The post Basics of Algorithmic Trading appeared first on Index Fundings.

]]>Likewise, it has given rise to unique innovations and solutions, making it easy to analyze the market. And scan for profitable trading opportunities. Consequently, gone are the days when traders had to spend hours glued to the screen in search of trading opportunities. Instead, algorithmic trading is the latest sensation sweeping the landscape.

What is Algorithmic Trading?

Algorithmic trading is a process in which market analysis and order execution are carried out through automated and preprogrammed instructions. It involves using computer codes and software that analyze the market in search of high-probability trading opportunities. And open and close trades based on set rules.

Once the prevailing market conditions match the predetermined criteria, the trading algos execute buy or sell orders. Therefore, traders spend the least time on the screen as the trading algos do everything.

Source: Bsebti.com

Algorithmic trading stands out by using complex formulas combined with mathematical formulas and trading indicators to gauge the direction in which the market is likely to move. The strategy is commonly used in high-frequency trading. It is allowing traders and large institutions to make thousands of trades per second. While taking advantage of the smallest price movements in the market.

Additionally, the trading practice can be used in various situations, including arbitrage, trend trading strategies, and order execution.

Algorithmic Trading Growing Popularity

Contrary to perception, algorithmic trading is not the domain of institutional investors. Retail traders are also getting involved in the practice thanks to an influx of programmers able to write computer codes integrated into trading platforms to analyze and execute market orders.

Computer programmers are increasingly competing against one another in writing the best algorithmic trading codes. That lead to profitable outcomes most of the time. The practice continues to fuel the spread of algorithmic trading as most of the codes are now available for the mass market to access at a small fee.

Additionally, the emergence of advanced technologies such as artificial intelligence and machine learning allows programmers to create programs that improve themselves through iterative processes. The development of algorithmic trading codes that rely on deep learning has led to profitable trading in the sector.

How Algorithmic Trading Works

Algorithmic trading involves using trading software and tools to make trading decisions based on pre-set rules. In this case, a trader or a programmer writes code that is integrated into a trading platform to execute trades on behalf of the traders when the pre-set conditions are met.

For instance, one can write a simple code that requires the trading algo to short 20 lots of GBPUSD once it rises above the 1.22540 level. In this case, the software will open a short position once GBPUSD rises to this level. In return, it could lock in profits once the price tanks to 1.22300. The algo could also avert the risk of incurring significant losses on price failing to drop after the short position is triggered and rises to the 1.22670 level.

Likewise, one can write a code requiring the computer program to Buy 100,000 shares of Apple stock once the price falls below the $200 a share level. In return, the program could buy an additional 1,000 shares on price increasing by 0.1% afterward and sell 1,000 shares for every 0.1% decrease in price.

The Moving Average Algorithmic Trading Strategy

Algorithmic trading leverages various tools to identify the ideal conditions and time to open and close positions. For example, one of the popular strategies involves the use of moving averages. That allows computer programs to open trades based on the prevailing trend.

In this case, a trading algorithm would be programmed to identify whenever the price of the underlying assets breaks below the moving average and moves above. It is expected that whenever the price breaks and closes below the 20-day moving average. It signals a buildup in selling pressure suggesting the likelihood of the price edging lower afterward.

Similarly, whenever the price rises and closes above the 20-day moving average. It implies a buildup in buying pressure suggesting the likelihood of price edging higher afterward.

Source: Tradingview.com

As a result, programming an algorithmic trading software would involve identifying instances when prices cross above and below the 20-day moving average.

Likewise, the program would open a short position as soon as the price moves below the 20-day moving average. And lock in profits 20 to 30 pips after the slide. To implement a stop loss order, one would set it to trigger at a price level that is ten pips above the entry-level.

Similarly, the algorithmic trading solution would open a buy position when the price rises and closes above the 20-day moving average. The program will close the position when the price moves 10 to 20 pips above the entry-level to lock in profits.

It would also trigger a stop loss order ten pips below the entry level to prevent losses accumulation on price edging lower after moving above the moving average before the profit target order is triggered.

Algorithmic trading using Moving average and RSI

The Relative Strength Index can also be used in combination with the moving average to generate trading signals in algorithmic trading. While the MA hints at the direction price is likely to move, the RSI provides hints on prevailing market momentum, whether bullish or bearish.

Consequently, an algorithmic trading solution would be programmed to identify whenever the market is oversold and whenever it is overbought by monitoring the RSI indicator. The RSI indicator reading below or near 30 implies that the prevailing asset is oversold. The prospect of price edging lower is usually low.

Likewise, whenever the RSI reading is above 70, it implies the underlying asset is overbought. As a result, the prospect of a price increase is usually low as market participants exit by locking in profits resulting in price reversals.

Therefore, a trader could program an algorithmic trading solution to look to enter a long or buy position as soon as the RSI reading is below 30. The Buy order should be triggered when the price bounces back and moves above the 20-day moving average.

Source: Tradingview.com

Look at the gold chart above. It is clear that gold was in a downtrend amid bearish momentum, with the RSI indicator nearing the 30 level. However, once the RSI started moving up from the oversold conditions, it signaled a change in momentum from oversold conditions.

Likewise, an algorithmic trading solution would have opened a buy position as soon as the RSI reading moved above the 50 level and the price closed above the 20-day moving average on the price chart.

The algorithmic trading solution will continue scanning for opportunities and look to enter a short or sell position on the RSI reading being above 70 and the price moving lower and closing below the 20-day moving average.

Algorithmic Trading Advantages

Minimizes Market Impact

Algorithmic trading is a preferred trading strategy for institutions looking to place large positions that would distort market price. Therefore, instead of placing one large position at once, the strategy would open the trades in portions or tranches.

For instance, an institution looking to buy 1 million Apple shares would rely on algorithmic trading to buy 50,000 shares at a go weighing its impact on the market. The buying spree will continue until one buys the entire 1 million shares intended.

Ensure Rule Based Trading

Humans are prone to emotions, often forcing them to make costly irrational decisions. However, with algorithmic trading, such practices are curtailed as trades are opened and closed based on predetermined rules.

With algorithmic trading, there is usually no room for emotions to take over and affect trading decisions. Instead, algorithms solve the problem by ensuring all market positions adhere to set out rules.

Fast and Easier Execution

During periods of heightened volatility in the market, prices move rapidly, making it extremely difficult to take advantage of the smallest price changes on time. Nevertheless, algorithmic trading solves the issues as it allows faster and easier execution of orders. Consequently, traders can open and lock in profits within seconds or minutes before an opportunity dissipates.

Scalping is a popular trading strategy that relies on algorithms to enable rapid buying and selling while taking advantage of the slightest price changes.

Algorithmic Trading Disadvantages

One of the biggest downfalls of algorithmic trading is that the programmed solutions can miss out on trades because an opportunity needs to exhibit the signs programmed in the first place. Different opportunities manifest in different forms, which the trading algo might not detect.

The speed of order execution with algorithmic trading can also be challenging whenever several orders are executed simultaneously without intervention. Should the market change course with more orders than usual in play, the risk of capital being wiped out is usually high. For example, the market crash of 2010 was due to algorithmic trading.

Algorithmic Trading FAQs

Is algorithmic trading profitable?

Algorithmic trading, like any other trading style, can be profitable if one gets a couple of things right. First, one must deeply understand the markets to program trading rules that would generate high probable trading opportunities. One must also effectively back-test their trading system to ensure it generates profits most of the time.

Does algorithmic trading work?

Yes, algorithmic trading works. It is one of the reasons institutional traders with vast sums of money use it to take advantage of the smallest of price changes in the market. It works much better than manual trading, as most algorithm trading rules are quantifiable and retestable. In addition, high-frequency trading systems have since cropped, leveraging advanced technologies and enhancing algo trading effectiveness.

Is algorithmic trading legal?

Algorithmic trading is legal as no rules or laws prevent traders from programming their trading rules and using them to squeeze profits from the market. Nevertheless, some people have objections to how automated trading impacts the overall impact, especially when used by institutions.

Can algo trading beat the market?

Like any other trading strategy, algo trading usually beats the market. Its high success rate is becoming increasingly popular in a world where people are looking to spend the least time scanning for opportunities. In addition, the strategy can consistently beat the market as it is based on rules rather than trading based on emotions.

Bottom Line

Algorithmic trading is an emerging strategy revolutionizing how people trade and invest in financial markets. Using pre-set rules and computer programs makes it easy for people to scan the markets around the clock and take advantage of the smallest price changes or short-term opportunities.

The post Basics of Algorithmic Trading appeared first on Index Fundings.

]]>The post Carry Trade: Strategy, Risks and How It Works appeared first on Index Fundings.

]]>You'll come across the carry trade method if you study various Forex trading strategies, a system that allows you to capitalize on interest rate differences in the currency market. In its simplest definition, this is a way of investing in high-yield currencies with the difference you borrow from low-yielding ones.

Source: Tradingheroes.com

It's one of the strategies that indicate why interest rates are so essential in FX since a divergence can result in profits or losses that amount to billions. In this article, let's look at how the carry trade strategy works, the best implementation, and the risks involved.

What Is Carry Trade, and How Does It Work?

Carry trade is a strategy where you can capitalize on the difference in interest rates of currencies, letting you borrow a low-interest currency to buy another that pays a higher rate. Returns are made on the differences in the interest rates, and you'll need to study updated central bank rates of different countries.

In any given currency pair, you can carry trade in both long or short trades, and the difference between two currencies' interest rates is known as the rate differential. While there are risks, such as the uncertainty of exchange rates, an upside of a carry trade is the chance of a high return.

Source: daytradetheworld.com

Under long-term static currency pair rates, implementing a carry trade can take weeks, months, or even years. For each featured currency, the home country's central bank sets the interest rate to ensure the stability of the financial markets.

It's ideal for the economy that these banks, such as the US Federal Reserve or the EU's European Central Bank, have sufficient liquidity to regulate the financial industry. As a carry trader, your fundamental analysis involves identifying currency pairs forecast to have movements in their exchange rates that favor the high-interest currency.

Why Pay Attention to Interest Rates When Strategizing Your FX Carry Trade

Various factors can impact interest rates, including economic growth and inflation influenced by a country's monetary policies. A central bank will hike or lower interest rates to support this growth, control consumer prices, and make spending or borrowing money easier.

At other times, a country could be combating inflation, so they'll raise interest rates, encouraging lower consumer spending. The varying interest rates are what a carry trader targets, as there are opportunities to borrow low-interest currencies and invest in high-yielding ones.

Select a currency pair with a significant interest rate spread when you're looking to implement a carry trade strategy. The AUD/JPY and the NZD/JPY pairs have traditionally been considered the most reliable carry trade options.

Source: tradingheroes.com

Being comfortable with interest rate movements is a strategy that makes finding an implementable carry trade strategy for a currency pair easier. As part of your fundamental analysis, target those currencies that give a high yield against those with low yields as part of your test before implementing the strategy.

What Are the Risks of the Carry Trade Strategy?

The carry trade strategy isn't risk-free as you stand a risk to your investment. Especially if you're leveraged or going long on a currency pair. That's because, despite your risk-free interest rate, your trade still faces position risk. As you can lose thousands of pips in hours.

But while loss potential doesn't equal the profits. You can make from wide interest rate differentials; some other primary risks associated with carrying trades include.

Currency Risk

Returns from interest rate differentials must exceed adverse exchange rate movements as carry trades are generally unhedged. You will therefore choose a currency pair with a forecast of higher interest rate appreciation relative to the lower interest currency over your chosen time frame.

Doing these forecasts involves selecting suitable combinations of fundamental and technical analysis. Traders typically hold carry trades for the long term.

Leverage Risk

You'll incur losses from sharp unfavorable market movements, prompting position closes or margin calls. As such, a carry trader should consider implementing trades using substantial leverage to avoid these risk factors.

Source: forextraders.com

Risk of Interest Rate Shifts

Your returns can vary depending on interest rate differential movements when you seek to compound your interest daily or monthly. A widening of the differentials will move in your favor and increase your overall returns. And you can take advantage of this widening in the compounding period.

However, when interest rate differentials narrow, you'll receive lower-than-expected returns in your next interest-compounding period.

Final Word

Rising interest rates mark the best environment to get into a carry trade. But it can be challenging to sell currencies when rates fall, and a currency depreciates. Your chosen pair must be free from volatility, as losses can outweigh profits with asset depreciation.

To minimize losses during low volatility, see that a currency's value grows or shows little or no change. You'll profit from the currency pairs movement alongside the interest rate differential while receiving daily interest from a swap. Whether your asset is growing or staying the same.

The post Carry Trade: Strategy, Risks and How It Works appeared first on Index Fundings.

]]>The post Swing Trading in Forex: Tips and Strategies appeared first on Index Fundings.

]]>The swing trading strategy works best with people who don’t have time to stay glued to the screen monitoring their positions. Trades are opened and left to run with take profit and stop loss orders.

How Swing Trading Works

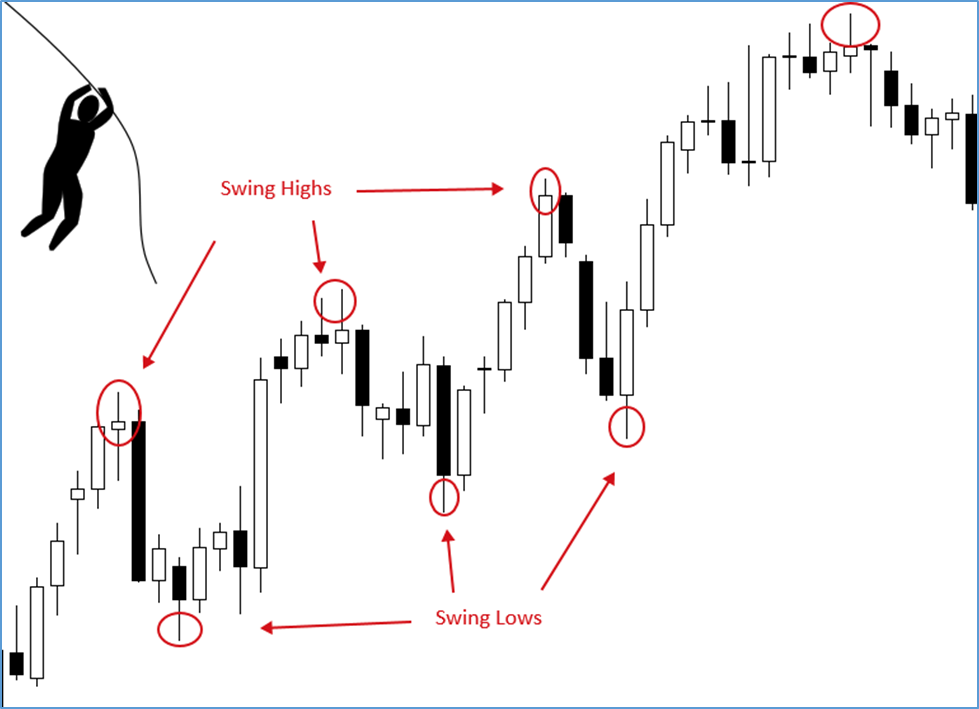

Swing traders employ fundamental and technical analysis to determine the ideal levels to open a trade and when to close. The analysis attempts to identify swings within medium-term trends, after which the price is expected to swing to the upside or downside.

The idea is to get into the trade when a new trend or swing starts and ride the wave until exhaustion or correction kicks in. For instance, if a market were moving up, swing traders would wait for the market to correct slightly and enter a buy position at the swing low in anticipation of price bouncing and swinging high in continuation of the underlying uptrend.

Source: Babypips.com

Similarly, if the market moved lower, a swing trader would wait for the price to correct and bounce back slightly to enter a short position at a swing high. By selling at a swing high, a trader will look to accrue significant pips as the price moves lower in continuation of the underlying downtrend.

While swing trading forex, traders utilize various indicators to determine the ideal entry and exit levels. Additionally, traders leverage multiple strategies while swing trading.

The Best Time Frame for Swing Trading

There is no definite time frame, which is ideal for swing trading. The time frame refers to the strategy or swing trading technique in play. For starters, swing traders rely on 15 Minutes or lower time frame charts to conduct technical analysis and determine ideal levels where swings are likely to occur. Such traders look to open and close positions within minutes or hours.

Scalping day trading swing trading is one strategy whereby traders rely on shorter time frames to identify potential areas where the market is likely to break out. In this case, the swing traders take advantage of short-term price movements to open and close positions.

On the other hand, swing traders rely on long-term time frames to identify potential swings in the market. By conducting hourly charts analysis, the swing traders can open and leave the positions to run for days or weeks.

The Best Indicators for Swing Trading

Some of the common indicators that traders use in Swing trading include:

- Exponential Moving Average

- Relative Strength Index

- Bollinger Bands

1. Exponential Moving Average

The Exponential Moving Average provides valuable insight into the direction price is moving. It relies on the most recent data to affirm the prevailing momentum, making it a preferred fit for traders looking to trade swings in a given direction.

While the EMA determines future trends, it also signals potential entry levels. For instance, prices will always exceed the Exponential Moving Average whenever the market moves up.

Source: Tradingview.com

Therefore, a swing trader will look to enter a long position as soon as the price pulls back close to the moving average and does not close below. Likewise, the traders will exit the position as soon as the price closes below the moving average and moves lower, implying a trend change from uptrend to downtrend.

Source: Tradingview.com

The price will always be below the exponential moving average in a downtrend. Consequently, a swing trader could look to enter a short position as soon as the price pulls back close to the moving average. Conversely, the bounce back provides an opportunity to sell high, anticipating the price edging lower afterward.

2. Relative Strength Index

While the EMA provides valuable insight into the prevailing trend, the Relative Strength Index sheds more light on the momentum strength. The indicator comes with readings between zero and 100. Readings above 50 imply a buildup in buying pressure, signaling that the price will continue increasing. On the other hand, readings below 50 indicate a buildup in selling pressure, signaling price is expected to tank.

Source: Audacitycapital.com

In swing trading, traders look to enter a long position whenever the RSI reading is below 30 and shows signs of bouncing back and moving up. Any reading below 30 signals overbought conditions. Consequently, there is usually a high chance of the price bouncing back. As the RSI starts moving up, a trader can enter a long position and ride the swing until the RSI reading is above 70.

Likewise, whenever the RSI reading is above 70, a swing trader can look to enter short positions in the market to take advantage of the overbought conditions. The prospect of price reversing and moving lower is usually high.

3. Bollinger Bands

The Bollinger Bands is one of the best swing trading forex indicators as it signals market volatility. The indicator has upper and lower bands with a median simple moving average. The price is expected to be close to the simple moving average in the middle during balanced market conditions.

Source: Tradingview.com

Swing traders look to take advantage of extreme volatility that causes the price to move and penetrate the upper and lower bands. Consequently, whenever the price rises and shows signs of penetrating the upper band, a swing tarred would look to enter a short position in anticipation of price correcting and moving lower to the middle simple moving average.

Likewise, a swing trader can look to enter a buy position as soon price penetrates the lower band, as there is usually a high tendency for it to bounce back and move to the simple moving average at the middle.

The Best Swing Trading Strategies

While swing trading is only a trading style, there are various strategies that traders leverage to accrue significant swing trading profits and avoid losses in the market.

Trend Following Using Moving Averages

Trend following is an effective swing trading strategy that allows traders to always be in sync with the market. In this case, swing traders use two moving averages, one fast-moving and another slow-moving. Consequently, one can use 21-period EMA as the fast-moving and 100 EMA as the slow-moving.

Source: Tradingview.com

The fast-moving EMA will respond to price changes. When it moves below the 100-EMA, it implies a shift in trend from uptrend to downtrend. A swing trader can use this opportunity to enter a short position. If the price remains below the 100 EMA and closes when it moves above the long-term EMA.

Similarly, a swing trader can look to enter a buy position whenever the 21 EMA crosses the 100 EMA and starts moving up. The crossover signals the start of an uptrend. A trader can leave the long position open to accrue gains if the price remains above the two EMA.

Reversal Trading or Fading the Move

Price only sometimes moves in one direction. As a result, a period of exhaustion comes after a significant move in a given direction. Whenever exhaustion kicks in, it presents an opportunity to enter reversal trades or fade the move.

With this swing trading strategy, you must identify strong momentum into a resistance or support level. Look for a strong price rejection at this level with the formation of a bearish candlestick at the resistance or a bullish candlestick at the support. Once the candlestick forms look to enter a trade in the opposite direction of the underlying trend

The EURUSD chart above shows the price moving up in a steep uptrend. However, the pair hits a strong resistance and gets rejected the first time, consequently pulling back. Nevertheless, bulls try to engineer another move up but fail. Forming a bearish candlestick at the resistance level presents an opportunity to enter a short-swing trade.

Source: Tradingwithrayner.com

The best way to trade this price action is to enter a short position when a bearish candlestick emerges at the resistance level. A stop loss should be placed a few pips above the resistance level. The take profit should be before the nearest swing low.

Swing Trading Tips

Now that you understand the basics of swing trading, there are some things to always keep in mind. First, ensuring that trades align with the long-term trend is essential. Swing trading is much easier and more effective when trading with the trend. While there might be opportunities to enter reversal trades or fade the move, it is essential to use tight stop loss to avert the risk of incurring significant losses.

Secondly, it is essential to use Moving Averages as they help identify the prevailing trend. Moreover, they make it easy to always trade in the direction of the trend and exit as soon as conditions change.

Additionally, it is essential to use little leverage. When used appropriately, leverage can amplify profits. However, it is a double-edged sword that can also magnify losses.

Bottom Line

Swing trading is an ideal strategy when dealing with volatile markets that trigger significant swings in the market. Technical analysis is essential to be consistent in generating swing trading profits. Fundamentals analysis can also come into play to analyze price trends and patterns.

The post Swing Trading in Forex: Tips and Strategies appeared first on Index Fundings.

]]>The post How to Trade With the Trend appeared first on Index Fundings.

]]>Once a trader identifies the trend, either by eyeballing the price action or with one of the more common trend indicators, he then needs to find a good setup to open his position. There are many trend trading strategies, but let’s start with the most essential trend trading strategy.

Pullback Trading

Trends are made up of impulse moves and pullbacks, also called retracements. At some point after a big move, the counter-trend traders enter the market to push the price back to some median level. One of the signs that the move against the trend is only a retracement and not the end of the trend is volume. When the volume is low on the pullback, it’s an indication that the trend is likely to continue.

Let’s take a look at a basic pullback in a trend:

Pullback or Breakouts

Initially, traders love to trade the breakout. They identify the trend and the consolidation. Then when the price breaks out passing the most recent high or low, they enter the market in hopes of a continuation of the trend. The general consensus of experienced traders is that although breakouts tend to make big winners, their probability is low. Most breakouts fail. The safe trade is to wait for the retracement to peter out and ride the price back to the most recent high/low, but not necessarily past it.

Simple Trend Trading Strategy

Let’s examine two price action trend trading strategies:

- Double Bottoms and Double Tops.

- Fibonacci Retracements.

Double bottoms and Double Tops

When price pulls back slightly and gets rejected, that’s already a sign of the trend continuing. If the price pulls back a second time and gets rejected, it’s even safer to assume that the trend will continue.

In a downtrend the two pullback rejections will make a double top (which looks like an M) and in an uptrend the two pullback rejections are called a double bottom (which looks like a W).

Notice the same GBP/USD daily chart from earlier where the price was downtrending and then rejected twice, making a double top (or an M) before continuing down.

Fibonacci Retracements

Another way to determine the end of the pullback and the continuation of the trend is by using the Fibonnaci indicator. This indicator measures the distance between the beginning of the move and the end of the move. It then plots specific measurements that the market often retraces to, such as a retracement of 38.2% or 50% or 61.8%.

Back to the same chart magnified and we see that the Fibonnaci indicates a pullback to the 50% retracement mark and then continues to decline.

Final Thoughts

In this article we learned how to identify a trend and a few trend trading strategies, but another important factor is waiting for a confirmation candle or set of candles as your setup. This will give you a better sniper position when you execute.

Good luck with your trading!

The post How to Trade With the Trend appeared first on Index Fundings.

]]>The post Position Trading Strategies and Tips appeared first on Index Fundings.

]]>From a day trader, the other side of the spectrum comprises trading activity that involves looking at the market's long-term, big picture, and overall market landscape. Position traders aren't affected by short-term price fluctuations, emphasizing waiting for trends to emerge instead of rushing to profit from price hikes.

A positional trader is confident that the market will correct itself through volatility, focusing on the long-term performance of an asset. They hold on to a position for extended periods with expectations of price appreciation, for a few weeks, months, or years.

Position trading is as close to investing as other trading categories, and only passive or buy-and-hold investors keep positions longer. But what strategies and tips do such traders utilize to profit from long-term position holding despite price gyrations?

What Does Positional Trading Entail, and What Are Its Features?

When an asset's price movement is in the long-term trend, position traders try to capture the long-term incentives instead of watching minute daily price changes. While such a trader can take both long and short positions, there's more risk but an inverse amount of potential profit.

A positional trader is less concerned about short-term price movements unless their impact affects the long-term outlook of their positions. It's not active trading but semi-passive position holding, using fundamental technical analysis and strategies to follow historical patterns and market trends.

When learning what position trading is, you'll embrace selling, although an exclusive understanding of investing features buying into long or short trades. It’s a suitable capitalization method for any market, including bonds, stocks, commodities, crypto, and Forex.

Source: https://forextraininggroup.com/position-trading-strategies-longer-term-prospective/

Only by studying market fundamentals can you spot these long-term trends using positional indicators, technical analysis, and an appropriate strategy. The best strategies incorporate attention to a trend, locking profits with a trailing stop loss, and specializing in one financial asset.

You'll also focus on high-value stocks, jumping onto an established trend and exiting only when it ends, and never because the price fell temporarily. A positional trader plans an exit when the time is right and doesn't pay attention to midterm movements or short-term surges like swing trading.

What's the Best Approach to Take in Position Trading?

Since it's a long-term investment, positional traders get involved in significant asset research and technical analysis. Their approach is analytical due to the high risk of holding positions long term, which demands continuous monitoring with detailed analytical tools.

There aren't any standard strategies available for positional traders, but they must have a knack for technical and fundamental analysis, whether using each or both. A techno-fundamental strategy uses charts and trend behavior factors to plot trends based on historical data while focusing on the inherent state of an asset.

Not only does that help to ascertain the right time to buy, hold or sell, but you can also dissect the asset's well-being, value, and security aspects using positional trading indicators. That helps you understand trend patterns and opportunities in price movements, alerting you to possible reversals to minimize risk and maximize gains.

As with any investment, you'll accrue benefits from owning an asset, but the real gain is reaping profits from its increased valuation over the holding period. Reliance on techno-fundamental analysis lets you in on useful market insights, allowing you to plan to move onto, retain, or square positions.

For positional trading to work, you'll need to get a grasp of understanding the market signals that your techno-fundamental analysis tools send out. Whether patterns or trends, it's all about maintaining a grip on the market's direction and price destination of an asset.

What Are the Top Position Trading Strategies and Tips?

You'll need a mix of fundamental and technical analysis to be a successful positional trader since it's necessary to evaluate potential risks and market trends before opening a trade. The most significant risk you'll face is trend reversal followed by low liquidity, which incurs losses due to price trend changes.

To trade positions effectively, it's required that you evaluate your risk profile and freeze capital over long periods. Several position trading strategies that combine market fundamentals and technical analysis to identify positive prospective trends include;

Support and Resistance Position Trading Strategies

By studying support and resistance levels, you will be able to recognize whether an asset’s price will likely rise in an upward trend or fall into a downtrend. Based on this analysis, you'll decide to open a long position on an asset, profiting weekly, monthly, or yearly from its price increases.

You can also open a short position because these levels correspond, aiming to profit as the asset suffers prolonged price drops. Support levels refer to the price an asset won't fall below, where buyers prefer opening, while resistance is where it ceases to rise, and there are no more buys.

Source: https://www.ig.com/uk/trading-strategies/how-to-trade-sugar-190318

Breaking through resistance levels indicates that the price will continue rising to reach higher highs. But a break below support is a sign of coming lower lows. When a breakout happens, support and resistance levels change roles. And with this strategy, there are three main factors to consider:

- Historical Price: It's the most reliable source of identifying support and resistance levels since you can use periods of significant price gains. Or reductions as potential indicators for movements in the future.

- Previous Levels: Just like historical price indicators, you can gauge future price movements, especially when a breakout is imminent.

- Technical Indicators: Specifically, the best indicator for positional trading tips will provide dynamic support and resistance levels. That change when the price of an asset changes.

Breakout Positional Trading Strategy

In Forex, commodity, or derivative trading, you'll attempt to open a position in a trend's early stages. Particularly when targeting large-scale price movements. A breakout position trading strategy is similar to support and resistance. Where you'll open long or short positions depending on the asset price’s levels.

As such, you should identify comfortable support and resistance levels as the foundation for your breakout position trading strategy. For instance, if a currency pair consolidates, a trader getting in early on the trend will wait for a breakout. It's more robust when the consolidation is longer.

As one of the risk-alleviating positional trading strategies, breakouts can also occur at the end of a trend. As a sign of an upcoming reversal, signaling a stop-loss exit for positional traders. However, be wary of false breakouts; a competent technical analysis indicator will help you chart actionable trend lines.

Moving Average Positional Trading Strategy

Another valuable tool in positional trading is not necessarily which type of moving average you implement since you're performing long-term trades. As one of the essential indicators, moving averages like the 50, 100, or 200-day signify the beginning of longer trends.

For instance, a 50-period Exponential Moving Average sets the stop-loss below the most recent price swing. When this indicator crosses a 200-day EMA, it indicates a golden cross, meaning the bull market will continue.

The opposite indicates a death cross or bear market. But moving averages tend to lag as indicators, leading to crossovers when the trend reversal has already happened. When that occurs, using this strategy alongside a Relative Strength Index, like a Stochastic RSI, helps correct a crossover.

Source: https://www.learn-forextrading.org/2017/05/positional-trading-with-stochastic-and.html

You can confirm a trend by looking for the price to break or close a 200-day EMA when the stochastic RSI indicates an above-level-20 at the beginning of a bullish trend. That's because positional trading tips give the impression of a golden cross before a moving average crossover happens.

Pullback and Retracement Positional Trading Strategy

The pullback strategy is useful for position trading, especially if you've failed to catch the beginning of a trend movement. This is because it offers the opportunity to join at better price levels. The basic idea involves selling long on an established trend, buying back when there's an uptrend, and selling when the price temporarily rises during downtrends.

When using a pullback strategy, you'll look for opportunities to enter the market with price dips. And to eliminate the possibility of trend reversal while that's happening, employ retracements. The most popular retracement indicator is the Fibonacci Retracement, which helps you to identify when to open and close positions.

By drawing Fibonacci retracement lines during a pullback, you can identify solid support and resistance levels to find trading opportunities. The best pullback is soon after a breakout since a market in range for longer will break hard as few traders want to buy against strong momentum.

Pullbacks often have shallow retracements. But with this strategy, you'll buy the swing high on the break and hop onto the trend. Sell after the asset recovers from the downward setback. And extend your position as the price resumes its former upward trajectory.

Range Trading Positional Trading Strategy

In some markets, prices will move up and down without any evident trend. And a range trading technique allows you to identify overbought or oversold assets. The lack of trends is useful to keep you on the lookout for buying or selling opportunities. So you can book profit or square off accordingly.

In position trading, waiting too long, like a buy-and-hold investor, risks your investment return. And price ranges will alert you to imminent reversals. Along with protecting your stop loss below the most recent swing. You'll define where to take profit, signal reversals, and give the market time to breathe.

Bottom Line

A strategy that matches your trading personality and lifestyle is essential to consistent margin-breaking trades. Whether you're seeking long or short-term fulfillment. Positional trading indicators allow you more time between trade decisions compared to the high pressure of swing or day trading.

With these top positional trading strategies and tips, you can trade multiple markets, assets, styles, or investment goals. You can follow trends in stocks that make prolonged moves over weeks and months. With some research and preparation and with a minimal time commitment.

The post Position Trading Strategies and Tips appeared first on Index Fundings.

]]>The post Supply and Demand Guide: How to Find, Analyze, and Trade Supply and Demand Zones appeared first on Index Fundings.

]]>What are Supply and Demand Zones in Forex?

Supply and demand zones refer to areas in a price chart where the price regularly approaches. They are areas of intense battles between buyers and sellers and often result in the form of consolidation, after which price break out.

Supply Zone in Forex

Supply, also called the distribution zone, is an area in a price chart where traders look to sell the market. The zone mainly occurs when the price has moved up significantly, presenting an opportunity for large institutions and retail traders to sell high. Given that the zone is present above the current price level, it presents the highest selling interest or potential.

Source: Tradersunion.com

The chart above shows the AUDJPY price action chart. Initially, the currency pair was in a downtrend before it bounced back and started edging higher. However, the bounce back appears to have hit a strong supply zone whereby buyers struggled to push the price higher.

Given that the supply zone is an area of strong selling pressure characterized by large institutions placing large sell orders, price struggle to rise further. Consequently, it acts as an area of strong resistance where sellers flock to the market and place sell orders to push prices lower.

Depending on the number and size of sell orders placed in the supply zone, the price will always get rejected and move lower every time it bounces to this level. Prices will only rise above the supply zone where buyers overpower sellers and place more buy orders.

Demand Zone In Forex

The demand zone is also the accumulation zone that occurs below the current price level. The area is characterized by strong buying interest or potential as large institutions tend to place more buying orders to try and buy low.

Consequently, the demand zone acts as a strong support level whereby sellers struggle to push prices lower under buyers' pilling pressure.

Source: Tradersunion.com

In the AUDJPY price chart above, it is clear that the price was initially in an uptrend with bulls in control. Every time the price pulled back into the demand zone, it bounced back, with sellers struggling to engineer any move lower. The seller's failure to push the price lower signaled that the area was well defended by large institutions that had initially placed buy orders to push the price higher.

As long as the large institutions defend this level with buy orders, the likelihood of price plunging below is minimal. Consequently, retail traders use this opportunity to enter long positions every time the price pulls back to the demand or accumulation zone.

How to Find Supply and Demand Zones?

The first step to identifying supply and demand zones entails looking at the price chart and identifying areas where strong price movements occurred. The sharp price movement should result in prices moving in one direction with minimal or no opposition.

Source: dotnettutorials.net

Once the strong price movement is identified, look for the level at which the strong price movement started. The level at which the sharp movement started will often be a crucial supply and demand zone deepening on the direction price moved.

For instance, if the price ended up moving lower, the supply zone would be the highest level at which the movement started. On the other hand, if the price exploded, making higher highs, the demand zone would be the lowest level at which the movement began.

The best way to find a supply and demand zone

The best way to find a supply and demand zone is to use longer timeframes to identify areas where strong consolidation occurs. Four-hours, daily, and weekly charts provide a clear view of potential supply and demand areas. While in the longer timeframes, it is essential to use rectangular shapes to denote this zone that should act as support and resistance levels.

In addition, always be on the look for strong moves out of potential supply and demand zones. Any sharp move signifies strong momentum in the new direction, affirming the initial buildup in momentum from large institutions placing orders. Price will always move sharply from the supply and demand zone until the value has diminished or the large institutions achieve their objective.

The use of indicators can also come into play to identify potential areas of distribution and accumulation. For instance, a moving average will often flatten whenever the price enters a period of consolidation due to accumulation and distribution in the market.

The Fibonacci indicator is another vital technical analysis tool that can help one pinpoint supply and demand zones. Given that price does not always move in one direction, pullbacks and bouncebacks often lead prices to key supply and demand areas.

Source: Tradersunion.com

For instance, if the price was moving lower only to bounce back after hitting a support level, the likelihood of it bouncing back to the supply zone is usually high. With the help of the Fibonacci tool, one can identify the supply zone. Plotting the Fibonacci tool from where the downtrend started to where the price started bouncing back makes it easy to identify the supply zone at the 61.8% retracement level.

The 61.8% level is considered a significant level where consolidation occurs, thus acting as a crucial supply and demand level.

How to Trade Supply and Demand Zones in Forex?

While an influx of sell orders characterizes the supply zone as sellers look to sell high, traders can look to enter sell positions in anticipation of the price edging lower afterward. Therefore, while placing a sell order below the supply zone, it is essential to place a stop-loss order a few pips above the zone. The stop-loss order will close the sell order should the price fail to edge lower after consolidation from the supply zone.

Likewise, one can look to enter buy orders near the demand zone, given that an influx of buy orders characterizes the area. The prospect of the price edging higher from the demand zone is usually high. Stop loss orders should be placed a few pips below the demand zone. This will close down any buy positions once the price fails to move up above the demand zone and starts moving lower.

Supply and Demand Forex Trading Strategies

Trading supply and demand zones boil down to the unique patterns at these levels. Below are some of the best strategies for trading supply and demand zones in forex.

Range Trading Strategy

Considering the consolidation in the demand and supply zones, a range trading strategy can be used with some success. With range trading, traders can look to sell on price approaching the supply zone, which acts as a level of intense selling pressure. Given that large institutions are increasingly placing short positions at this level, a retail trader can place a sell position in anticipation of a price dropping.

Likewise, one can look to enter a buy position as soon as the price drops to the demand zone, which is a zone characterized by intense buying pressure. Given the growing number of institutions placing buy positions, one can place a buy position anticipating the price bottoming out and moving up.

Source: Dailyfx.com

Breakout Strategy

A breakout strategy is another vital strategy for taking advantage of the forex supply and demand zone. The price can never remain restricted in a given trading range in the forex market. Once in a while, it breaks out on a buildup of momentum in a given direction.

Similarly, one can leverage the Stochastic indicator, a momentum indicator, to know when to enter a sell position in the distribution zone and buy positions in the demand zone. For starters, whenever the stochastic reading exceeds 80, it implies overbought conditions, and the prospect of price reversing course from the supply zone is usually high. Therefore, it is an ideal level to go short. Similarly, if the RSI reading is below 20, it implies oversold conditions, which are ideal conditions for placing buy positions in anticipation of the price bouncing back.

For instance, after long periods of consolidation in the supply zone, the price would eventually break out and edge lower on short sellers placing significant sell orders. If selling pressure is enough, the price will edge lower.

Likewise, in the demand zone, price is often expected to break out to the upside with large institutions using the opportunity to place buy orders resulting in a buildup in bullish momentum. Consequently, a trader can look to enter a buy trade to profit from the price breaking out of the accumulation zone and moving up.

Source: Dailyfx.com

The price usually moves in a predetermined direction based on supply and demand zones. For instance, instead of the price moving up from the demand zone. It might end up edging lower on buyers failing to place significant buy orders to counter the selling pressure from the supply zone.

In the chart above, it is clear that the price ended up breaking out to the downside from the demand zone. Confirming intense selling pressure from the supply zone

Bottom Line

Mastering how to find supply and demand zones is one of the best ways of gaining an edge in forex trading. Given the consolidation, these zones are vital price action levels from where big trends start. If it is a supply zone, the prospect of price plunging afterward is usually high as large institutions place sell orders. Similarly, if it is a demand zone, the prospect of price exploding and moving up is usually high on large institutions placing buy orders.

The post Supply and Demand Guide: How to Find, Analyze, and Trade Supply and Demand Zones appeared first on Index Fundings.

]]>The post Top 3 RSI Trading Strategies: Step-by-Step Guide appeared first on Index Fundings.

]]>Understanding the RSI indicator

The RSI is a momentum indicator with readings between 0 and 100. Whenever the RSI readings are above 70 indicate overbought conditions. What this means is that buyers have bought the underlying asset too much. The likelihood of momentum shifting from bullish to bearish under these conditions is usually high as few traders are willing to buy at extreme highs.

When the RSI readings are above 70, savvy traders have been exiting the market by taking profits. On the other hand, short sellers use the opportunity to open short positions to take advantage of the extremely high prices.

On the other hand, whenever the RSI readings are below 30, they imply oversold market conditions. What this means is that the underlying asset price has tumbled significantly. While the price can continue dropping, a reversal often occurs as savvy traders who were short exit by taking profits.

Likewise, buyers on the fence start looking for ideal levels to trigger buy positions to take advantage of the extremely low prices. Therefore, whenever the RSI reading is below 30, the prospect of price bouncing back is usually high as sellers exit and buyers enter the market resulting in a momentum shift from bearish to bullish.

Using the RSI Indicator for Trend Confirmation

The middle line, usually at the 50-level, is also of interest when using the RSI indicator. Whenever the RSI indicator moves from oversold conditions and rises above the 50-level. It confirms a shift in momentum from bearish to bullish, signaling the market is trending up. Consequently, technical analysts use the opportunity to eye long positions.

Similarly, whenever the RSI is reading tanks below 50 from the overbought levels, it implies a shift in momentum from bullish to bearish. Consequently, technical analysts use the opportunity to enter sell or short positions as the prospect of price plunging is usually high, going by the buildup in selling pressure.

Therefore, the RSI indicator can signal an uptrend or downtrend in addition to confirming the prevailing market condition, oversold or overbought.

RSI Trading – MACD Combination

While RSI can be used to generate trading signals, it does not provide reliable trading signals when used in isolation. However, combined with other indicators, it generates some of the best trading signals.

One of the biggest downsides of the RSI indicator is that the price can remain in an oversold or overbought condition for quite some time. Therefore, one cannot enter a short or long position just because the indicator indicates the asset is overbought or oversold.

One must rely on another indicator to be sure when the price will likely reverse from an uptrend in case of overbought conditions and start moving lower. Similarly, the technical indicator must signal the appropriate time to enter a long position whenever oversold conditions kick in.

The Moving Average Convergence and Divergence (MACD) is one of the best momentum indicators to use with the RSI for the best outcomes. The MACD stands out for its ability to signal whenever momentum shifts from bullish to bearish or vice versa.

The indicator comes with two moving averages, one fast-moving and another slow-moving. Whenever the fast-moving MACD line crosses the Signal line and starts moving up, it affirms the momentum shift from bearish to bullish. On the other hand, whenever the MACD line crosses the Signal Line and moves lower, it signals a momentum shift from bearish to bullish.

RSI Trading Strategy

Equipped with the RSI and the MACD indicator, it becomes pretty easy to identify the ideal entry and exit levels as prices oscillate up and down on the chart.

Strategy 1: Going Short in Overbought Conditions

Whenever the RSI indicator suggests the underlying asset price has increased significantly due to increased buying pressure leading to overbought conditions, it would be wise to watch out for potential trend reversals.

The chart above shows Gold price action. Between September 2019 and July 2020, it is clear that gold prices were trending up with the RSI above the 50-line. In early July 2020, overbought conditions started ringing bells, with the RSI reading way above the 70-level. However, prices continued making higher highs going by the bullish green candlesticks.

However, a closer look at the MACD indicator started caving in at the top of the chart resulting in the MACD line (in blue) crossing the signal line (in orange) and starting to move lower. The crossover affirms a shift in momentum from bullish to bearish, thus affirming a trend reversal from uptrend to downtrend.

The formation of a large bearish engulfing candlestick at the top also confirms that bears have overpowered buyers and are poised to push prices lower. Following the closure of the bearish

engulfing candlestick with the RSI and the MACD indicators pointing lower. This would be the ideal time to trigger a short or sell position with a stop loss a few pips above the previous high.

Strategy 2: Going Long on Oversold Condition

When the RSI indicator readings are below 30, one should watch out for potential price reversal from the downtrend to the uptrend. With oversold conditions in play short, sellers tend to exit, presenting an opportunity for buyers on the fence to enter long positions.

While the price can continue moving lower even with oversold conditions in play, the MACD indicator can provide early signals of a change in momentum from bearish to bullish.

The gold chart above shows that the price was trending lower between July and December 2016. As prices tumbled, oversold conditions started appearing in early December, with the RSI dropping to the 30 level. Additionally, the histogram on the MACD indicator was high, affirming the strong bearish momentum below the zero line.

However, the price struggled to drop below the $1136 level as sellers started locking profits and buyers started opening buy positions. Afterward, the MACD line crossed the Signal line and began moving up. The histogram above the zero line was also becoming bigger, confirming a buildup in buying pressure.

The formation of three bullish candlesticks confirmed that gold had bottomed out and was well poised to edge higher. Traders who used this opportunity to enter long positions at extremely low positions ended up accruing significant pips and profits. A stop-loss order was opened a few pips below the lowest level, which worked well as the price never retreated from the emerging uptrend.

Another buy signal emerged in August as the RSI plunged below the 30-level, signaling too much selling of gold. Afterward, the MACD line crossed the signal line and moved up, affirming the momentum shift from bearish to bullish.

Strategy 3: RSI Divergence Strategy

In most cases, the RSI indicator moves in the same direction as the price. If the price increases, the RSI will also trend up; if the RSI points lower, the price must also drop. However, that is not always the case. At times the RSI diverges from the price and moves in the opposite direction.

The RSI and price moving in the opposite direction is usually a sign of weakness in the underlying trend. Conversely, if the price continues to rise even as the RSI moves low, the upward momentum is waning, and that price is likely to correct and move lower afterward.

Similarly, if the RSI is moving up, but the price continues moving lower, making lower lows, it signifies waning selling pressure. It means that after some time the price will correct and start moving up in the direction of the RSI.

In the gold price action chart above, gold was trending up, making higher highs between August 2019 and February 2020. However, instead of the RSI indicator moving in tandem and making higher highs, it moved lower.

The divergence between the price and the RSI confirmed weakness in the underlying uptrend. Gold plunged from highs of $1696 at the end of February to lows of $1448. The divergence provided an early signal for technical analysts to position potential selling opportunities.

Bottom Line

The Relative Strength Index is a vital technical analysis indicator for determining prevailing market conditions. With readings above 70, it implies overbought conditions, an early warning sign of potential price reversal from uptrend to downtrend. Similarly, readings below 30 suggest oversold conditions signaling the likelihood of price bounce back after some time.

The post Top 3 RSI Trading Strategies: Step-by-Step Guide appeared first on Index Fundings.

]]>The post The Simplest Trading Strategy in the World appeared first on Index Fundings.

]]>Mastering Horizontal Levels

The simple trading strategy way to trade any security in the financial markets is to understand how to identify support and resistance levels. These are levels where ideal trading opportunities often crop up. But, unfortunately, it is also at this level that traders usually exit the market if they are already in a trade.

Horizontal Support Level

It refers to the lowest level where the price struggles to move below a significant move lower. If you pay close attention to price action, you will identify levels where the price failed to dip below and ended up bouncing back, reversing course, and moving up.

The support level provides ideal areas to enter long positions as it acts as a magnet for attracting buyers into the market. Consequently, any simple price action strategy should pay close attention to the support level.

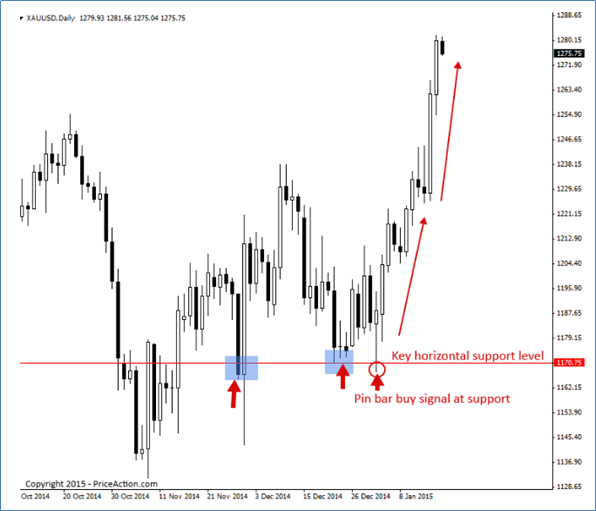

Source: Priceaction.com

The chart above shows a gold price action. After the price had moved lower, it bounced back and started moving up. However, sellers came into the fold and tried to push prices down. After pushing the price lower, they struggled to engineer another leg lower as buyers came into the fold and pushed the price up.

The first arrow indicates a crucial area of the battle between sellers and buyers. It is at this level that support was first marked. Later on, sellers came into the fold and tried to push prices lower. However, near the 117 level, buyers flocked to the market and pushed prices up.

Sellers struggling to lower prices the second time only affirmed the 117 area as a crucial support level. Likewise, as depicted by the third arrow, the emergence of a pin bar signal at the support level only affirmed the support level.

From the chart above, it is clear that price action failure to push below the support level affirms the prospect of price pushing up. Consequently, traders often look out for buy positions at the support level as the price usually bounces and moves up.

Support levels tend to occur at the lowest price action level and charts. The formation of a large bullish candlestick at the support level acts as a buy signal signaling buyers have overpowered sellers and that price is likely to move up.

Horizontal Resistance Level

Resistance in price action refers to a level where the price struggles to move up, as was the case in the past. The level mainly occurs at the top of price charts, whereby buyers fail to push prices higher. Every time the price rises to this level, it experiences a strong selloff, resulting in the price moving lower.

By looking at the price chart of any security, it becomes easy to see levels where the price rose but came under pressure and moved lower more than two times from the same level. An easy price action strategy should pay close watch to the resistance level for potential price breakouts or rejections.

Source: Priceaction.com

The chart above clearly shows that the price was trying to move up in the first phase. However, as depicted by the first arrow at the 1.39 level, it came under pressure and ended up moving lower. The fact that the price got rejected at this level affirms why it is an area of interest and a potential resistance level.

After the price had moved lower, it bounced back and yet again tried to move above the 1.39 level. While it broke through the 1.39, its failure to close above the level affirmed strong resistance to buyers' bids to push the price higher.

The formation of a strong bearish candlestick below the 1.39 level firmed the resistance level. From the resistance level, it is clear that the price edged lower.

Trading Range-Bound Markets

In range-bound markets, prices fall when they try to move above a given level (resistance level). And also struggle to move below the support level'. In this case, the price tends to oscillate within the level, moving up and down without making any new highs or lows.

Source: learntotradethemarket.com

In the chart above, it's clear that the price dropped as soon as it rose to the resistance level as sellers flocked to the market and pushed the price lower. Additionally, the price bounces back at the support level and moves up, collapsing to the support level.

Simple Trading Strategy Bottom Line

The simplest trading strategy focuses on the horizontal support and resistance level. These are high-probability areas where ideal trading opportunities in trending markets emerge. Whenever a large candlestick occurs at the support and resistance levels. It provides a reliable signal on the direction price is likely to move.

For instance, the emergence of a large bullish candlestick. At the support level affirms price is likely to move up on a buildup in buying pressure. Similarly, the emergence of a large bearish candlestick at the resistance level signals price is expected to move lower as selling pressure builds up.

The post The Simplest Trading Strategy in the World appeared first on Index Fundings.

]]>