The post How to Trade Cryptocurrency CFDs appeared first on Index Fundings.

]]>Trading cryptocurrencies offers an opportunity to divest an investment portfolio. Therefore, in addition to trading currencies, stocks, and commodities, the emerging asset class provides a chance to bet on the underlying blockchain technology that significantly impacts the global economy.

There are two ways to trade cryptocurrencies:

1. Purchasing Crypto Through Exchanges

It is primarily done in cryptocurrency exchanges, whereby people buy some tokens for the underlying cryptocurrency. The tokens allocated and delivered for storage depend on the amount of money spent in the crypto exchange.

The token is then stored in cryptocurrency wallets built on the exchange or third-party wallets installed in a computer. This mode of investing in cryptocurrencies allows investors to bet on the long-term prospects of the underlying project. It is also mostly done when someone expects the token's value to increase significantly in the long haul.

Purchasing cryptocurrencies outright also offers the opportunity to stake or lock part of the tokens in the ecosystem to help provide liquidity and secure the network. By staking, token holders are usually entitled to part of the fees generated in the network.

2. Trading Cryptocurrency Through CFDs

Contracts for Difference (CFDs) are derivative products that allow traders to speculate on the underlying cryptocurrency prices. In this case, people don't end up owning cryptocurrencies. Instead, they can bet on whether the prices will increase or decrease. Given that there is no delivery, there is no need for cryptocurrency wallets.

Trading cryptocurrencies through CFDs occurs in brokerage accounts and not in cryptocurrency exchanges. Additionally, the CFDs contract has no expiry date and can be opened and closed anytime.

Unlike buying cryptocurrencies outright in exchanges, CFDs allow traders to speculate on cryptocurrency prices increasing and decreasing.

How to Trade Cryptocurrencies with CFDs?

The first step to trading cryptocurrencies with CFDs entails opening an account with a brokerage firm. Once an account is verified, you should be able to deposit the minimum amount required by the broker to be able to trade. Once everything is set up, you can speculate cryptocurrency pairs using CFDs.

While trading cryptocurrency CFDs is all about buying and selling, knowing when to buy and when to sell is vital. For instance, BTCUSD is one of the market's most traded crypto CFDs. When the price of Bitcoin increases, it means Bitcoin (BTC) is strengthening against the dollar due to various factors. In this case, a trader will look to open a Buy or long position in the brokerage account to profit from the prices of Bitcoin increasing over time.

Source: Flowbank.com

While going long in CFD trading, the position's value increases with an increase in the price of the underlying cryptocurrency pair. Therefore, it is essential to buy low and sell high.

Once the price of BTCUSD increases from $17,500 to $19,200, the underlying profit in the CFD contract will be $1700 per contract, depending on the lots bought. The profit is the difference between the price level at which the CFD buy position was opened and the final position at which the price was closed.

Similarly, whenever the price of BTCUSD is decreasing, it means the dollar is strengthening, or there is negative news about BTC that has scared traders, fueling the sell-off. In this case, a trader would look to open a sell position in the brokerage account to profit from the prices of bitcoin declining.

Source: Flowbank.com

While going short, the idea is to sell high and buy low to make a significant profit from the CFD position.

Therefore, if the coin was trading at $17,500 and a trader opened a short or sell position, they would make a $1500 profit per CFD contract on the BTCUSD, tanking to $16,000. The profit is calculated as the difference between the level at which the short or sell position was opened and the level at which the CFD contract was closed.

How Much Money You Need to Trade Crypto CFDs

One key advantage of trading cryptocurrency CFDs is that you only need to deposit a small amount into a brokerage account. In return, the broker will provide leverage or a loan that magnifies the amount of money deposited, allowing you to trade a much bigger position than what the initial capital could handle.

For instance, if you deposit $100 and use a 100:1 leverage, you could open positions worth $100,000. In this case, it becomes much easier to magnify profits. Nevertheless, leverage is a double-edged sword. Therefore, as profits get magnified, so will losses at the same rate.

How to Forecast Cryptocurrency Prices in CFD Trading?

While trading CFDs and looking to make profits, traders conduct two types of analysis to determine whether cryptocurrency prices will increase or decrease.

Fundamental analysis

Fundamental analysis is an analysis of news and events affecting cryptocurrency projects. Any positive information will always fuel demand for the cryptocurrency, arousing a buying spree in the market. Similarly, any negative news will evoke fear and concern, forcing investors to sell the coin.

Government regulation is one aspect that affects cryptocurrency sentiments, fueling heightened volatility in the market. Introducing new tighter regulations, crackdowns, and bans often triggers fear causing traders to shun cryptocurrencies. The net effect is a strong selling spree in the market.

Problems at cryptocurrency exchanges, such as breaches and collapse, also tend to have a negative impact and are known to trigger sell-off waves. In this case, most crypto CFD traders use the opportunity to open sell positions in the market.

Likewise, new technology developments such as blockchain upgrades adoption or innovation tend to arouse investor interest, triggering buying sprees in the market. Consequently, CFD traders use this opportunity to open buy positions in anticipation of cryptocurrency prices increasing.

Technical Analysis

Technical analysis is another important evaluation that helps crypto CFD traders know in advance whether prices will increase or decrease. The technique involves using technical indicators and studying chart patterns to understand the direction price moves.

If the underlying trend is up and technical indicators hint at growing bullish momentum, traders use the opportunity to open a buy position while trading crypto CFDs. Similarly, suppose the underlying trend is down, and technical indicators hint at growing bearish momentum. In that case, traders use the opportunity to open sell positions using CFDs to try and profit from a decline in prices in the long term.

Crypto CFD Trading Strategies

Trend Following Strategy

One of the most effective ways of trying to profit while speculating crypto prices using CFDs is trading in line with the underlying trend. In this case, positions in the brokerage account are opened in line with the underlying trend.

Moving Average is one of the most effective technical indicators that help traders know the direction in which prices are moving; therefore, open trades in that direction.

Source: Tradingview.com

For instance, if Bitcoin price is above the 50-day Moving Average in a price chart, a trader could look to open a buy position on pullbacks in anticipation of further increases. Conversely, any pullback close to the MA provides an opportunity to buy low.

Source: Tradingview.com

Similarly, it implies bearish momentum whenever the price is below the 50MA. Therefore, one can look to open short positions whenever the price bounces back close to the MA, offering an opportunity to sell high.

Moving Average Crossover Strategy

The strategy involves using two moving averages, one fast-moving and another slow-moving. Whenever a crossover occurs, it signals to either open a buy or sell position. For instance, one can use the 21MA as the fast-moving average and 50MA as the slow-moving average.

Consequently, whenever the 21MA crosses the 50MA and starts moving up, it acts as a buy signal implying prices are likely to increase. A trader can open a buy position using CFDs to profit from further price increases.

Source: Tradingview.com

Similarly, whenever the 21MA crosses the 50MA and moves lower, it implies a build-up in selling pressure. Consequently, a trader can use the opportunity to open a sell or short position in anticipation of prices dropping.

Source: Tradingview.com

Trend Reversal Strategy

Cryptocurrency prices, like any other asset, sometimes move in different directions. As a result, periods of trend reversal are a common occurrence providing an opportunity for traders to open trades just as a new trend is starting.

The Relative Strength Index is one effective indicator for trading trend reversals in the market. The indicator comes with readings between 0 and 100. Whenever the indicator reading is above 70, it implies the underlying cryptocurrency is bought too much.

The prospects of price reversing with RSI signaling overbought conditions are usually high, as very few people would be willing at the prevailing highs. In addition, the emergence of a bearish engulfing candlestick with the RSI reading above 70 often signals a trend reversal from bullish to bearish. Consequently, a trader can use the opportunity to open a short position.

Source: Tradingview.com

Similarly, whenever the RSI reading is below 30, it implies the underlying cryptocurrency is sold too much. The prospect of prices tanking further is usually low as smart traders exit the market to lock in profit. Therefore, the emergence of a bullish engulfing candlestick with the RSI signaling oversold implies a trend reversal.

A trader can use the opportunity to enter a long position; therefore, buy low as the price bottoms out and starts moving up.

Bottom Line

CFDs are some of the most effective financial instruments that allow traders to speculate on cryptocurrency prices without buying the actual cryptocurrencies. They stand out in making it easy for traders to speculate on prices increasing by buying and decreasing by selling. Additionally, trading cryptocurrency through CFDs does not require a lot of money, as brokers provide leverage.

The post How to Trade Cryptocurrency CFDs appeared first on Index Fundings.

]]>The post Quick Guide to Trading Exotic Currencies appeared first on Index Fundings.

]]>What is an Exotic Currency?

Exotic currencies are currencies from developing or emerging markets. They are not considered major as they are not easily traded in the forex market. Additionally, they are subject to partial or total exchange rate controls from the render. Some top exotic currencies include the Thao Baht, Uruguay Peso, Turkish Lira, and Hungarian forint.

Unlike major or minor currencies, exotic currencies are thinly traded and are not widely used in the global financial market. They are also illiquid, lack market depth, and can be highly volatile. However, given the reduced number of people trading them, they are subject to low trading volumes.

Nevertheless, the factors that affect major and minor currencies are the same that affect exotic currencies. They include geopolitical instability, strengthening of the country’s economy, monetary policy, and the level of foreign direct investment in the local market.

Exotic Currency Pairs

Some of the best exotic forex pairs to trade include USD/TRY (US dollar/Turkish lira), USD/SEK (US dollar/Swedish krona), USD/ZAR (US dollar/South African rand), TRY/JPY (Turkish lira/Japanese yen), EUR/TRY (Euro/Turkish lira), USD/CZK (US dollar/Czech koruna), USD/HUF (US dollar/Hungarian forint), EUR/HUF (Euro/Hungarian forint).

Source: Forex.academy

Exotic Currency Pairs Trading Tips

While trading exotic currency pairs, a few things must be considered. First, given the limited number of people or market participants betting on such pairs, they tend to be highly volatile. Therefore, wild price swings over a short period could come into play whenever a bigger-than-normal order hits the market, which offers the opportunity to realize profits quickly if on the right side of a trade. However, the risk of incurring significant losses is also high.

Additionally, they are less liquid, given the reduced number of market participants. While the EURUSD pair is the most liquid currency pair accounting for 23.1% of daily traded volume, USDTRY makes up less than 1% of traded volume.

Less liquidity increases the risk of slippage, whereby orders don’t get filled at the price one requested. It occurs when insufficient market participants take the other side of the order placed.

How to trade the Most Volatile Exotic Currency Pairs?

While exotic currency pairs can be traded through any broker, it is vital to master various trading strategies to take advantage of the extreme volatility always in play. Some of the best trading strategies for trading exotic currency pairs include.

Trend Trading

Traders looking to take full advantage of the heightened volatility associated with the exotic currency pairs leverage the trend-following strategy. With the help of moving averages, traders can identify the underlying trend and place a trade in the direction of the trend.

Source: Tradingview.com

In the price chart above, it is clear that whenever the USDTRY pair pulled back to the moving average, bulls used the opportunity to enter long positions with prices above the Moving average.

The technique relies mostly on technical analysis rather than fundamental analysis. Additionally, the focus is usually on long-term moving averages. Any pullback close to the moving average presents an opportunity to buy low or sell high in the direction of the trend.

Breakout Trading

Breakouts are a common occurrence when trading exotic currency pairs. With the breakout strategy, traders focus on support and resistance levels. Whenever the exotic currency pair is in consolidation mode, moving up and down within a defined trading range, it becomes much easier to anticipate breakouts.

With the help of moving averages, traders could ascertain the direction in which the exotic pair would break out in advance.

Source: Tradingview.com

For instance, if the pair price is above the moving average, a trader can look out for a breakout to the upside from the resistance level. Likewise, if the pair is trading below the moving average, a trader can look to open short positions on the pair breaking through the support level and edging lower.

Range Trading

In range trading, traders can look to trade exotic pairs within a defined range as the price struggles to break to the upside or downside.

Consequently, whenever the price moves and nears the resistance level, a trader can look to enter a short position in anticipation of the price reversing and moving lower to the support level.

Source: Tradingview.com

Likewise, a trader can look to enter a long position as soon as the price drops to the support level, only to be rejected and start moving up. Conversely, a price near the support level allows buying low in anticipation of an upswing.

Why Trade Exotic Currency Pairs

The best exotic currency pairs stand out on their ability to provide the best opportunities to diversify a trading portfolio. The heightened volatility that such pairs come with also makes them ideal for people leveraging short-term trading strategies such as scalping. However, the high volatility also increases the risk of trading them as losses can accumulate significantly over a short period.

Bottom Line

Exotic currency pairs are some of the best instruments for traders looking to take advantage of high volatility. The best exotic forex pairs to trade depend on the trader’s appetite for risk and the trading style. Given the high volatility, most traders choose not to hold exotic currency pairs overnight and deploy short-term and day trading strategies.

The post Quick Guide to Trading Exotic Currencies appeared first on Index Fundings.

]]>The post How to Trade Gold: XAU Trading Strategies, Indicators, and Tips appeared first on Index Fundings.

]]>During times of inflation, recession, and market volatility, gold (XAU) is considered a safe investment haven, but only if you know the best trading strategies. But while it’s found on Forex platforms as a Contracts-for-Difference or CFD asset, gold’s not well understood in retail markets.

Thanks to options and futures, you can now trade gold without actually owning any bars, jewelry, or coins, which wasn't always possible. Besides CFDs, XAU is also traded as Exchange Traded Funds or ETFs, which makes trading it much like trading commodities, assets, or stocks.

In metals trading, retail investors simply speculate on how they think the price of gold, one of the safest commodities, is trending, or whether it'll rise or fall. Keep reading this article, which explores how to trade gold in Forex. And touches on several profitable strategies to trade gold if applied correctly.

What Does Gold Trading Involve, and Which Factors Move Prices?

Trading gold requires that you understand its contract specifications, fundamentals, and character as it's unlike other currency pairs. Metals trade well when there's uncertainty or upheaval in other financial markets, and you can see this in gold's nascent price behavior over the years.

Due to its unique set of fundamentals and lack of an industry-based economy, gold is used for capital preservation. Its price is affected by the risk on or off sentiments of retail traders. And as such it doesn’t respond to attributes of supply and demand.

Because most of the gold that's mined is used in jewelry or investment, its prices respond to fundamentals like;

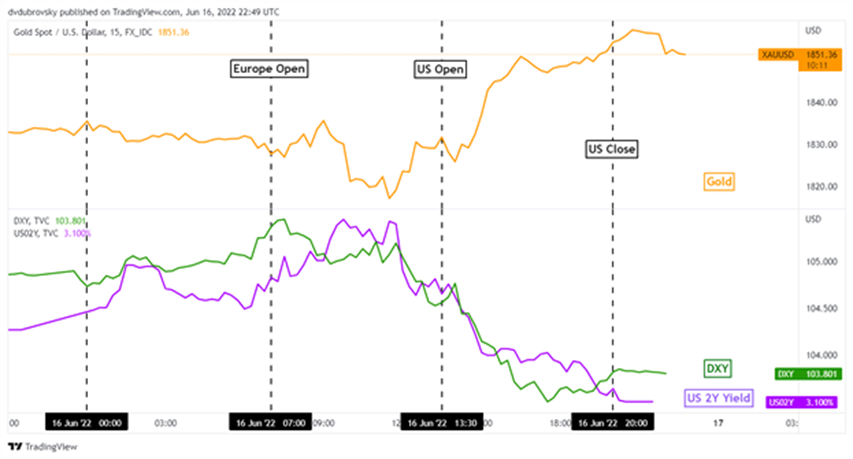

Value of the US Dollar

Gold has an inverse value relationship with the US dollar, whose value is spurred by demand for US treasuries. Since the dollar finances foreign investment transactions, gold prices and the dollar's value move in the opposite direction.

US Interest Rates

US interest rates govern the rate of return on deposits and fixed-income investments like bonds. Low rates dampen profits on treasuries and derivatives. When that happens, the trading focus turns to gold as the haven asset, leading to buying demand and raising prices.

A rise in interest rates makes investments revolving around rate returns like bonds and alternative investments attractive. The focus then shifts from the gold trading price, leading to a reduction in demand, thus lowering its prices.

Traders Risk On/Off Sentiments

Risk on and off sentiments suggest that when the focus is to make profits, traders take on volatile markets but move away due to uncertainty and into safe havens like gold. A trader watches the markets closely. Using reliable trading indicators to decide whether to risk on for profitability or risk off for capital preservation.

Is Trading Gold the Same as Trading Currency in Forex?

Generations of humans have valued and treasured gold since early Mesopotamia, mainly due to its appearance and malleability. It’s a benchmark of commerce that’s one of the most ancient forms of currency, and one that hasn’t lost any of its value.

Gold maintains its value and is therefore considered a haven asset during times of wars. As opposed to currency pairs, your XAU trading strategy follows the same factors that underline the high-flying nature of derivatives that are the backbone of market growth.

Strategies you'll use to trade gold are similar to those you employ in currency pair trading, which includes studying:

- XAU demand and supply fundamentals.

- Technical analysis of the gold price chart.

- The current positioning of gold traders.

Traders commonly trade gold alongside the US dollar, although they also have the option to trade it with the Australian dollar, euro, and Swiss franc. Increased geopolitical uncertainty means the correlation with USD has waned, thus trading XAUUSD isn't different from other currency pairs except for the lower volatility.

Tips on Developing a Winning Gold Trading Strategy

It's now apparent what fundamentally affects gold prices, including the value of the US dollar, interest rates, and risk on or off sentiment by traders. Your next line of action is to develop a strategy when these economic indexes and market attributes are at play by utilizing an oscillating trading signal.

There are less significant movements in gold charts since it moves more in a direct line within timeframes than purely currency pairs. Prices aren't influenced by monetary or fiscal policies, which makes XAU not subject to the whims of governments or central banks.

To follow informed gold trading tips in Forex, you must take into account the factors that may impact its pairing with a partner that’s subject to inflation pressures. What makes gold unlike other commodities such as oil or corn is that its prices fluctuate independent of supply chain demands, but trader sentiments still drive its major trends.

You can use the same strategy you've developed for trading other currency pairs with gold, but some strategies are unlikely to return. For instance, using a range of XAUUSD trading strategies that work well for such currencies will perform poorly due to the differences in volatility.

What Is the Best Trading Gold Futures Strategy?

Trading strategies are sets of rules that help traders determine whether to enter, manage, exit, or close a position. It can be simple or complex, depending on the trader.

The top gold trading strategies include:

Position Trading Strategies

Trading stocks involves studying industry or company-related news. And you'll look at relevant data relating to the pairing currency's geopolitics and economic parameters. But when you trade gold, you'll seek to find out what influences prices. Including hikes during times of uncertainty and inflation fears.

If the currency you've paired with XAU has an inverse monetary relationship, such as the USD, expect that interest rates in that country will push gold prices up or down. Trading futures for gold in terms of CFDs and ETFs is popular with speculative traders. And demand for the commodity affects price movements.

News Trading Strategies

There's a relationship between fundamental analysis and news trading, which refers to gold traders that pinpoint specific news or events to hold positions. Scheduled happenings that impact the economy will have a significant impact on XAU prices. Even for seconds or minutes of trading.

A news trader keeps an eye out for economy-impacting events like central bank briefings, inflation data releases, and Federal Reserve or IRS rate adjustments.

Trend Trading Strategies

Similar to trading stocks, derivatives, or other currency pairs, you can identify opportunities in the direction of the asset in the market when trading gold. You're essentially speculating that the commodity will continue in its current trend. Before you close a position, or ride it further.

Uptrend in gold trading mean that the commodity price consistently rises by posting higher highs. And the opposite is a downtrend. The best indicator for gold trading will show a XAUUSD signal that’s fairly volatile, resulting in robust trends that form regularly, whether trending up or down.

Day Trading Strategies

Unlike scalpers, day traders hold trades for longer, tending to focus on specific times or sessions when they can act on opportunities. Another difference is that day trading involves taking it slow and opening two to three positions at maximum. This is contrast to the tens or hundreds generated by a trend or news scalper.

Day trading suits gold as the instrument is highly liquid with low spreads in comparison to other commodities. The volatility of the XAUUSD trading hours is that volatility in this commodity is high enough for you to find trading opportunities that are present on most days.

Price Action Trading

You can make your position-holding decisions by the movement of prices for an instrument without incorporating technical indicators. Price action trading strategies include reversals, breakouts, and other advanced candlestick patterns implemented across all timeframes.

On the M15 chart, you can trade a breakout in gold. Which a swing trader could place trades based on that pattern in the H4 charts. Due to the speculative and volatile nature of gold, you can streamline price action with another trading gold futures strategy to filter unreliable Forex gold signals.

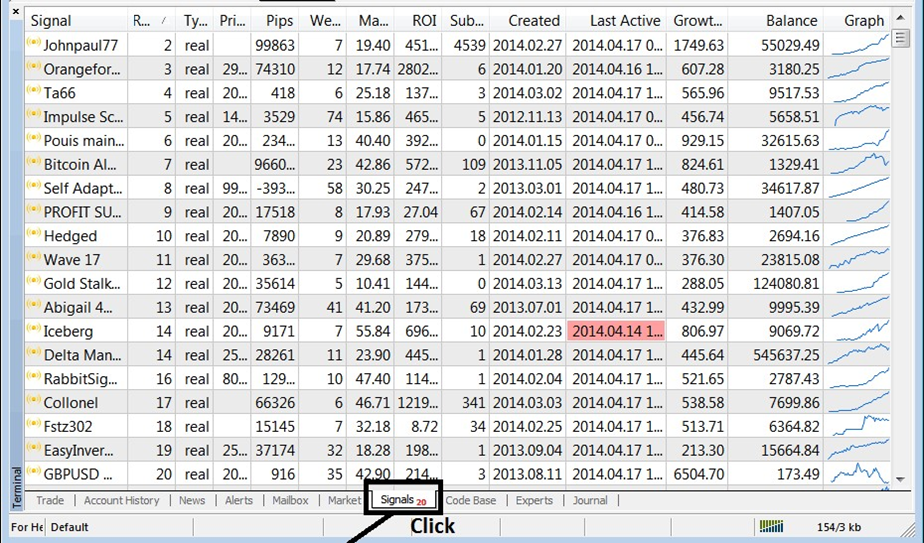

Copy Trading Strategies

There are a lot of experienced traders and advisors available to guide your gold trading, alongside signal providers that specialize in speculative trades on this commodity. Using a copy trading platform, you can mimic these traders' trades. This is a suitable strategy for beginners or a trader without a solid gold-trading strategy.

What Are the Best Indicators to Use for Gold Trading?

Indicators are used to predict the movement of gold prices, including liquidity, relative strength, and symmetrical triangle patterns and indices. You can start by using simplistic technical analysis tools that read into XAU price highs, lows, chart patterns, and trend lines so you'll know how to buy gold futures.

The best gold trading technical indicators include:

Relative Strength RSI Indicator

The relative strength indicator, being one of the popular indicators for gold traders, indicates whether the commodity is oversold or overbought. If the RSI rises above 70, it’s a reflection of overbought conditions. While one that drops below 30 indicates an oversold scenario.

By enabling you to check values, RSI filters signals. And you can settle for a value below 70 to improve the overall quality of your trades.

Moving Averages Indicator

A simple but effective technical indicator, moving averages gauge the market's direction. Which is useful to spot trends for gold traders. While also generating entry and exit signals, these indicators help to test parameters and filter out bad Forex gold signals.

Moving average indicators help day trading strategy users to better utilize their selected Forex gold trading hours.

Bollinger Bands

You can represent market volatility using Bollinger bands, a set of three chart lines that historically depict price ranges. Two outer lines represent trading bands where upper and lower prices will move 90% of the time. While the middle shows real-time price fluctuations.

You know the gold market is highly volatile when Bollinger bands contract, and if they expand, you're experiencing low volatility.

Bottom Line

Gold is more of a financial instrument than a commodity asset, a foundation of many institutions and investor portfolios. It’s widely used for making jewelry and in the high-tech electronics components industry due to its superconductivity and anti-corrosive nature.

Trading gold requires incorporating components of its price movement fundamentals, technical analysis, and market sentiments. Besides being a haven instrument, XAUUSD signals are attractive. Because the underlying asset is a physical thing, and not a digital file somewhere in an exchange or bank.

The post How to Trade Gold: XAU Trading Strategies, Indicators, and Tips appeared first on Index Fundings.

]]>The post How to Trade Crude Oil: What You Should Know appeared first on Index Fundings.

]]>Oil prices vary depending on origin and supply and demand metrics. Brent oil and West Texas Intermediate (WTI). While looking to profit from the oil price, it is essential to know the difference between the two.

Source: Investyadnya.in

Brent oil is more prevalent as it is sourced from the North Sea and most countries worldwide. West Texas oil, on the other hand, is sourced from oil fields in the US, mainly in Texas and Louisiana. Additionally, Brent oil prices are widely affected by political, economic, and geographical pressures. Consequently, it tends to be highly volatile, providing unique trading opportunities.

Given that WTI is mainly sourced in the US, it is less widespread and thus not affected by international pressures or uncertainties.

There are three ways to trade oil.

1. Brent CFDs

Crude oil contracts for difference (CFDs) offer one of the most popular ways of trading or speculating on oil prices on the market. CFD Brent crude oil are derivative products that allow traders to bet on current oil prices. In this case, one agrees to exchange the difference between when a position is opened and when it is closed.

How to Trade Brent CFDs?

While Brent CFDs involve speculating on future oil prices, it requires a form of leverage to trade on various trading platforms. For example, most brokers would offer a loan that allows traders to buy or sell positions relatively bigger than what their actual capital can buy.

With leverage, one can open a buy or sell position on crude oil prices and gain profit on the difference between the opening and the closing prices. For instance, if crude oil was trading at $106 a barrel in the oil market and one opens a buy position, any price increase will be profit. On the other hand, if the trader were to close the position on oil prices rising to $109, the profit would be $3.

Nevertheless, the overall profit will depend on the number of contract differences one bought or the lots at which the trade was opened.

2. Oil Futures

While oil CFDs amount to over-the-counter trading whereby traders take advantage of prevailing prices, oil futures provide a way to speculate on future oil prices. With oil futures, traders agree to exchange an amount of oil at a set price in the future.

How to Trade Oil Futures?

Trading oil futures is not the same as trading oil CFDs. In this case, you will need a specialized account with a broker that offers futures trading. Once you can access the futures trading market, you can place trading orders to speculate on future oil prices. An oil futures contract represents 1,000 barrels of crude oil.

Oil futures Trading Strategies

For example, if oil is currently trading at $90 a barrel and you believe it will be worth more than $95 over the next month, you can enter into a futures contract with a broker. If oil prices rise to, say, $96 a barrel over the next month, the profit, in this case, will be $6 per barrel. If the trader had bought two contracts, the profit would be $12,000 ($6 x 2 x 1000).

Similarly, if oil prices over the next month plunge to $89 a barrel, the trader will incur a loss of $1,000 on contract expiration.

3. Trading Crude Oil Options

Oil options are traded the same way as an oil futures contract. The only difference is that there is usually no obligation on the trader's part to execute the contract. Additionally, there are two types of oil options, calls, and puts.

Any trader who feels oil prices will rise over a month can enter a call option to profit from the oil price increase. Likewise, a trader who feels oil prices will drop over the next month will enter a put option to profit from the oil price decline.

Crude Oil Option Trading Strategies

Let's say Brent crude prices are trading at $90 a barrel. Based on the analysis, a trader believes that oil prices will rise but is not sure. The trader can enter a call option with an options broker. Every contract that the trader enters is equivalent to 1,000 barrels. The strike price for the contract will be $90. The premium, which is the cost incurred to open the call option, could be $2 a barrel. Consequently, each contract will cost $2,000.

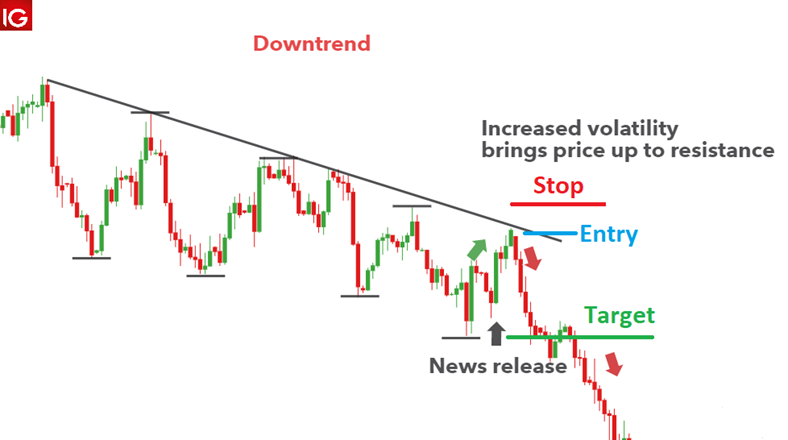

Source: IG.com

If, after one month, oil prices rise to $95, the trader will have generated a profit of $5 a barrel, translating to a $5,000 profit ($5 x 1,000). However, the profit reflected in the account will consider the premium, which is the cost incurred to open the trade. Consequently, the trader will end up with a profit of $5,000 - $2000 = $3,000 for each call option entered

Alternatively, if oil prices plunged to $85 a dollar barrel, the trader would be in for a $3,000 loss. However, instead of incurring a much more significant loss, the trader can forfeit executing the call option before the expiry date and incur only the premium, which is $2,000 per call option contract.

Oil Trading Strategies and Tips

While looking to profit from oil price fluctuations, there are several things that one must keep in mind. Top on the list is the factors that affect supply and demand and consequently trigger price fluctuations.

The influence of OPEC on the oil markets cannot be taken for granted. The oil cartel regulates the amount of oil that hits the market. As a result, oil prices tend to decline whenever OPEC members overproduce, leading to a glut of supply relative to the overall demand. Similarly, whenever the cartel cuts supply amid soaring demand, there is always a tendency for oil prices to increase.

Source: Pinterest.com

The global economic outlook is another factor that affects sentiments on the oil markets, leading to price fluctuations. Whenever the global economy is booming on the back of heightened industrial activities, oil demand is usually high, something that often causes prices to increase. On the other hand, whenever there are concerns about the global economic outlook, prices tend to drop amid worries about demand.

Geopolitical developments in some of the biggest oil producers are another essential aspect to consider. For example, the prospects of war in the oil-producing nations often cause prices to increase amid concerns that the oil supply will come under pressure.

The strength of the US dollar also affects oil prices on the market, given that all the major benchmarks are priced in the global reserve currency. Consequently, whenever the dollar strengthens, there is always a tendency for oil prices to decline. Similarly, whenever the dollar weakens, oil prices tend to increase.

Bottom Line

Crude oil is one of the best financial instruments to trade, given the unique opportunities that always crop up. Futures Options and Contracts for Difference are some instruments that one can use to speculate on oil prices. In addition, it is important to know all the factors that might affect prices before trading.

The post How to Trade Crude Oil: What You Should Know appeared first on Index Fundings.

]]>The post Forex Order Blocks: What is It and How to Trade It? appeared first on Index Fundings.

]]>Central banks and institutions cannot buy and sell currency pairs as they wish. As doing so can trigger significant volatility and unexpected moves. Therefore, large institutions are often forced to split their orders and execute them in a given order to avoid spooking the market and triggering wild swings.

How to Trade with Order Blocks

Order blocks occur when central banks or other large financial institutions accumulate large quantities of the currency pair they wish to buy or sell in one big order. While such institutions cannot complete a buy or sell in one big order, they must create unique “blocks.”

The “blocks” allow the institutions to split their orders into smaller blocks or orders. The orders will then be executed at different price points or levels to avoid spooking the market. Or triggering extreme volatility. Institutions will continue to trigger small orders and blocks repeatedly until they reach their target. The result is price breaking out in a given direction in volume after a long period of consolidation.

For instance, if a bank wants to open a buy position worth $200 million, it will split the order into four parts, each worth $50M. The orders will then self-execute at different levels.

Institutions typically use sophisticated orders not to disclose their involvement in the market. For instance, they can place an order that shows 4 on the bid or sell side even though they have a block of 1,000.

There are two types of order blocks in forex:

- Bullish order block;

- Bearish order block.

Bullish Order Block

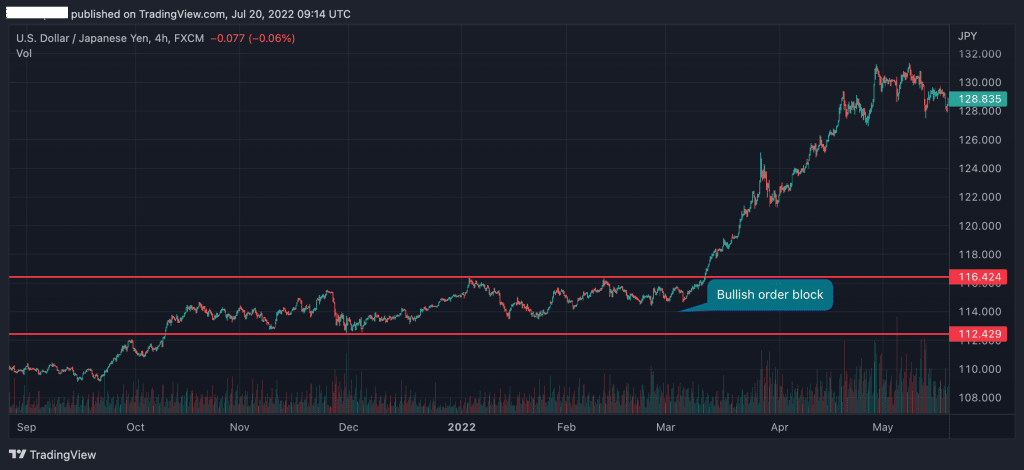

A bullish order block occurs when a large financial institution accumulates or buys large quantities of a currency pair in the forex market.

Such orders occur whenever central banks want to weaken the strength of their underlying currency. So, for instance, when the Bank of Japan wants to weaken the Yen in a bid to bolster the country’s export business, it accumulates a significant position in the US dollar.

The BOJ buying lots of US dollars only weakens the Yen, thus making the country’s exports more affordable.

The chart above shows a period when the USDJPY was in range bound, with the pair struggling to make any new highs or lows. During this period, some candlesticks came into play, supported by high trading volumes.

The high trading volumes affirm the accumulation as institutions placed blocks in the market. Later, the pair broke out to the upside as the accumulation triggered increased upward momentum.

If momentum shifts from bearish to bullish, the focus should be on bullish order blocks. Consequently, it would be a safe play to open long or buy positions to take advantage of the large financial institution's bid to instigate higher prices in the market.

Bearish Order Blocks

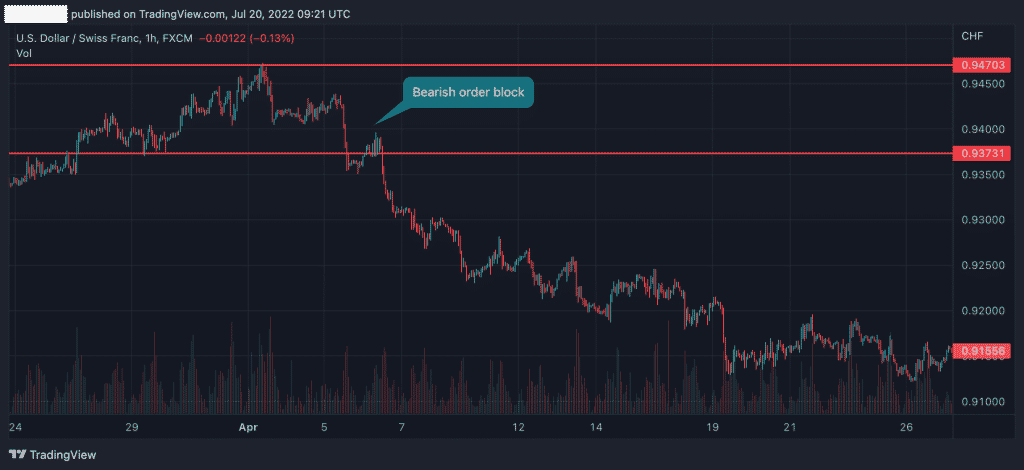

It mainly occurs when a central bank wants to strengthen its own currency. In this case, the central bank will sell the counter currency, weakening it at the expense of its own currency. For instance, the Swiss central bank could sell a large amount of the US dollar and buy large amounts of Swiss francs.

Such action weakens the dollar and strengthens the franc. The net effect would be the tumble of the USDCHF pair, as shown above. The distribution phase shows a period where the central bank placed order blocks to weaken the US dollar at the expense of the Swiss franc.

Whenever a market shifts from bullish to bearish, the focus should shift from bullish order blocks to bearish order blocks. Consequently, one should open a short trade to be in sync with the large financial institutions fueling bearish momentum.

Forex Order Block Strategy

Looking to take advantage of order blocks and trade in the direction that large financial institutions are placing trades? Well, it is essential to note that forex order blocks don’t occur daily. No one knows when central banks will enter a market through order blocks. They are a rare phenomenon, making it hard to add to a trading plan.

While order blocks in forex can take some time to occur, they present some of the best trading opportunities. The best way to identify them is when the markets are range bound. It is usually an early sign of accumulation and distribution whenever currency pairs struggle to make new highs or lows.

The longer the distribution range, the bigger the move presenting an ideal opportunity to profit from a significant move. Therefore, it is crucial to plot support and resistance levels.

Whenever the price breaks the support or resistance level on a considerable volume, it affirms a buildup in momentum. For instance, if the price breaks the resistance on volume, it shows a buildup in upward momentum after significant accumulation. Consequently, this will be the best time to open a buy position to be in sync with financial institutions that place long positions.

Identifying

The USDJPY pair shows the price in an uptrend before it hits strong resistance and resorts to trading in a range. The bullish order block consolidation takes some time after which the price breaks to the upside

Likewise, whenever the price breaks below the support level after a long period of consolidation, it affirms a bearish block break out. As a result, this would be the best time to enter a short position to be in sync with the central banks and other financial institutions.

While engaging in order block trading, the best forex order block indicator is one capable of tracking the underlying volume. A volume indicator makes it easy to know if the accumulation or distribution is in high volume. A high volume means that a big player is accumulating a big position pending price break out in a given direction.

How to Identify?

Understanding what institutional traders do in the market is crucial to accruing edge trading currency pairs. To know what they are doing, identifying high-probability order blocks is vital.

Identifying order blocks in smaller timeframes can be challenging, given the volatility of such chart patterns. Order blocks are best found on higher timeframes, making it easy to identify areas of price consolidation. Periods of consolidation whereby price moves up and down without making any new highs, let alone lows, most of the time signal accumulation and distribution.

In a bullish market, often periods of exhaustion kick in, resulting in prices moving in a range at the top of the chart. The weakness presents an opportunity for large institutions to accumulate positions while planning to steer prices higher. Consequently, whenever the price breaks above the resistance level, it affirms a bullish order block confirming the prospects of the price breaking out to the upside and creating new higher highs.

In the case of a bearish market, a period of consolidation may kick in whereby price struggles to tumble further, let alone move up and create new higher highs. The rotation that occurs in a range resulting in range-bound price action often signals periods of distribution if it occurs in large volume.

Price breaking out to the downside on huge volume affirms the bearish order block breakout paving the way for the price to tank and create new lower lows.

Bottom Line

Forex order blocks are essential aspects that provide valuable insights into what institutions are doing. They avert the need to randomly guess the direction price is likely to move. One of the best ways of staying in sync with the market is to trade in the direction of financial institutions as they wield too much power, thus steering the market in a given direction.

Higher timeframes provide a deeper insight into the quality of order blocks. Additionally, higher timeframe charts show a bigger picture of price action, making it easy to identify areas of accumulation and distribution before a bearish order block or bullish order block breakout occurs. Once the price leaves the order block area with high momentum, that offers an ideal trading signal.

The post Forex Order Blocks: What is It and How to Trade It? appeared first on Index Fundings.

]]>The post The 3-Session System in the Forex Market appeared first on Index Fundings.

]]>Likewise, there are forex trading sessions when the volume is relatively low, making it challenging to generate optimum profits. Additionally, there are times when specific currency pairs are active and enjoy increased trading activity than other times due to the market participants in play.

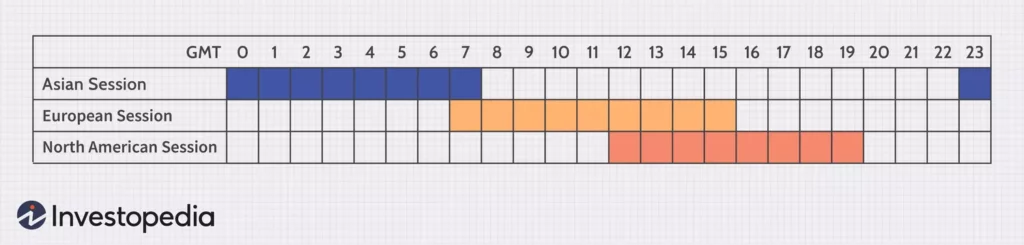

Consequently, the Forex market is divided into three key sessions:

- North American

- European

- Asian

The trading sessions are also referred to as New York, London, and Tokyo in response to the major financial centers in play when the sessions are up and running. Additionally, the forex market becomes more active when banks and corporations in the three economic powerhouses open and conduct business.

Asian / Tokyo Forex Session

The Asian or Tokyo forex trading time is usually the first to see action when the forex market opens after the weekend. The session runs between 11 pm and 8 am every day as long as the forex market is up and running.

Most trading activities during this session are represented by developments and trading activities on the Tokyo capital markets. Other notable markets that account for the most trading activity during the Asian session. Include China, Australia, and New Zealand, as some of the economic powerhouses.

Given how scattered these major economic powerhouses are, the Asian Forex trading session spans or stretches beyond the regular hours when the Tokyo market is up and running.

European / London Forex Session

The European forex session gets underway as the Tokyo session is winding down. And people in the region are going to sleep. The European session is usually up and running every day, beginning at 7 am to 4 pm GMT.

London, the financial hub in the region, takes the honors in defining the European session as an economic powerhouse in the area. However, developments in Germany and France also account for a big chunk of trading activities when the London session is up and running.

During the European session, forex market volatility is usually higher than during the Tokyo session. The increased volatility has to do with increased market participants in the form of big banks and corporations within Europe. While the European session progresses, volatility tends to increase as traders await the start of the North American session.

In addition, trading activity tends to increase when the Tokyo and European sessions overlap. The Overlap occurs when the Tokyo session is about to shut down and the London session starts.

North American / New York Session

The North American session accounts for the forex market's largest share of daily turnover. The session opens up as The Tokyo session has been closed for several hours. It also comes up as activities in the European session begin to wind down.

The session is dominated mainly by trading activity in the U.S., the world's financial hub. However, trading activity in Canada, Mexico, and some countries in South America also contribute to the trading volume.

Considering the early trading activity around financial futures commodity trading and economic releases, the forex market open time for the New York session is 12 pm GMT. After that, trading activity continues until 8 pm as the Tokyo session opens.

Daylight Savings Time

The forex market open time and close times in the European and New York sessions vary during October and November and during March and April. The changes come as the United States, the United Kingdom, and Australia shift to and from daylight savings time.

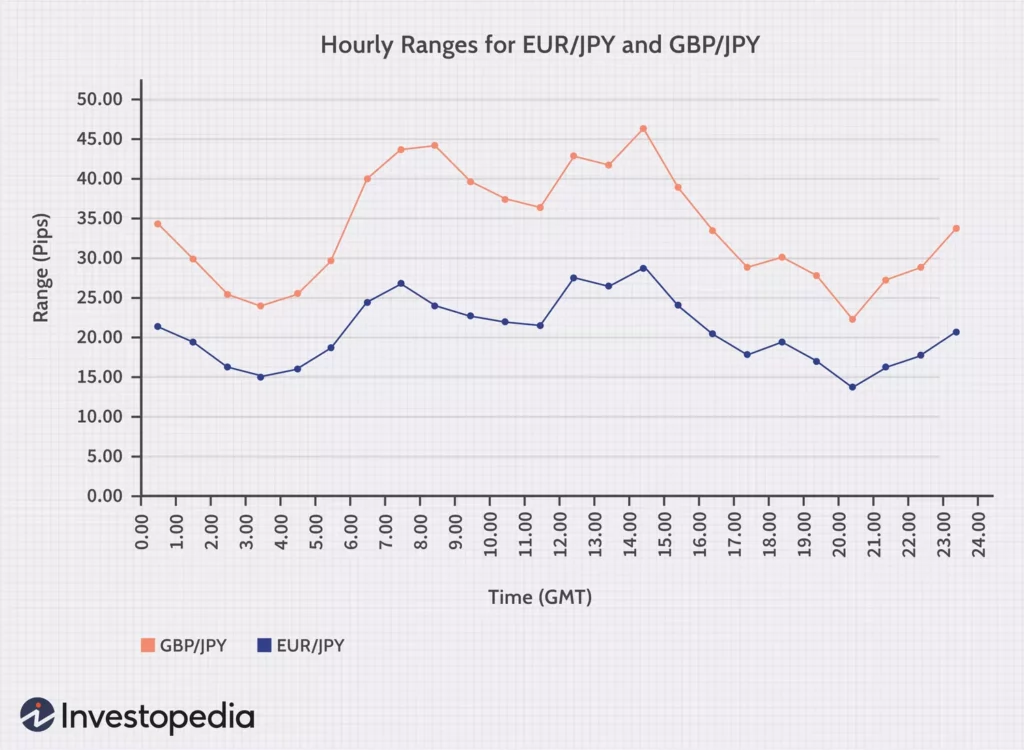

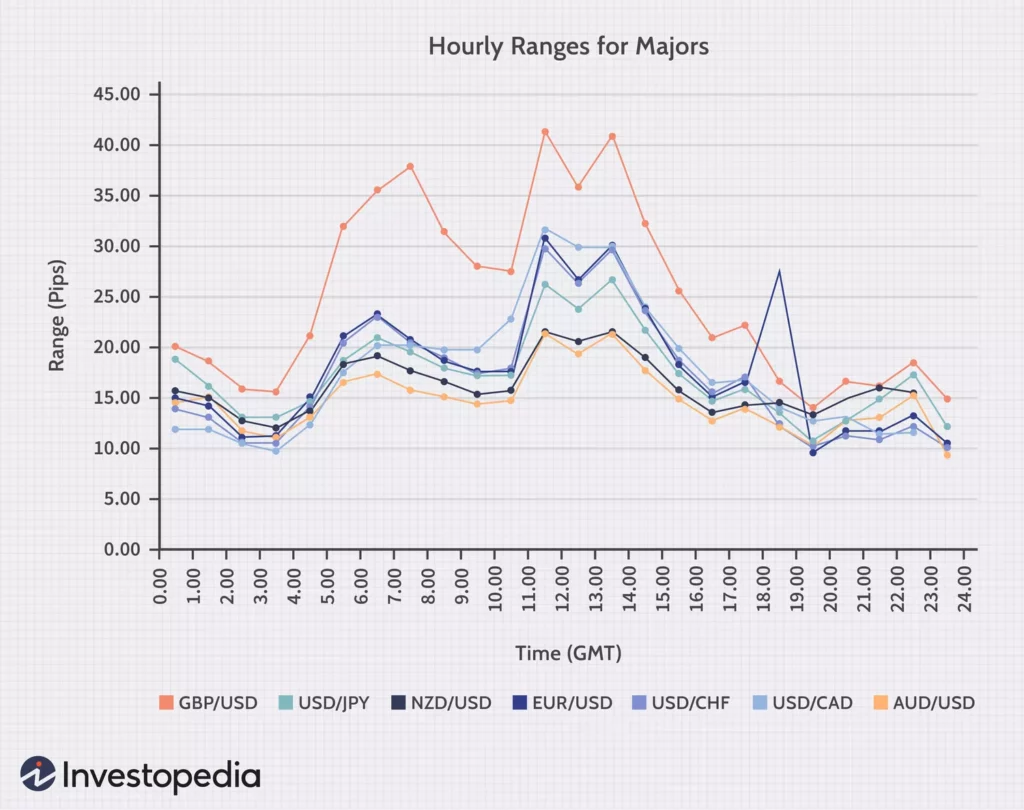

The Best Time for Forex Trading

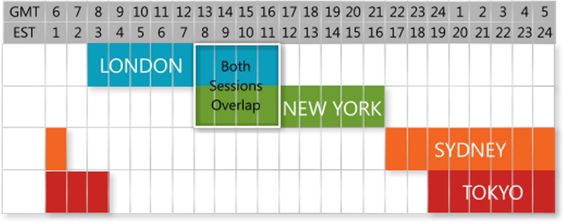

The best trading session times to trade the forex market are when two sessions overlap. For instance, volatility on the EURJPY and GBPJPY pair tends to be the highest when the Asian and European Sessions overlap. The increase in volatility is largely due to market participants in the Tokyo and European sessions speculating on the Euro, the Yen, and the British Pound.

Source: Invetsopedia.com

The increased volatility on the EURJPY and GBPJPY also has everything to do with economic releases in Europe and Asia that affect sentiments on the two pairs. Nevertheless, trading activity on the pairs tends to be muted when the North American and European Sessions overlap.

Source: Invetsopedia.com

During the European/U.S. Session, currency pairs with ties to the European and North American economies tend to see the most action. For instance, GBPUSD and EURUSD remain the most active, generating ideal trading opportunities.

Source: Invetsopedia.com

The increased volatility on the GBPUSD and EURUSD has everything to do with traders reacting to economic releases in the U.S. and Europe. Additionally, there are usually more banks and corporations in Europe and the U.S. doing business, thus fuelling demand for cross-currency pairs.

Bottom Line

While trading currency pairs in the forex market, the focus is usually on the market's level of liquidity and volatility. This is because the best trading opportunities occur when the liquidity level is high, making it easy to open trades and fill orders.

Therefore, knowing which pair is active during a given trading session is crucial. Most currency pairs tend to be more active and volatile during specific forex market timings than others. Nevertheless, it is essential to note that volatility is a double-edged sword.

While high volatility makes it easy to open and close positions, losses can increase significantly during such periods as prices experience wild swings. Therefore it is essential to deploy solid risk management strategies.

Professional traders who open trades when two trading sessions overlap may be desirable for traders who wish to take advantage of extreme volatility levels. Price action during this period tends to be high. However, for traders who want to take advantage of low volatility, the Tokyo forex time zone is closing, and the European session is just getting started would be ideal.

The post The 3-Session System in the Forex Market appeared first on Index Fundings.

]]>