The post How to Trade with Fractals: Step-by-Step Guide appeared first on Index Fundings.

]]>Fractals Pattern Structure

Fractals are a five bars pattern that signals potential price reversal from the underlying trend. The pattern can either be bullish or bearish.

Bullish Fractal Pattern

The pattern occurs when the price appears to be in a downtrend. The first candlestick appears as the price edges lower, making a higher low. The second and the third candlesticks also form higher lows, affirming the strong bearish momentum.

Source: Ig.com

Nevertheless, the emergence of a fourth bullish candlestick affirms waning downward momentum. While the candlestick has a higher low, it ends up closing above the previous low, signaling a momentum shift. The fifth candlestick opening and closing above the fourth candlestick signal a change in momentum from bearish to bullish, implying that the price is likely to increase.

A bullish fractal pattern is a reversal pattern that suggests the start of an uptrend from a downtrend. Consequently, traders can use the opportunity to open a buy or long position after the fifth candlestick closes to try and profit from further price rallies.

Source: Ig.com

Similarly, short sellers can also use the opportunity to exit the market as the emergence of the fifth candle in the bullish fractal pattern affirms a change in momentum from bearish to bullish.

Consequently, a bullish fractal pattern is synonymous with three successive candlesticks edging lower and forming lower lows. Then, the next two candlesticks start moving up, forming higher lows and signaling a momentum shift.

Bearish Fractal Reversal Pattern

The pattern occurs when the price appears in an uptrend, trading above a key moving average. In this case, the first candlestick opens lower but closes higher. It is followed by a second candle that opens higher and closes higher, affirming the bullish momentum. Nevertheless, the third candlestick records a new high but closes lower, implying waning upward momentum.

Source: Ig.com

Despite recording a new high, the third candlestick closing lower is a warning sign of potential price reversal. The emergence of a fourth bearish candlestick with a lower high affirms bears are increasingly pilling pressure, and prices are likely to edge lower. The fifth and final candle in the Fractal pattern having a lower high confirms the change in trend from uptrend to downtrend.

Source: Ig.com

Consequently, the emergence of the bearish fractal pattern signals it is time to open a short position, as the price will likely edge lower. Similarly, traders who were long can use the opportunity to close their positions amid the change in momentum.

Therefore, a bearish fractal pattern occurs when three successive candlesticks show the price edging up, forming higher lows, followed by two candlesticks showing the price edging lower and forming lower highs.

Rules for Identifying Fractal patterns

- The focus should always be on the third candlestick or the middle candlestick. In this case, it should represent the highest point in a bearish fractal pattern or the lowest point in a bullish fractal pattern.

- A bearish fractal pattern occurs when two candlesticks that precede the middle candlestick form higher lows. The candlesticks are followed by two bearish candlesticks that form lower lows.

- Likewise, a bullish fractal pattern occurs when the two candlesticks that precede the middle candle or the lowest point show lower lows. On the other hand, the two candlesticks that follow the lowest point or the middle candlestick have lower highs.

Trading Fractals using RSI Indicators

Some of the best indicators used in conjunction with the fractal pattern to confirm potential price reversal are oscillator indicators. The Relative Strength Index is one such indicator that can provide insights into the likelihood of momentum shifting from bullish to bearish and vice versa as the fractals pattern form.

Bearish Fractal with RSI

The RSI indicator shows overbought and oversold periods in the markets. During this period, exhaustion tends to kick in, triggering price reversal. Consequently, whenever the RSI reading is above 70, it implies the underlying asset is bought too much.

This means that the price has increased significantly to the extent that buyers may not be willing to sell at the new highs. Therefore, when the RSI indicator is above 70, traders can look out for the formation of a Fractal bearish pattern that will signal a potential trend reversal.

Source: Ig.com

The chart above clearly shows that as soon as the RSI was above 70, signaling an overbought condition, the bearish fractal pattern was also forming. On the other hand, as soon as the RSI pulled below 70 and the fifth bearish candlestick in the bearish fractal pattern formed, the price dropped, resulting in a downtrend. Consequently, this was the best time to open a sell position.

While opening a sell position in the bearish fractal pattern, a trader might place a stop loss a few pips above the highest level of the fractal pattern. The stop loss will close the position should the price bounce back immediately and edge higher instead of lower.

Bullish Fractal with RSI'

Likewise, the RSI also signals when an underlying asset or security is sold too much. Whenever the RSI reading is below 30, it implies short sellers have pushed the price significantly lower to a level very few would be willing to continue selling. Short sellers tend to exit the market to lock in profits at this level.

As shorts sellers exit, the selling pressure tends to wane. It is at this level that a bullish fractal pattern tends to emerge.

Source: Ig.com

In the chart above, it is clear that the price was moving lower to the extent of the RSI tanking below the 30 level, signaling an oversold condition. With the RSI deep in oversold territory, the fractal pattern emerges with the formation of a third lower low candle immediately followed by two bullish candlesticks that signal a momentum shift.

The RSI moving above the oversold territory and forming two bullish candlesticks in the bullish fractal pattern confirmed a change in momentum from bearish to bullish. Consequently, traders can use the opportunity to open buy positions.

While opening a buy position, a trader may place a stop loss a few pips below the third candle's lowest level or the fractal pattern's lowest point.

Bottom Line

Fractals are one of the most reliable trend reversal patterns made up of five candlesticks. The bullish fractal pattern occurs when the price is a downtrend, followed by a bounce back. Likewise, the bearish fractal pattern occurs in an uptrend, with price forming higher lows, which is followed by a pullback from the highest point. The pattern offers the advantage of making it easier for traders to identify market entry points at the close of the fifth candle.

The post How to Trade with Fractals: Step-by-Step Guide appeared first on Index Fundings.

]]>The post How to Trade Breakouts appeared first on Index Fundings.

]]>In this article, we learn about breakout trading strategies, how to identify real breakouts when trading Forex, and how to identify false breakouts, downsizing your risk. We'll also walk you through how to react instead of predicting the start of new trends and trade consolidations and deal with sudden market reversals.

You can enter excellent trades using the right strategy and technical analysis when the market is trending in the right direction. But markets aren't always conducive and will range, move sideways, and trend in opposite directions. If you don’t have the best approach, technique, or strategy, it can be challenging to leverage trading opportunities.

When done right, breakout trading is captivating since you can make quick profits, but it has risks. False breakouts or whipsaws that aren't accompanied by increased volatility are common, and price levels may not be sustainable.

What Is Breakout Trading, and What's the Best Time to Use It as a Strategy?

If you can predict that the market direction will lead to a new trend and identify when to consolidate ranges or enter sideways, you're essentially breakout trading. That's done by analyzing the market's movement to determine that it's not biased but moves within upper resistance and lower support levels.

Once you’ve identified that the market moves a range that’s either trending or non-trending, you'll look at the trend history to find failure highs or rebound lows. If the market breaks out below support levels, enter short positions and buy long exposures above resistance in favorable trading ranges.

Source: hmarkets.com

In such a breakout, setting a stop loss on top of the identified resistance for a short breakout and below the defined support level when buying long is essential. It’s also advisable to place a buffer or price filter above or below the placed stop, whether for resistance or support levels.

A technical momentum indicator is useful in timing your breakout entry and identifying resistance or support levels at which it occurs. Always find a market trapped between a range pattern, such as a channel or triangle, and wait until it breaks beyond the volatility surges.

You'll avoid predicting the market but react to it and buy high and sell low as a form of momentum trading. That means you'll enter when resistance levels fail or break out above it and sell when below support since, with breakout trading, you're seeking to profit from increased volatility.

What Are the Tips for Trading Breakouts and Identifying False Breaks?

There are ways to trade breakouts and others that will frustrate you as an FX trader, especially if you’re used to targeting trading opportunities in well-defined price ranges. That’s because you should be aware of false breaks and patterns or ranges occurring within significant trends.

Source: tolberti.com

When you wait for breakouts, you should focus on patterns like pennants, flags, and triangles. To set the groundwork for your breakout trading, follow these tips that include;

Confirm a Breakout by Waiting for Volatility vs. Higher Volume

Unlike futures or stocks, the Forex market doesn't rely on the volume of trades, and you're at a disadvantage when managing risk. To position for a potential breakout, identify price movements at short time frames that signal high volatility.

Entering the market when movement is speedy is stressful and comes with anxiety, so you must use volatility to your advantage. Find currency pairs when volatility is low, so you'll be in a stellar position when it skyrockets, and a breakout occurs.

Source: tradeciety.com

Trade a Breakout in the Trend's Direction

Stick to breakouts that follow the general direction of a prevailing trend, using technical analysis tools to study patterns like rectangles, triangles, and wedges. You can boil this down with the simplicity of focusing on two swing points that allow drawing support and resistance lines against the trend.

As a form of trend trading, breakouts offer an elaborate way to join after a pullback, but it's best to place a pending order in many instances. That's because a stop loss for selling below the support level might lead to a loss as it triggers your entry as the price returns to a high.

Avoid a false breakout by placing entry orders below the breakout candle for short positions, especially if the candle's length exceeds the 1.5 pip average. Whether a pin bar or doji, the second confirmation candle should be smaller and close below the breakout level.

Example of Breakout Trades

Breakout trading is often based on consolidating formation, and price triangles or channels project your natural target. Since you're following trends on a volatile market, keep in mind that it may break out swiftly and snap back as quickly, so set actual limit orders.

False Breakout or Fake Out

An unsuccessful or false breakout will signal a currency pair’s move from a downtrend to a trading non-trend range. The market will pull back or rebound between resistance and support parameters and then push back to a fake bearish breakout, also called a fake out.

When you use a time or price filter, you can avoid a short breakout position when the market doesn't continue lower or reverts to its trading range quickly.

Source: tradeciety.com

A Real or Successful Breakout

In a successful trend trading breakout, the currency pair continues within the range with stall-back moves from below resistance and down rebounds above support levels. When the market signals a break from the bullish range, it's categorized as an impulsive or aggressive higher move.

That would be a successful breakout from a sideways trading range as the currency pair significantly climbed higher.

Benefits and Downsides of Breakout Trading

The best way to save time is by scanning for candidates for potential breakouts using trend trading and technical analysis scanners. Look for patterns on your FX charts, such as channels, flags, and wedges, or shortlist currency pairs that showcase low volatility with exponential moving averages or Bollinger bands.

Pros

Some benefits of breakout trading include leading to profitable solid trades when entered at the beginning of bearish or bullish trends. Rather than wait for a trend to establish, early entry allows you to incur significant profits when you identify the trading range with stop losses or exit levels.

You can define unsuccessful breakouts within your strategy to limit losses due to fake outs by setting tight stop losses.

Cons

On the other hand, fake breakouts may happen when the market breaks out below support and above resistance levels. That's common when no bearish or bullish trend is established or when the market reverts to its initial trading range.

Source: tradeciety.com

Active risk management or stop losses are the only techniques to protect your trades from such occurrences. The market may also break out from range, but you need to move farther for your take profit target, seeing a move back risks before starting a new trend. That's when an active top loss pulls out your position before the trend energizes.

Final Word

You can combine essential price action and trend trading skills to approach a breakout without ignoring momentum due to the simplicity of this strategy. Retracement trades and bullish reversals occur from the significant accumulation and minor bull wedges in a crucial context that signals how to proceed.

The market will tell you whether the breakout is real or fake, especially if price movement flutters around tight ranges. Breakout trading can serve you well if done right and when you continually iterate on feedback and learn to improve on open opportunities.

The post How to Trade Breakouts appeared first on Index Fundings.

]]>The post How to Trade Forex on News appeared first on Index Fundings.

]]>Currencies to Trade Based on News Releases

The eight major currencies from the eight most followed countries are the best to trade for anyone looking to take advantage of news releases in the forex market. The currencies stand out partly because there is usually a consistent stream of reliable information from the countries that one can use to analyze and gauge the strength of the official currencies.

In addition, seven or more crucial economic releases each week affect the price action of the major currencies. Therefore, the best currency pairs to trade based on economic and news releases are EUR/USD, GBP/USD, USD/JPY, AUDUSD, NZDUSD, USDCHF, and CADUSD.

One can always trade any currency pair based on the economic release likely to send shockwaves in the market. Nevertheless, the US economic releases tend to have the most impact on the forex market, which makes major currency pairs the best for anyone looking to take advantage of heightened volatility.

When is Key Economic News released?

Economic releases shape sentiments; thus, price action in the forex market hits the wires or web at different times. While geopolitical and other news that influence traders' sentiments can occur at any time, economic data get released at specific and scheduled days and times.

The time varies depending on when the market in the respective countries is opened. The best time to watch economic releases likely to shape currency pairs' price action.

Source: Investopedia.com

Key Economic Releases to Trade in Forex

When looking to trade based on news releases, it is crucial to know when the releases are expected in advance, focusing on the exact time. While there are varying economic data releases every day, it is essential to know to which data most market participants will place their attention.

Interest rate decisions by central banks is one of the key economic releases that sways sentiments and price action in the forex market. In some cases, rate hikes tend to trigger currency strength, while cuts signal weak in the economy, triggering currency weakness.

Retail sales are another important economic data to watch closely as it paints an accurate picture of spending patterns in the economy. Better-than-expected retail sales data often triggers currency strength. Inflation data in the form of consumer price data and producer price influences central banks' interest rate policies.

An unbearable inflation surge often forces the central banks to hike interest rates to try and reduce money in circulation. Employment and unemployment data is another important economic data to watch closely as it affirms the state of the underlying economy.

Other economic releases likely to influence price action in the forex market include Industrial production data and trade balance, manufacturing sector surveys, and consumer confidence surveys.

How to Trade Forex News

There are two probable outcomes whenever news hits; Price can spike in one direction or remain intact without any significant movement. Therefore, knowing the two probable outcomes, there are two possible approaches to trading the news.

Having Directional Bias

Having directional bias means expecting the market to move in a particular direction depending on the news outcome or economic releases. For instance, one can enter a short position on the EURUSD pair if the Non-Farm Payroll Report comes better than expected, signaling strength in the US economy, therefore, dollar strength.

Similarly, if the Non-Farm Payroll Report was to miss expectations signaling weakness in the US labor market, one can look to go long the EURUSD to try and profit from dollar weakness after the report.

Non-Direction Bias

With no direction bias, one does not plan what to do based on the outcome of the economic release. In this case, one is only interested in seeing the direction the market will move after the news release before opening trade, as there is no bias as to whether the price will go up or down.

Consequently, a trader will only enter a long position when the market interprets the news and starts moving up. Similarly, once the data is interpreted, one would enter a short position as soon as the price begins moving lower.

Forex News Trading Strategies

The Breakout Strategy

The breakout strategy is the most popular strategy traders use to trade based on news releases in the market. In the run-up to a significant economic release, there is usually a form of consolidation in the market. As a result, the price tends to move in a tight range, struggling to make new highs or lows.

The balance that comes into play during the consolidation signals key market participants await the news release. Seconds after the release, there are usually wild swings in the market, with prices struggling to break out of the range.

Nevertheless, a few minutes afterward, a new trend often emerges as the price breaks out of the range and starts moving in a new direction away from the range.

The chart below shows EURUSD, which consolidated ahead of the Non-Farm payroll release.

Source: Babypips.com

Once the NFP came in better than expected at 227K vs. 209K expected its signaled strength in the US labor market, all but fueling dollar strength. The dollar strengthening against the Euro followed, fueling a slide in the EURUSD pair.

Any trader who placed a short position below the trading range during consolidation accumulated significant pips as EURUSD fell.

Had the NFP report missed expectations signaling weakness in the US labor market, the dollar would have weakened against the Euro, presenting an opportunity for traders to enter long positions on the EURUSD pair rallying.

Straddle News Trading Strategy

The uncertainty with economic releases makes it extremely difficult to predict the direction price is likely to move after the news release. Therefore, instead of staying on the fence and waiting for things to play out, one can deploy the Straddle trading strategy.

The straddle trading strategy involves taking both sides of the price action in the short term. With the help of pending orders, one places a Buy Stop order that triggers as soon as the price breaks out of the range and starts moving up. Likewise, one places a Sell stop order that would trigger when the price breaks out of the range and drops.

In this case, only one order will trigger once the price breaks out, presenting an opportunity to get early into a trade as soon as the price breaks out.

While using the straddle strategy, it is essential to use tight stop losses to avoid incurring significant losses.

The chart below shows EURUSD, which consolidated ahead of the NFP report release. A trader placed two orders in anticipation of a substantial price movement from the range after the report. Buy stop orders above the range and Sell stop orders below the range.

Source: Tradingview.com

Once the NFP report hit the wires and showed resilience in the US labor market, the dollar strengthened against the Euro. The result was the EURUSD plunging on dollar strength. The Sell stop order got triggered, allowing a trader to lock in significant pips as the price moved below the range.

In return, the trader ended up closing the Buy stop order as it was clear EURUSD would continue moving lower amid the dollar strength.

Buy the Rumor Sell the News Strategy

While the focus is usually on what the market will do once the news hits, the reverse usually occurs. Buy the rumor, and selling the news is a phenomenon that occurs when the market starts pricing in the news even before the economic release or any other news release is made available.

For instance, let's assume that the market expects the European Central Bank to cut interest rates on concerns about the health of the EU economy. In anticipation of the cut, weakness starts prevailing on the Euro ahead of the release sending the EURUSD pair lower.

While the market traded lower and lower during the day, when the actual news was released, it was already priced into the currency pair. Consequently, many market participants refrain from the temptation of selling at the new lows—instead, the focus shifts towards buying at the new lows, sending the currency pair higher.

Source: Thesecretmindset.com

That is precisely what happened in the EURUSD price chart above. The EURUSD pair rallied after the bad news release about the Euro as it was already priced in.

Bottom Line

News releases provide some of the best trading opportunities in the forex market. Ideally, you should focus on economic releases likely to trigger heightened volatility in the market. However, focusing on the major currency pairs is vital as they generate significant moves as traders react to the news releases.

The post How to Trade Forex on News appeared first on Index Fundings.

]]>The post Stop-Loss Orders Guide appeared first on Index Fundings.

]]>When trading any market, whether Forex, crypto, commodities, or derivatives, you'll only win if you can avoid losing. But since one bad trade can wipe out your capital investment, how do you track your trades and catch the moments to enter, buy, sell, or exit?

You need an exit strategy to limit your risk on a trade, and a stop-loss order is crucial when the market moves against you. That's an automated tool activated once the asset price has reached a predetermined level, protecting your trading capital.

A stop-loss order minimizes an investor's loss burden, ensuring that a trader achieves a safe portfolio with better growth potential instead of sacrificing potential returns. While that helps lock in profits and limit losses, how do you set up a stop-loss order for every trade?

What Is a Stop-Loss Order?

When the desired price is reached, a stop loss order automatically buys or sells assets, so you don't pay above or sell below market price. Also called a stop order, investors use an automated tool to trade only up to specified prices to set loss limits and mitigate risk.

Source: ig.com

For instance, if you set your stop loss at 10% below the buying price of an asset, your loss won't exceed ten percent. In a stock trading scenario, you can buy shares and set a stop loss order for when the prices fall to a specified amount, and your assets are sold at the current market price.

A stop-loss order is vital in risk management, and you'll use it to impact the size of your position while determining reward-to-risk and risk-per-trade ratios. You can place regular stop losses like charts, equity stops, or a combination.

How to Use Stop Loss Order

As a market order type, you should consider fundamental analysis factors like current underlying conditions and the likelihood of slippage. That's the difference between the expected and actual price that a trade is executed and occurs due to causes of high market volatility.

Such occurrences are common after news releases, events that impact price when you're entering or exiting a trade, and your stop loss order will last until:

- The predefined stop loss level is reached.

- Stop loss is removed before you’ve closed the trade.

- The trade is closed.

Types of Stop Loss Orders

All your trades should have a stop-loss order to protect your trading capital. There's a risk of losing a substantial amount if only one trade goes wrong. That's a grim prospect, as the loss may indefinitely affect the size of your trading account.

Source: ig.com

Stop losses are categorized according to the rules you can apply when you're setting a stop loss up, and these include;

Equity Stops

An equity stop is based on the percentage derived from your account's size, and you can set stop losses to close positions once your account size depreciates to a certain amount.

Chart Stops

If a stop loss order is set up based on support, resistance levels, or significant price action, it's a chart stop. However, it can only remain valid if these zones are respected when setting a stop loss up, either above or below the defined zones.

Source: cashbackforex.com

If a chart stop's support and resistance levels, which represent a boundary or obstacle, are broken, the stop loss order ceases invalidity.

Volatility Stops

A volatility stop is a stop-loss order based on the average price-volatility index of the traded instrument. If the current volatility of an asset isn't enough to dissuade you from exiting a trade, you can set up such stop losses so that you're not holding positions when it starts working against you.

You can use an Average True Range or ATR indicator to determine where to place a stop-loss order based on volatility.

Source: cashbackforex.com

Time Stops

After a specified time has elapsed, a time stop closes your position at the end of a trading period, whether several hours, a day, or a week.

How to Set Up a Stop-Loss Order

Place stop-loss orders depending on your tactics and trading goals, whether for day trading or as a long-term investment market order. But it would help if you were armed with basic knowledge of how such tool placement affects your trade and the difference between market stop loss vs. stop limit orders.

Configure the Type of Stop-Loss Order

Once you've understood the automated stop loss tool and how to place it, you'll proceed to the next stage, configuring where to place the stop loss instrument. You'll either set an equity, chart, or volatility stop; otherwise, you can specify a timeframe for the order to cancel automatically when that time passes.

Source: cashbackforex.com

One of the most common stop losses is a day order, which closes the trade on the same day it's placed and can be reused every day you're trading. You can also opt for ‘Good till Canceled’ or GTC order which works well for long-term trading strategies that last from 30 to 60 days.

Calculate Price

After selecting the type of stop-loss order that agrees with your trading strategy or goals, you'll have the order's price calculated. Various charts are handy here to highlight asset price ranges within a set timeframe, overviewing them with significant highs or lows.

You'll approximate within 4% to 7% of the trend line’s middle once you've calculated the average price to set the stop loss order. There are technical tools used by experienced traders that help when you need to know how to determine stop-loss price calculation.

Place a Stop-Loss Order

To place a stop-loss order, enter a trading account and select the section for setting up new trades. Instead of a market order, choose a stop loss order and set the price that will execute or trigger the order's parameters.

Whether you've set your order based on timeframe or price, you can now relax and let the automation work its progress. It's vital to note that the set parameters will not execute if the trade’s asset price doesn't perform up and down movements.

Source: libertex.com

What to Avoid When Placing a Stop-Loss Order

Traders make common mistakes, leading to even more significant losses despite setting up and placing stop-loss orders. Now that you’ve learned how to set stop loss, you could still be selling or buying helplessly without making a profit if you;

- Ignore historical data: When looking at where to set stop loss, don’t underestimate an asset's history. That's a mistake since it helps you predict price movements from previous moves or rapid turnovers.

- Use stop loss for gapping stocks: Stocks that gap or have their prices growing high during one period but drastically dropping in another will trigger your stop loss order unexpectedly. Instead of gaining profits the next trading session, such triggering leads to subsequent sales.

- Forget to update or renew your stop loss orders: If you’re a day trader, or have set your stop losses on a timeframe basis, don’t forget to update or renew your expired orders.

What’s The Difference between the Stop-Loss and Stop-Limit Orders?

When comparing a stop loss and a stop limit order, it’s essential to note that both are for mitigating risk on existing positions against potential losses. You can also capture profits on swing trades.

Stop losses guarantee execution when a position hits a specific price while limits build in the limit price an order gets filled at. Whether your trade is long or short, you can enter a stop limit or stop loss order, but this depends on your position and current market price.

You can also alternate between a stop loss and stop limit order when establishing a new position at a price level you believe represents the start of a trend. The limit will guarantee the maximum buy and minimum trade price for sell once the trade executes.

How to Place Stop-Loss and Take-Profit

A stop-loss order will prevent you from regularly monitoring asset prices as it'll execute a trade within the set price or period parameters. Often tools for stop losses are free as part of your trading account or brokerage MT4 functionality offers.

When a stop loss turns into a market order, brokers charge a commission once the trade is complete, but it's not a tool that guarantees risk-free trading. Besides failing at rapidly falling markets, you also can't use stop losses with specific assets such as securities.

The post Stop-Loss Orders Guide appeared first on Index Fundings.

]]>The post Psychology Tips to Trade Confidently appeared first on Index Fundings.

]]>What is Trading Psychology?

Trading psychology refers to the frame of mind and emotions while trading. With proper trading psychology, a trader can shun emotions, remain objective, and trade based on agreed rules rather than make irrational decisions.

Source: Investorsunderground.com

Emotions are some of the biggest obstacles for any trader looking to be objective and stick to rule based strategy. Fear and greed often than not, force traders to trade haphazardly without putting to use their tested strategy or rules.

For instance, the fear of losing another trade forces some traders to hold on to a losing position much longer than they should. Fear also causes traders to close positions as soon as a loss emerges instead of waiting for the trade to play out. Proper trading psychology ensures one keeps the buy and sell strategy free of fear.

Similarly, greed often causes traders to hold on much longer to a winning position instead of taking profits, to the extent of a market reversing, resulting in all profits being wiped out. Greed also causes traders to enter trades that they should not.

Strong market psychology is the only way any trader can remain objective and avoid the pitfalls of greed and fear.

How to Improve Trading Psychology?

Create a Trading Plan

The best way to remain disciplined and objective while trading is to create a trading plan and resolve to stick to it. A rule-based trading strategy ensures trades are opened and closed based on set-out guidelines rather than fear and greed.

The trading plan should entail when to open buy and sell positions and close them down. Additionally, the plan should detail when to stay off the market. Finally, the plan should also involve a risk management strategy involving a stop loss and when to take profits using profit-take orders.

It would be better to look at the trading plan whenever you start feeling stressed, fearful or greedy.

Cut Out the Noise

The internet is an unlimited source of resources, some good and some bad. While trading, the prospect of encountering divergent views or plans is typical. Some may be helpful, and some may be noisy.

The vast majority of the information on the internet is merely noise that acts as a distraction. Therefore, it is important to shun such news aimed at taking your confidence. While everyone comes with a different approach to the market, sticking to the trading plan can help ignore most unnecessary information that is merely noise.

Remember that just because something worked for somebody may not work for you. Similarly, just because it worked in the past does not mean it will work in the future.

Regular Breaks are Crucial

Siting glued to the screen an entire trading day only messes up the trading psychology. It is vital to take breaks to help the mind relax and digest whatever is happening in the market. Breaks also help ease any emotional strain that may cloud judgment and lead to irrational decisions.

While taking breaks, do something completely different from trading to help reconfigure and rejuvenate the brain. In addition, the suspension will help ease any emotional strain, making it difficult to remain objective in the market.

You Will Not Be Right All The Time

No matter how proven or effective the underlying strategy is, it is essential to understand that the market will always do what it wants. Therefore, there is no such thing as being correct all the time; all trades lead to profitable outcomes.

In this case, there will always be periods of downtown when things need fixing. Therefore, the prospect of making losses will always be high. However, understanding losses are part of the trading process should help calm the nerves and prepare for the next trade or day.

The trading plan is okay even if something needs fixing in a given trading session. The losses could be coming because of forces beyond your control.

Remind Yourself You Are Trading Real Money

While trading, always be cautious and remind yourself that money is on the line. There is always the risk of forgetting that the actual numbers on the screen are real money, thus a lot at stake. This way, it becomes much easier to avoid being greedy, let alone letting fear take control and influence the decision-making process.

Whenever a big loss hits home, it is vital to have the emotional strength to stomach it. So instead of making hasty decisions to try to recoup the loss, take a back seat and understand what the market is doing and what went wrong.

Have a Journal and Review all the Trades Made

A journal is an important aspect of the trading career. It allows one to monitor all the trades made and why they were made. Putting everything down is a sure way of keeping in touch with all trading activities and shunning any bad behaviors that might come into being due to emotions.

Additionally, it is important to review each trade made, whether it ended at a loss or a profit. Carrying out an in-depth analysis helps strengthen and polish the trading strategy, making it more effective and reliable for generating positive outcomes.

Know When to Cash in and When to Cash out

Regardless of the analysis carried out, you will never know what the market is going to do. Therefore, you must develop a clear plan for entering a trade and exiting at a loss or profit. With clearly spelled-out entry and exit rules or signals, gambling risk in the financial markets is always low.

Likewise, emotions will always take over, resulting in trades that should not have been made in the first place. The fact that the market sometimes behaves differently than expected means one should always have a strategy for getting in and out. Always have a clear plan to exit rather than waiting for the market to offer a clear exit sign.

Bottom Line

No matter how much you learn, study, practice, or analyze the market, having a proper mental edge will dictate the amount of success you enjoy in trading. Discipline is an important attribute that helps traders remain calm and collected in the market. In this case, trading based on a spelled-out strategy and rules becomes much easier than being an emotionally driven trader.

The post Psychology Tips to Trade Confidently appeared first on Index Fundings.

]]>The post Best Technical Indicators for Swing Trading appeared first on Index Fundings.

]]>Technical traders rely on indicators to identify potential swings. The indicators allow traders to identify support and resistance levels whereby the price will likely break out or reverse direction from the underlying trend.

How Swing Trading Works

In swing trading, traders look to open a position in a given direction and let the position accrue profits until a reversal occurs. The position will only be closed when the trend shows signs of reversing. Unlike day trading, traders are not interested in short-term price volatility. Consequently, the focus is on price actions in larger time frames.

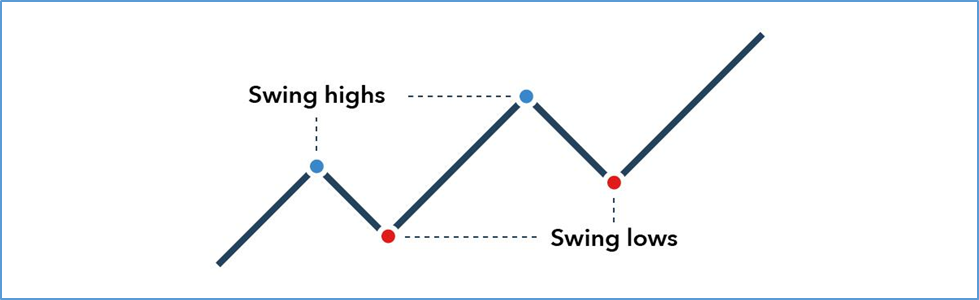

Swing Highs and lows are the only things that matter in swing trading.

Swing Highs: In this case, the price tends to make new peaks after every pullback. Whenever the price moves up and forms a new swing high from the previous correction, it affirms a bullish trend, signaling it is the best time to look for buy or long positions.

Source: IG.com

Swing lows: They are mainly used to affirm a bearish trend implying it is the best time to look for short or sell positions. Swing lows occur whenever the current low is lower than the previous low, signaling a buildup in selling pressure.

What Are Swing Trading Indicators?

Swim trading indicators are technical analysis tools allowing traders to determine whether the market is bullish or bearish. Additionally, the tools can affirm the strength of the prevailing momentum, making it easy to know whether the trend will hold or reverse.

The top indicators for swing trading are broadly classified into three categories:

- Trend Indicators

- Momentum Indicators

- Volume Indicators

Trend Indicators

These are technical indicators for swing trading that signal the direction in which the market is moving. In this case, they signal whether the market is moving up or down. The indicators smooth price volatility to confirm the primary trend. The best indicators for swing trading based on trend include the moving averages and Moving Average Convergence Divergence.

Momentum Indicators

These swing trading indicators show the solid underlying trend and whether a reversal could be in the offing. Additionally, such indicators confirm whether the underlying asset is sold too much, thus oversold conditions, or bought too much, thus overbought conditions.

Volume Indicators

They are some of the best forex indicators for swing trading, showing how many traders buy or sell at any time.

Below are some of the best indicators for swing trading based on the above classification.

Moving Average

Moving Average is a common indicator used in many swing trading strategies. It stands out as it allows swing traders to calculate or know the average price of an underlying asset at a given time. While MAs are lagging indicators that rely on past price actions, they are mainly used to confirm the underlying trend rather than predict future price movements.

MAs are classified into three; short, medium, and long-term MAs. The classification is based on how many periods the indicator monitors. Short-term moving averages have a period of between 5 and 50, while medium-term MAs have a period of between 50 and 100. Long-term MAs have a period of more than 100.

Moving Average Swing Trading Strategy

The most popular swing trading strategies leveraging moving average indicators rely on short and medium-term MAs. In this case, one can use a 21 Moving Average as the short-term MA and 100MA as the long-term MA.

The strategy is based on the crossovers that come into play. Consequently, whenever the short-term 21MA crosses the 100MA and starts moving up, it affirms the start of an uptrend. The crossover signals a buildup in bullish momentum, implying that prices will likely increase.

Source: Tradingview.com

Consequently, a swing trader can use the opportunity to open a buy position in anticipation of accruing profits as the price moves up the chart. The traders will let the position remain open or run until the 21MA crosses the 100MA and start moving lower, implying a change in momentum from bullish to bearish.

Likewise, the trader can look to open short positions whenever the 21MA crosses the 100MA and starts moving lower. The crossover implies the start of a downtrend presenting an opportunity to profit from short positions as the price edges lower. The trader will let the position run until the 21MA crosses the 100MA and start moving up, suggesting the end of the downtrend and the start of an uptrend.

Relative Strength Index

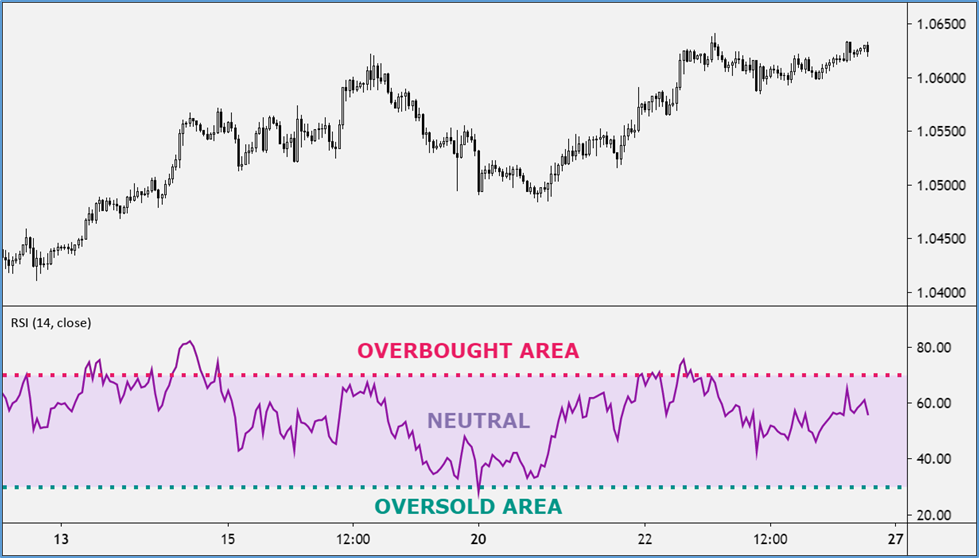

It stands out as one of the best swing trading tools on its ability to confirm the prevailing market momentum. The indicator calculates the sizes and magnitude of the latest price changes, showing which traders have the upper hand: bulls or bears. In addition, it comes with readings of between 0 and 100, which helps affirm overbought and oversold conditions.

Source: Babypips.com

As the oscillator moves between the extremes of 0 and 100, it signals the prevailing market conditions, whether bullish or bearish. Consequently, whenever the oscillator reading is above 50, it signals bullish momentum implying traders should look out for long positions as more buyers are placing positions.

On the other hand, whenever the RSI reading is above 70, it signals the underlying asset has been bought too much, thus the overbought conditions. While the price can continue increasing even with the RSI reading above 70, the prospect of a price reversal occurring at this level is usually high. Therefore, swing traders generally look for reversals whenever the RSI exceeds 70.

Likewise, whenever the RSI reading is below 50, it implies a buildup in bearish momentum, suggesting swing traders should look to enter sell or short positions. Whenever the RSI is below 30, it suggests the underlying asset is sold too much and thus oversold. While sellers can continue pushing prices lower even with the oversold conditions, price reversals tend to occur at these levels.

Source: Bybit.com

The price chart above shows that the price is in a downtrend in the initial phase as soon as the RSI falls below 50. As the price dropped significantly, the RSI dropped below 30 and fell below 20. While the price did move lower significantly, the downward momentum lost strength as swing traders sensed the oversold conditions. The price returned as the RSI rose above 30 from the oversold condition.

The bounce back in the RSI presented an opportunity to enter a buy position to profit from a potential bounce back from oversold conditions.

Volume

Volume is one of the best indicators for swing trading as it allows swing traders to align their positions with the direction in which big players are trading. The indicator is typically set below the main chart by default and shows how robust a new trend is. While the indicator shows how many traders buy or sell a given asset, it emerges as bars below the price chart.

The bigger the bars, the higher the trading volume, implying traders will likely push the price toward their orders. As the bars increase, more buyers or sellers are placing orders toward the underlying trend.

Source: Bybit.com

The price chart above clearly shows that Bitcoin increased as volume surged. This is because swing traders could have used the opportunity to enter a long position and align their positions with whales pushing prices higher as the volume bars increased.

Whenever the volume bars appear small and balanced, it implies consolidation, signaling that neither buyers nor sellers are in control. In this case, the price is expected to move in a range and struggle to make any new highs or lows.

Moving Average Convergence Divergence Indicator

The moving average Convergence Divergence indicator is one of the best forex indicators for swing trading as it shows the trend and underlying momentum of the asset under study. The indicator comes with two moving averages, a fast-moving and a slow-moving. In addition, it comes with a Histogram that shows the strength of the underlying trend.

The fast-moving average acts as the MACD line as it responds fast to price action activity in the market. On the other hand, the signal line is the slow-moving average that takes some time before changing direction.

Source: Tradingview.com

Consequently, whence the MACD line moves above the Signal line, it implies a buildup in buying momentum, implying the start of an uptrend. Traders can use the opportunity to enter long positions in anticipation of higher prices.

As the buying pressure increases, the MACD line will move further away from the Signal line. As a result, the Histogram will appear above the zero line and increase in size as the upward momentum increases.

On the other hand, whenever the MACD line or the fast-moving average crosses below the Signal line and moves lower, it implies a buildup in selling pressure. Swing traders can use the opportunity to open short positions.

As the selling pressure increases, the MACD line will move further away from the Signal line. As the Histogram increases in size below the zero line, it signals the appropriate time to eye short-selling positions.

Divergence is another scenario swing traders pay close attention to when looking to profit from potential price reversals. Whenever the MACD line is above the Signal line, the price is expected to continue increasing, making higher highs. However, that is only sometimes the case.

Source: Bybit.com

Identifying Divergence Signals for Swing Trading

There comes a time when the price makes new higher highs, but the MACD indicator changes course and moves lower instead of also making higher highs. As the MACD indicator makes lower lows while the price makes higher highs, it affirms a disconnection or divergence.

If this were to happen, swing traders would look to enter short positions as the prospect of price reversing from the higher highs is usually high. The MACD making lower lows signals bearish momentum is slowly building up and that price is unlikely to edge higher further.

Likewise, it implies divergence whenever the price moves lower, making lower lows while the MACD indicator increases. A swing trader can look to enter a buy position as the MACD indicator implies. That buying pressure is building up and that price will likely bottom out from the downtrend and move up.

Bottom Line

The best indicators for swing trading are the ones that provide valuable insight into the underlying trend, the momentum, and the direction in which most traders are placing positions. Moving Average, RSI Volume, and MACD are some of the best swing trading tools in this case.

The post Best Technical Indicators for Swing Trading appeared first on Index Fundings.

]]>The post How to Identify a Trending Market appeared first on Index Fundings.

]]>Trend trading can be a very profitable endeavor. When the price is volatile, breaking through previous support and resistance zones, even one trend trade can prove to be extremely profitable. This is why so many traders base their strategies around trading with the trend. In order to build a trend trading strategy, we need to better understand what a trending market is and how to identify one.

Liquidity

Liquidity is a vital ingredient in a trend-based strategy. That means that there are always enough buyers and sellers at all times. One of the most attractive features of forex trend trading is liquidity. Because forex traders are trading currency pairs, there is always a buyer and seller available.

When a stock folds, there are no buyers to take it off your hands. But in forex it is extremely rare for a nation’s currency to become worthless, so there will always be bulls and bears ready to take a position. This is also why, in general, a currency price is always hovering between a major high and a major low. Over the long term the price always comes back to the middle of the chart, the mean price.

Major pairs (pairs that include USD) are usually very liquid pairs. Liquid pairs can display major movements in the markets in a very short time frame. These extreme moves up or down are called trends, as if to say it is a new trend (popular in the short term) that the currency price is moving up or down to this extreme.

One last point before we learn how to identify a trend. Trending markets aren’t limited to long-term charts. Trends are found in short-term charts as well. For example, in the GBP/USD Daily chart below we can see a downward trend, but in the 1 MIN chart of GBP/USD that follows, the market is trending upward.

“Novice traders convince themselves a trending market will reverse, whereas professional traders jump onboard the trend and ride it”.

- Nial Fuller

How to identify a market trend?

There are a number of indicators that can determine if a market is trending. However, before we get into them it’s best if the trader can find the trend himself, without the support of any indicators.

To spot an uptrend on your chart, you want to find a series of higher highs and higher lows. To identify a downtrend you're going to look for a series of lower highs and lower lows.

Usually a trader who develops a unique system will predetermine how many highs or lows is necessary to be considered a trend in his strategy. For example, a trader who speculates on the 5M chart might decide that unless the chart prints three higher highs followed by three higher lows, he will not consider it to be an uptrend.

Here are some indicators that can help you determine if the market is trending:

- Moving Averages.

- ADX.

- Bollinger Bands.

Moving Average as a Trend Indicator

Many traders use the moving average indicator to determine if the market is trending. The best way to use the moving average indicator is to plot three simultaneous moving averages on the chart, one short term, one long term and one in the middle.

For example, a 5 candle simple moving average, a 15 candle average and a 50 candle average. This will plot three lines on the chart. One will show you the average price over the last 5 candles. The second will show you the average over the last 15 candles and the last one will show you the average over the last 50 candles. When the averages cross over each other, see below, it indicates the beginning of a trend.

ADX Trend Indicator

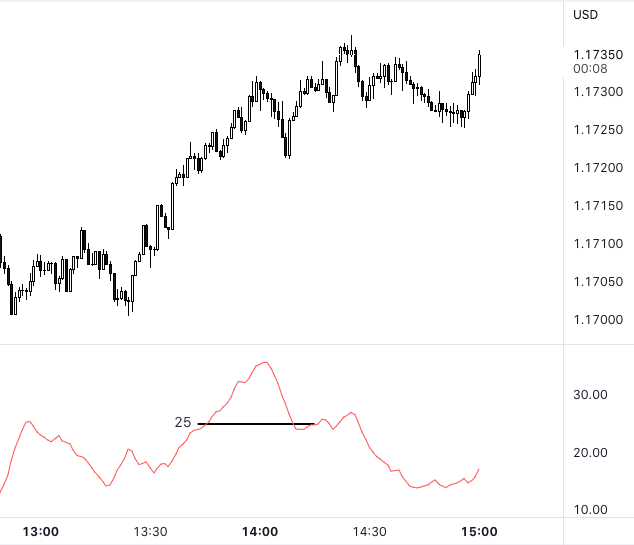

The ADX indicator helps differentiate between a ranging market and a trending market. The ADX indicator is a simple reading. You just set up the indicator and if it shows a reading greater than 25, it’s indicating that the price action above it is trending. A reading below 25 indicates that the market is ranging. See the same chart below and notice that the same place where the moving averages crossed has a reading above 25.

Bollinger Band to Determine the Trend

Bollinger Bands is a third indicator to help determine if the market is trending or ranging. When the bands are contracting, the market is ranging and when the bands are expanding it signifies that the markets are trending. In the chart below with the same price action we notice that between 13:00 and 13:30 the bands are contracted and between 13:30 and 14:00 the bands are expanded.

Final Thoughts

Putting all this together is what traders call confluences. Confluences are when multiple strategies or ideas converge and become one. So suppose that a trader wants to identify a trend; he might decide to rely on two or three confluences before making that determination. For example, the trader notices a higher high and higher low and then moving averages cross, that could qualify as two confluences. More confluences give traders greater confidence that their opinions are representative of the majority opinion in the market.

We hope this article provides a basic introduction to trending market indicators and helps you better identify a trending market. Good luck traders!

The post How to Identify a Trending Market appeared first on Index Fundings.

]]>The post Can You Day Trade For a Living With $1,000? appeared first on Index Fundings.

]]>Beginning traders often ask, “Can I day trade for a living starting with just $1,000?” Well, $1,000 is not enough buying power to day trade in stocks, but in forex it’s enough to start because many forex brokers have a minimum opening balance requirement of only $100.

Leverage

Another major advantage of day trading forex over stocks is the leverage that forex brokers offer. Forex brokers offer more leverage than stock brokers because the forex market is significantly more liquid than the stock market. Leverage is essentially when the broker gives the trader more purchasing power in the form of a loan.

For example, with $1,000 of capital and 30:1 leverage a trader can purchase 30 times his capital, or in this case a maximum of $30,000.

This advantage allows his gains to be 30 times as big, but it also means that his losses could be 30 times greater. Needless to say, leverage can be a lucrative, yet dangerous trading tool. The risks of using leverage are beyond the scope of this article and a trader should fully understand these risks before engaging in it.

“Leverage has the potential to turn a reasonably good investment into disastrous gambling.”

Naved Abdali

How much can you make with $1000?

In this article we will demonstrate two ways to build a $1,000 account:

- With your own money

- With a proprietary trading firm

1. Day trading with your own money

Let’s make up an example for illustrative purposes. Mister A has been working on a demo account for the past 12 months. Over nearly 1000 deals, Mister A averages about 1 and a half deals per day with a 52% winning percentage. He risks 1% of his capital on every deal. His average reward to risk ratio is 2:1, which means for every two dollars he wins, he loses a dollar. Mister A is excited about his prospects for day trading and he opens up a $1,000 account with a broker.

Person A quick stats recap:

Deals per month: 33 (1.5 per day with 22 trading days)

Winning Percentage: 52%

Risk per Deal: 1%

Reward-Risk Ratio: 2:1

Based on the above stats, his expectancy formula in month 1 is as follows:

$20 per win x [33 trades x 52%] - $10 per loss x [33 trades x 48%]

= $343.20 - $158.4

= $184.80

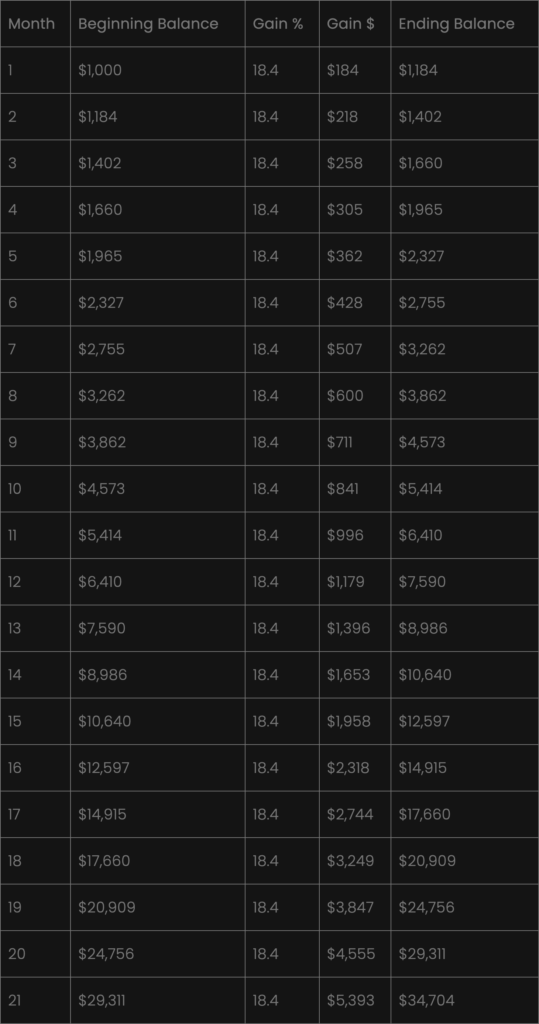

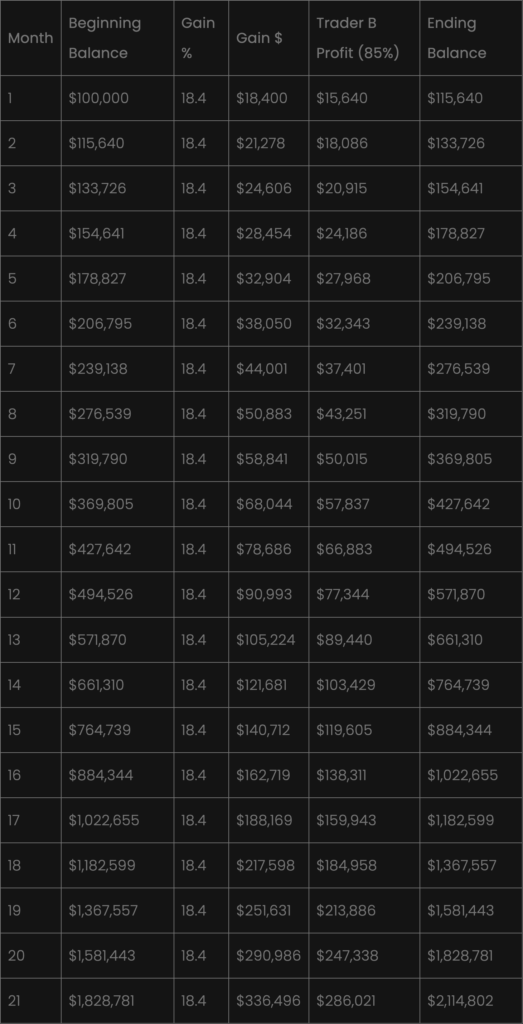

That is an amazing 18% return on investment in only one month, yet parson A only made $184.80. Let’s take a look and see how his equity will grow if he consistently makes that 18.4% per month and doesn’t withdraw any money from his account (assuming it compounds at the end of the month only).

According to the table above, Trader A compounded his account month over month and in month 21 made $5,393 of profit. The average US household expenses in 2020 was $5,011. So if he was that good of a trader (18.4% per month = 220% ROI per year) and was disciplined enough to wait 21 months before withdrawing a penny, he could withdraw his profit in month 21 to pay his bills.

Day trading with a firm like Index Fundings

Let’s imagine that Trader B has the same stats and the same success in 12 months trading with a demo account. Instead of opening up a $1,000 account with a broker, he uses the $1,000 to purchase a $100,000 evaluation with Index Fundings. After two weeks B made 10% profit and passed the evaluation. Now Trader B is funded with a real live $100,000 account. After only one month, he made a whopping $18,400 in profit. Obviously that’s enough to live on already, but just for fun let’s imagine two different scenarios.

- He decides for some reason not to withdraw for 21 months just like dealer A.

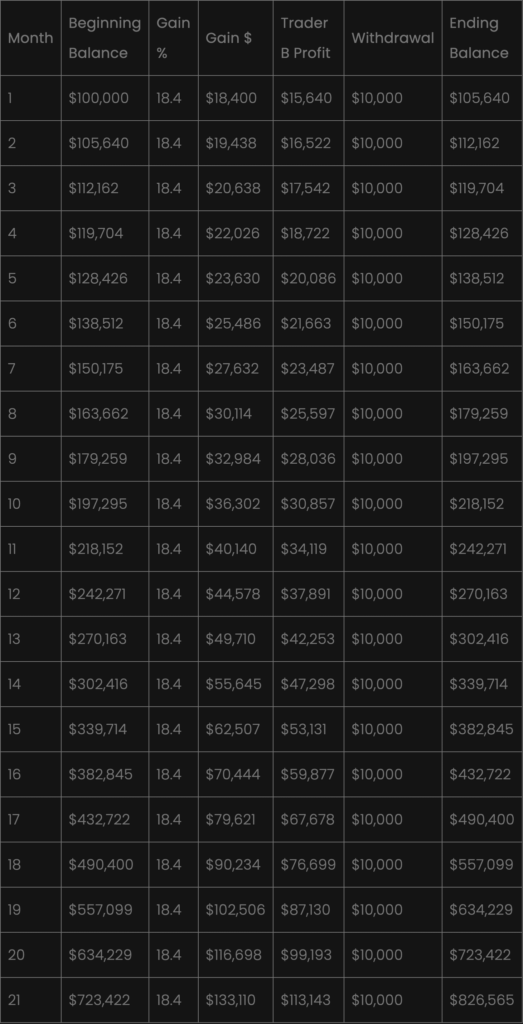

- He decides that $10,000 is more than enough for him to live on. Therefore, he only withdraws $10,000 and he leaves the rest of the money in the account to grow.

See the below table where Trader B does not withdraw any profit for the first 21 months and makes more than $286,000 in month 21, trading a $1,800,000 account.

See the below table where Trader B withdrew $10,000 per month from month 1 for the first 21 months (a total of $210,000) and still makes more than $113,000 in month 21, trading a $723,000 account.

As we clearly see, Trader B whose percentage gains are exactly equal to A is so much better off than A. These are the extraordinary benefits of trading in a funded account with a proprietary trading firm like Index Fundings.

Check out Index Fundings today to see how you can get funded just like Trader B.

The post Can You Day Trade For a Living With $1,000? appeared first on Index Fundings.

]]>The post Range Trading: How to Trade Ranges appeared first on Index Fundings.

]]>Vertical price movement between support floors and resistance ceilings is called a range. Price support is offered at the bottom and resistance at the top of the trend. While you may use this trading method alone, it's better to complement it with other strategies. These include following trends or an opening range breakout strategy.

You can apply the idea of trading within a narrow range to various markets, including stocks, Forex, and crypto. This means buying when an asset is oversold and selling when it's overbought. Horizontal consolidation provides numerous breakthrough trade opportunities to buy near resistance and sell next to support levels.

Since markets usually trend 20% of the time, some counter-trend actions and retracements result in a directionless nature of transitioning. Once you've learned how to trade ranges, you can develop an effective strategy usable with any asset in various market conditions.

What Is Range Trading?

A range-bound market has prices bouncing between specific highs and lows, acting as major resistance and support levels where prices can't break above or below. It's a movement described as horizontal, sideways, or ranging, but it's also termed choppy, which is the opposite of trending.

Since there is no clear price direction, seeing as they chop either up or down, trades are only possible within narrow ranges. As such, range trading is seen in all timeframes, similar to following trends, whether long or short-term. Once you’ve spotted how to identify the range, you can go with the overall trend direction, buy dips or sell when the price rallies.

Source: https://www.school.stockcharts.com/doku.php?id=chart_analysis:chart_patterns:price_channel_continuation

In the absence of a trend, you can use range trading as a technique to trade range-bound markets that lack clear direction or look for range breakouts on the back of strong momentum. That requires you to time your entry with overbought and oversold indicators, which identify clues that your support and resistance levels will hold.

What Are the Types of Trading Ranges?

Like other strategies, range trading requires correct execution, which you'll only achieve if you practice attention to detail and identify market conditions. Using various technical analysis approaches, look for instruments with lower volatility since these indicate less turmoil and suitability for range-bound trading.

To avoid false breaks or bounces, adopt various triggers and trade filters to enter and exit a range, together with whichever range-bound strategy you use. Such technical tools include moving averages, oscillators, Bollinger bands, and others, applied to typical trading scenarios that have:

A Rectangular or Horizontal Range

The price moves sideways between upper resistance and lower support levels, roughly horizontally in a rectangular range. While these ranges aren't as common as continuations or channels, they occur at any-time scale, and you can spot them visually or with an indicator.

- A rectangular horizontal range will show clear lower and upper support and resistance zones.

- Moving average lines that are flattened.

- Troughs and peaks within the horizontal band.

Using Forex trading Indicators, you'll chart your support and resistance levels to indicate a signal line that crosses downwards to sell or upwards to buy.

Source: https://www.ifcmarkets.com/en/forex-trading-strategies/range-trading-strategy

While there are specialized tools for automated range trading, an Average True Range or ATR, standard moving averages, and a Relative Strength Index or RSI are helpful.

The Diagonal or Price Channel Range

Another common pattern in Forex range trading is the diagonal or price channel range, where the price ascends or descends within sloping trend channels. It can be rectangular, it can also be broader or narrower and sometimes extend into long periods, even years.

These are trends, but most short-duration trading opportunities happen within ranges developing in a trend, and as such, you can trade channels with a breakout or trend-following strategy. If these form against the main trend, they're referred to as continuation patterns, including wedges, pennants, and flags.

Breakouts tend to happen in the opposite direction from channel ranges, especially the short-duration ones, with the most likely break in an upward-sloping range to the downside. As a useful technical analysis rule of thumb, and while it's not a guarantee, downward-sloping range channels are likely to break on the upside.

Source: https://forexop.com/learning/range-trading-basics/

False breakouts will also happen due to various triggers, including news releases resulting from program trades, when an automated system enters its response to a data release. The move fades since the markets have already absorbed and registered reactions to the news, and a consensus view reestablishes as the price reverts to its original level.

Continuations Ranges: Flags, Pennants, Wedges

Chart patterns within a range are called continuous ranges, including pennants, wedges, triangles, and flags. While marking a correction against predominant trends, these ranges can generate bullish or bearish signals, occurring at any time scale.

You can trade a continuous range in its own right or as a breakout, depending on your time frame. But since these patterns produce robust bearish and bullish breakouts, traders prefer to trade them as breakouts. Especially when the prevailing trend resumes.

Irregular Ranges

For some ranges, the pattern isn't obvious in formations where price movement centers on a central pivot line. That forms support and resistance lines around it. Moving averages and trend line analyzers mark these ranges. Identifying where the lines are so you can trade toward the pivot line and not its extremes.

Source: valutrades.com/en/blog/range-trading-a-simple-forex-strategy-explained

To trade out price extremes in the hope it'll revert to a mean, use smaller profit targets. Capture movement that pushes towards the central pivot line. The strategy offers the chance of a breakout or stop-loss partial. Reducing risks with the assumption that the price will turn in your favor.

How to Trade Range: The Best Range Trading Strategy

In most cases, price movement in a range will deviate towards a center line. You can set your entry and profit targets away from the extremities to guarantee returns. While the number of tradeable opportunities increases, the downside is that it reduces potential profits per trade.

Trading a range requires waiting for a price reversal at or near the range's boundary wall. You'll spot consolidation beforehand before reversals happen. Prices often turn before your support resistance levels. If you confirm the move with a candlestick pattern marking the direction towards the center of a range.

The best range trading strategy is to set your take profit to not more than two-thirds of the range's span. And your stop loss well clear of the boundary to account for false breaks. If you spot setups that appear too obvious, beware that a breakout may happen soon. So try not to chase the price, or they'll take your profit.

The post Range Trading: How to Trade Ranges appeared first on Index Fundings.

]]>The post Top 5 Tips for Scalping Trading appeared first on Index Fundings.

]]>How to Scalp in Forex Successfully

Scalping is a strategy that allows traders to generate profits from small price changes. Trades are taken quickly, and once they become profitable, one can lock in profits. The action is repeated throughout the day, with traders opening and closing dozens of positions.

Most scalpers open and close positions within minutes, whether they generate profits or losses. The idea is to take as many trades as possible, taking advantage of short-term price swings. Consequently, no position is left open for hours as market sentiments will have changed.

Tips for Scalping Forex Successfully

Ignore Fundamentals, Focus on Technical Analysis

One of the best tips on how to scalp in forex calls for traders to focus on price movements on the chart rather than carrying out fundamental analysis. The idea is to study price movements and look for support and resistance levels.

Support and resistance are critical levels from where trading opportunities emerge. For example, if the price is in an uptrend, a trader will look to enter a quick buy position whenever prices pull back to the support level. Similarly, a trader can look to enter a quick short position as soon as the price rises to the resistance level when the underlying trend is bearish.

Source: DailyFX.com

If you're wondering how to scalp in forex, it's better first to master how to identify support and resistance levels and other chart patterns. Reversal patterns are some of the best as they provide an opportunity to open a quick trade as the price reverses course and starts moving in the opposite direction.

It is also essential to master candlestick patterns as they provide valuable insight into the direction price is likely to move. For instance, the emergence of a bearish engulfing candlestick is usually a sign that the price is expected to tank from an uptrend. Likewise, the emergence of a bullish engulfing pattern is an early sign of the price's likelihood to bounce back after moving lower for some time.

As a result, one of the best tips on how to scalp in forex calls for traders to master various chart and candlestick patterns. The only way to understand the market momentum, therefore, predict the direction price is likely to move. In this case, one ignores economic factors that might affect price movement.

Focus on One Currency Pair at Time

Taking advantage of short-term and small price movements calls for a lot of precision and timing. Therefore, to master how to scalp forex successfully, it is essential to focus on one currency pair at a time.

Focusing on one pair at a time makes it easy to analyze price action with the utmost concentration. In this case, attention is not diverted. However, it can be challenging to properly monitor the technical charts of various currency pairs and take advantage of small price movements simultaneously.

Liquidity is Key

While there are many currency pairs that one can scalp and squeeze in considerable profit, few provide solid and highly probable trading opportunities. Liquid currency pairs are the best for anyone looking to master how to scalp forex successfully.

Liquid currency pairs generate ideal trading opportunities, given that the price moves up and down rapidly. In contrast, illiquid currency pairs take a long time to move from one place to another, making it impossible to take advantage of small price movements.

The major currency pairs are the best for anyone looking to master how to scalp forex successfully. Moreover, given that many people trade these currency pairs, their prices tend to fluctuate quickly, generating ideal scalping opportunities.

Source: Fxssi.com

Additionally, liquid currency pairs come with low trading costs. The spreads while trading these pairs are usually small, given the high number of people trading them. Therefore, a scalper will only incur a small fee despite opening dozens of trades while scalping.

In contrast, illiquid currency pairs come with wide spreads, which translates into higher trading costs. Consequently, the more positions one opens, the more likely one is to incur additional costs, making it challenging to generate optimum profits.

Psychological Edge

Scalping is a high-speed trading strategy that requires a high level of sobriety and concentration. Given that prices can move too fast, one must be mentally prepared and well-equipped to respond adequately to profit as a scalper.

A trader's technical analysis skills and patience are crucial to mastering how to scalp forex successfully. A trader must be ready to make hasty but well-thought out decisions to make a profit as a scalper. Additionally, one must be able to overcome greed and avoid the temptation of overtrading while trying to scalp forex successfully.

Instead of forcing trades as a scalper, it is vital to take what the market gives. While it is possible to place up to 15 trades daily, the scalper must also appreciate that, at times, placing four trades or less is better.

Best Time to Scalp

Successful scalping would also come down to a trader's ability to trade at the appropriate time. Even though the focus is usually on liquid currency pairs, they don't provide ideal scalping opportunities all the time. Therefore, a trader should know the best time to open trades and when it is better to stay off the market.

For instance, GBPUSD and EURUSD provide the best scalping opportunities whenever the London and New York trading sessions overlap. Moreover, this would be the best time to open and close positions, given the increased volatility that makes it easy to take advantage of small price movements. In contrast, the pairs might not be ideal during the Tokyo session as market participants in North America and Europe are sound asleep, and there is little market movement.

Source: Admiralmarkets.com

The best time to scalp the major currency pairs is during the New York session, as the focus is usually on the US dollar. During this time, economic releases and increased market participants trigger wild swings in the market, making it easy to enter and exit positions.

Bottom Line

Successful forex scalping is a combination of many factors. Mastering technical analysis is overly important as it is the only way to understand market sentiments and predict the direction price is likely to move. In addition, one should focus on liquid currency pairs and only trade when ideal conditions arise.

The post Top 5 Tips for Scalping Trading appeared first on Index Fundings.

]]>