid being caught off-guard by failed breakouts.

The post Top 6 Reversal Patterns in Forex appeared first on Index Fundings.

]]>The post Chart Patterns vs. Candlestick Patterns: What You Should Know appeared first on Index Fundings.

]]>Understanding Candlesticks in Forex

Candlesticks show emotion in the market by representing the size of price moves. A candlestick packs data for different times into one single price bar. The data includes the opening and closing prices for a given period. It also shows the highs and lows reached during the period.

While one candlestick can shed more light on the prevailing market conditions, a group of candles together form vital forex patterns. They provide more data on what buyers and sellers are doing and what the price is doing. Candlestick patterns predict the direction the price is moving.

Candlestick pattern forex is broadly classified into two categories. A bullish candlestick pattern suggests the price is in an uptrend and poised to make higher highs. On the other hand, bearish candlestick patterns suggest the cost is in a downtrend and poised to make lower lows.

Bullish Candlestick Patterns

Bullish Candlestick patterns show bulls have overpowered bears and assumed control of price action. With bulls in control, the price tends to edge higher after forming the bullish candlestick pattern. Some of the popular bullish candlestick patterns in forex include:

The Hammer: The candlestick pattern shows that sellers pushed prices lower but came under pressure from bulls, who pushed prices higher. The long wick to the downside affirms low price rejection by bulls. It mainly occurs at the bottom of a downtrend.

Bullish Engulfing: A typical bullish candlestick appears after the price has tanked significantly. Characterized by a large bullish candle that engulfs the previous bear candlestick. The forex pattern signals that bulls have overpowered the bears and are poised to instigate higher prices.

Morning Star is a three-candlestick pattern that forms after the price has plunged significantly. The pattern starts with the price gapping lower, characterized by a large candlestick to the downside. Afterward, a small, bearish, bullish candlestick emerges at the base, affirming waning downward pressure. Finally, price gapping higher, followed by a large candlestick, asserts price reversal with bulls now in control.

Bearish Engulfing Candlestick

Bearish engulfing are forex patterns that occur at the top of a price chart after the price has moved up significantly. Therefore, they help signal a potential price reversal.

Hanging Man: The bearish version of the hammer occurs at the top of an uptrend. It appears as an inverted hammer signifying bulls tried to push the price higher but came under pressure from bears. Consequently, the candle ends up with a long wick at the top and a small bullish body.

Shooting Star: It is similar to the hanging man pattern and comes with a small bearish body whose size is half the size of the upper shadow. Sometimes the candlestick has little or no lower shadow.Bearish Engulfing: The patterns surfaces at the end of an uptrend signaling a change in momentum from bullish to bearish. The pattern consists of one large bearish candle that engulfs the previous bullish candle.

Understanding Chart Patterns in Forex

Chart patterns in forex are a graphical representation of price movement consisting of highs and lows. Unlike candlestick patterns, they present themselves over several trading sessions, therefore longer. The patterns come into being as price oscillates up and down as traders react to various developments, including news releases.

Types of Chart Patterns in Forex

Forex trading patterns are broadly classified into two patterns: continuations and reversals.

Continuation patterns come into play after the price has moved significantly in a given direction. They come into play as traders lock in profits triggering some form of weakness. Despite the consolidation, the price often ends up breaking out and moving in the direction of the underlying trend. Therefore, continuation patterns assume that the price will remain in the same direction after consolidation.

The common forex chart patterns that affirm continuation in the long run include

Bullish Rectangle: It occurs at the top of the uptrend, characterized by prices moving up and down in a tight range that appears as a rectangle. Afterward, the price tends to break through the uppermost resistance level and continue moving up.

Falling wedge: Characterized by price moving up and down in a wedge-shape-like pattern after a significant upward move. As the wedge narrows price often ends up breaking out to the upside

Bearish rectangle: It occurs after the price has plunged significantly, resulting in a slight bounce back with the price oscillating up and down in a tight range. Finally, the price breaks out and edges lower after breaching the support level.

Bearish pennant: It is a forex trading pattern that occurs after the price has plunged significantly. The pennant forms with the price moving in a triangle-like shape that narrows. Afterwards, the price tanks and edges lower.

Reversal Patterns

Reversal patterns signify that prices will change direction and move in the opposite direction from the underlying trend. For instance, if the price was moving up once a reversal pattern occurs, it implies the price will end up edging lower.

Double Top: A bearish reversal chart pattern that occurs in an uptrend. It appears when the price tries to move up but gets rejected twice at the resistance level. The result is price plunging after the second top.

Head and Shoulder: It is a chart pattern characterized by one high peak and two peaks on the side that are slightly below the middle peak. Once the pattern occurs in an uptrend, it signals price will end up reversing course and tanking

Double bottom: It's the opposite of a double top and occurs after a significant move to the downside. The pattern is characterized by the price trying to move lower twice but getting rejected each time, resulting in a correction to the upside.

Inverse head and shoulder: They are forex trading patterns that occur at the base of the price chart after the price has significantly decreased. The pattern has two troughs of the same height and one large trough in the middle.

Difference Between Chart pattern and Candlestick patterns

Candlestick Pattern

• Formed by combining one or more candlesticks

• Occurs in a brief period as it includes one or two candlesticks

• Ideal for quick entry and exit into the market, perfect for scalpers

• Implies price direction over short period

Chart Pattern

• Formed as price oscillates up and down as a reflection of psychological and fundamental factors

• Mostly occurs on longer time frames

• Ideal for long term buying and selling signals

• Implies price direction over a long period

The post Chart Patterns vs. Candlestick Patterns: What You Should Know appeared first on Index Fundings.

]]>The post The Six Most Popular Forex Chart Patterns appeared first on Index Fundings.

]]>The trading patterns are broadly classified into bearish and bullish. However, some patterns stand out when trading volatile markets, while others work well in range-bound markets. Therefore, knowing the “best” chart pattern to use to trade a particular market is essential.

Below are some of the most popular forex chart patterns.

Triangle Chart Patterns

A triangle pattern is one of the most popular chart patterns in forex. The trading pattern occurs when prices converge with highs and lows, narrowing into a tighter price area. They are broadly classified into ascending and descending triangle patterns.

Ascending triangle pattern

The ascending triangle pattern is a continuation of chart patterns in forex trading that occurs when currency pairs are trending up. It occurs when price action creates a horizontal resistance line and an ascending support line at the top of an uptrend. It also happens as weakness kicks in, following a solid move to the upside.

Source: Dailyfx.com

In most cases, the price breaks out of the ascending triangle pattern and moves up to continue the previous underlying trend.

Descending Triangle Pattern

The descending triangle pattern is also a continuation pattern that appears when the market is trending downwards. It is synonymous with a horizontal support line and a descending resistance level.

Source: Tradingwithrayner.com

Once prices become tighter and tighter within the triangle, they end up breaking out to the downside. Consequently, the occurrence of a descending triangle pattern signals the likelihood of price edging lower after some time in continuation of the underlying downtrend.

Engulfing Patterns

Engulfing price patterns are common chart patterns in forex trading that are easy to spot and signal a potential change in the direction of the underlying trend. There are two types of engulfing patterns: Bullish Engulfing and Bearish.

Bullish Engulfing

It occurs when the price appears to be moving lower. The pattern consists of one large bullish candlestick that engulfs the previous bearish candlestick. When the large bullish candle occurs when a currency pair is trending lower, it affirms a change in market sentiments from bearish to bullish.

Source: Bybit.com

The bullish engulfing candlestick signals a buildup in buying pressure, implying prices are likely to continue moving up on reversing course from a downtrend.

Bearish Engulfing Pattern

It typically occurs at the top of an uptrend. It is characterized by a large bearish candle that engulfs the previous bullish candlestick. The large bearish candlestick implies a change in market sentiments from bullish to bearish on bears overpowering bulls.

Source: Dailyfx.com

Consequently, the price often reverses course, from trending up to edging lower as bears enter the market and pile pressure on bulls.

Head and Shoulders Pattern

Head and Shoulder is a typical chart pattern that occurs in range-bound or trending markets. The chart pattern is characterized by a large price peak in the middle with two smaller peaks on either side. The two peaks on either side will be at the same level and slightly below the higher, larger peak. It acts as a reversal pattern implying a change in sentiments from bullish to bearish.

Source: IG.com

Once the third smaller peak on the side breaks below the previous level, it affirms a bearish breakout with prices expected to edge lower as part of a new downtrend. Consequently, traders use this chart pattern to enter short positions.

Double Top Chart Pattern

Another trend reversal pattern that occurs at the top of an uptrend is the Double Top. The pattern occurs when the price tries to break out of a resistance level only to experience a strong sell-off resulting in lower prices. However, buyers continue to enter the market at the neckline and try to push the price higher. Nevertheless, they experience strong opposition at the top resistance level, resulting in the price edging lower.

Source: Dailyfx.com

The fact that the price tried and failed to move higher on two tries results in two tops, thus the double top pattern. Technical analysts enter short trades as price breaks below the neckline or support level after the double-top chart pattern.

Double Bottom Chart Pattern

The reverse of the double-top trading patterns occurs at the base of a price chart. The chart patterns in forex signify waning short-selling pressure. Sellers try to push prices lower but fail, resulting in two lower bottoms.

Source: Dailypriceaction.com

Price moving up after the double bottom formation and breaking out of the resistance level or neckline affirms a change in market sentiments from bearish to bullish. Consequently, the price often breaks out to the upside, providing ideal opportunities to enter buy positions.

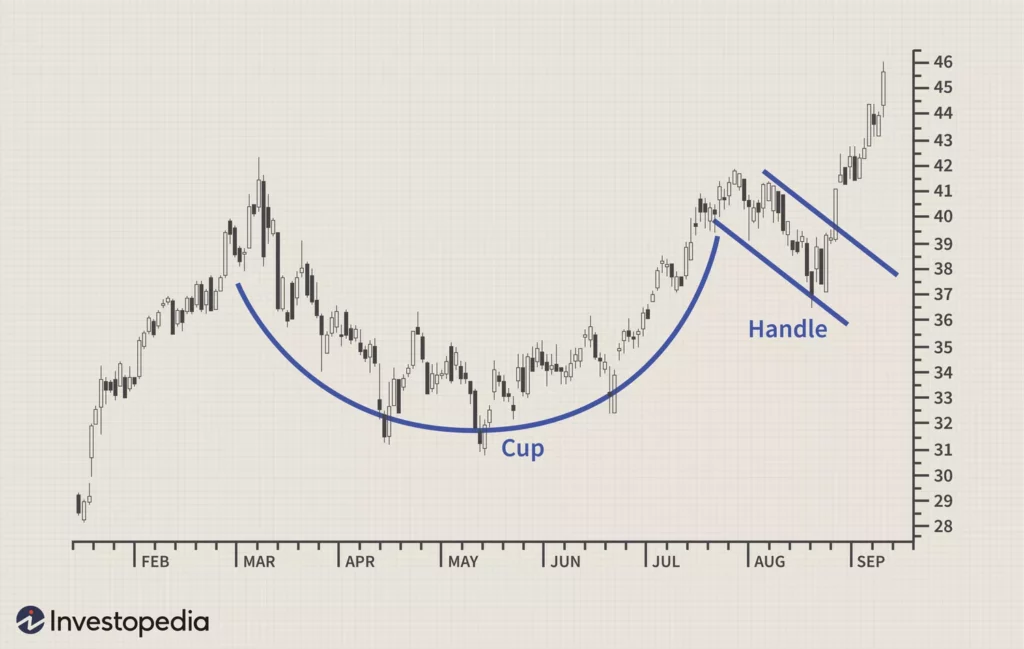

Cup and Handle Pattern

A cup and handle pattern is a bullish continuation pattern that indicates a period of bearish market sentiment before the market turns bullish. At first, prices tend to move lower before hitting a support level, resulting in a round-shaped bottom. The round-shaped bottom affirms waning short-selling pressure as bears struggle to push prices lower.

Source: Invetsopedia.com

The cup appears as the price bottoms out of the round bottom and moves up. However, instead of price edging higher after bottoming out, there is usually short-term retracement whereby the price moves lower before breaking out to the upside resulting in the handle-like pattern.

Once the price reverses course from the handle, it allows buyers to open a buy position as it affirms the price is likely to make higher highs.

Bottom Line

Price action in the forex market gives rise to various trading patterns. The chart patterns in forex provide insight into whether the price will continue moving in the underlying trend after consolidation or reverse course and move in the opposite direction. Triangles, engulfing, double top and double bottom, Cup and Handle and head and shoulder are some of the most popular chart patterns in forex trading.

The post The Six Most Popular Forex Chart Patterns appeared first on Index Fundings.

]]>