Read about using fractal indicator in trading. Our experts explained a possible fractal trading strategy for your best outcomes. Learn how to trade with fractals on the Index Fundings Blog.

The forex market is home to dozens of currency pairs whose exchange rates fluctuate as traders react to various economic releases and geopolitical developments. Given that currencies come in pairs, no single pair trades independently of others. There is usually a correlation between different currency pairs. While trading, it is vital to understand the various forex pairs' correlation for the best trading experience.

Forex correlation is the extent or measure to which two or more currency pairs relate. Once you master how the currency pairs correlate, controlling a portfolio's exposure becomes manageable. Additionally, it can directly affect trading pairs with or without trader awareness.

There are two types of currency pair correlation:

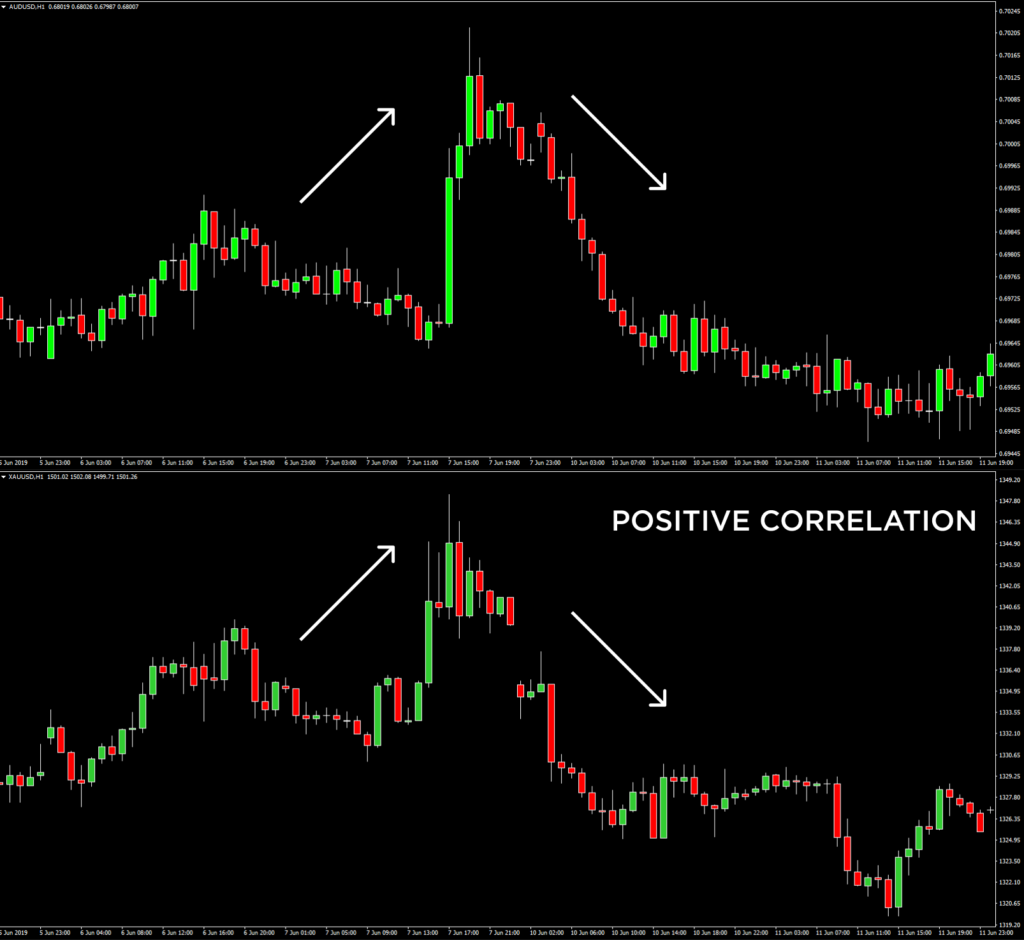

It is a correlation associated with currency pairs that move together. It occurs when two or more currency pairs move in the same direction as traders react to various developments in the trillion-dollar marketplace.

Source: Octafx.com

For instance, EURUSD and GBPUSD have a positive correlation. Therefore, whenever EURUSD is trending upwards due to dollar weakness, GBPUSD tends to behave the same way in taking advantage of dollar weakness.

A negative forex correlation occurs when two or more currency pairs move in the opposite direction most of the time in response to various factors affirming an inverse correlation.

Source: Ninjatradr.com

For example, GBPUSD and EURGBP have an inverse correlation. Whenever the GBPUSD pair moves up due to dollar weakness, EURGBP tends to move in the opposite direction.

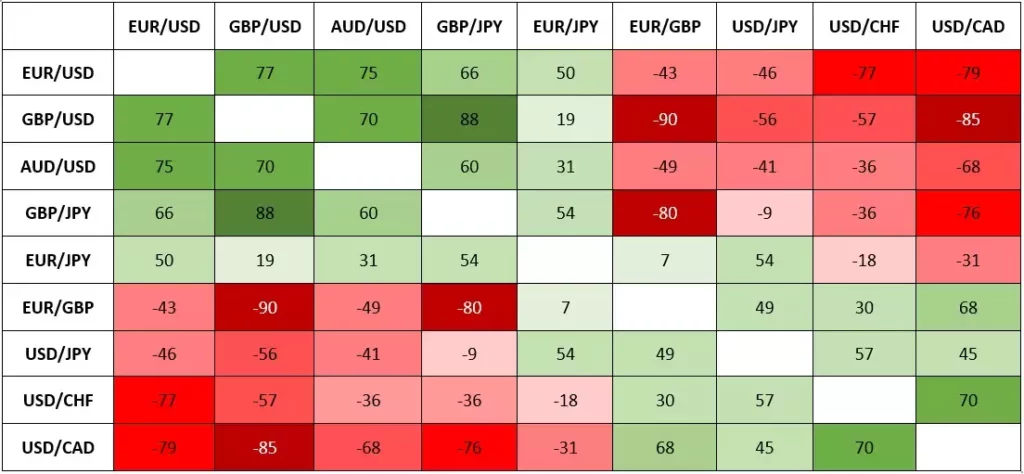

The currency correlation coefficient denotes how strong or weak a correlation exists between two pairs, expressed from -100 to 100. A -100 reading implies that the two pairs are nearly identical but move in opposite directions, whereas a 100 reading suggests that the two pairs are similar and will always trend in the same direction. Any reading below -70 and above 70 signifies a strong correlation in the opposite and same direction, respectively.

Source: CMCmarkets.com

The chart above shows correlated forex pairs listed between various currency pairs. Any positive reading affirms a positive correlation, while a negative reading affirms a negative correlation.

For instance, EURUSD has a strong positive correlation with GBPUSD and AUDUSD, which sees the pairs often move in the same direction 75% of the time.

In contrast, EURUSD has a robust negative correlation with USDCHF and USDCAD, implying that it often moves in the opposite direction from the two pairs. Likewise, the GBPUSD has a robust negative correlation with EURGBP at -90.

Understanding forex pairs correlation allows traders to avoid taking trades that cancel each other. For instance, EURUSD and USDCAD have a strong negative correlation; therefore, it would not make sense to open a long position on both pairs. The trades will eventually cancel each other, given that the pairs move in the opposite direction 79% of the time.

Similarly, going long on EURUSD and long on AUDUSD could make sense as the two pairs move in the same direction most of the time. Therefore, if EURUSD showed a strong uptrend, the AUDUSD pair will behave the same. Thus, instead of opening a significant position in EURUSD, one can diversify their holdings by going long AUDUSD or NZDUSD, which have a positive currency pair correlation.

Diversification is essential in the forex market, allowing traders to reduce risk in one currency pair. Given the different monetary policies of central banks, it would make sense to go long or short; other currency pairs with a direct or positive correlation.

The pairs trading strategy entails focusing on two currency pairs with a strong historical correlation of over 80 or below -80. For instance, GBPUSD shares a strong positive correlation with GBP/JPY at 88. Conversely, whenever GBPJPY is tanking because of pound weakness, a trader can open a short position on both pairs to take advantage of the prevailing weakness.

Additionally, GBPUSD has a robust negative correlation with EURGBP at -90. Consequently, whenever GBPUSD is trending up in the price chart affirming pound strength, one can enter a short position on the EURGBP as the pair moves in the opposite direction to GBPUSD.

Hedging occurs when a trader does not want to exit a position but wants to offset or reduce losses on a trade that is already running. For instance, if a trader is long the EURUSD pair and it reverses course and starts making losses, it means the U.S. dollar is strengthening across the board.

Consequently, a trader can hedge against losses on the EURUSD by opening a short position on the AUDUSD pair. Given that the two pairs have a positive forex correlation as the first position accrues losses, the second position, opposite the first, will help offset the losses.

Another hedging strategy could involve highly correlated currency pairs. For instance, one could open a long position on EURUSD to profit from EUR strength. The hedge would be to go short on EURJPY and take advantage of any future EUR weakness.

The use of options also provides an ideal hedging process for correlated currency pairs. For instance, a trader can go long on AUDJPY pair at the 70 level. In return, they can place a put option at 69. Consequently, when the AUDJPY pair starts to fall the trader can exercise the 69 option.

Mastering currency pair correlation is crucial for anyone looking to take advantage of different price actions in the forex market. It is vital to understand how different currency pairs move in relation to one another to avert opening trades that end up canceling each other.

Read about using fractal indicator in trading. Our experts explained a possible fractal trading strategy for your best outcomes. Learn how to trade with fractals on the Index Fundings Blog.

Are you thinking about using the breakout strategy? Check out tips on breakouts trading from our experts on Index Fundings Blog. Read about false breakouts and build your winning strategy.

Read about news impact on Forex. How to understand forex news? Explore how to trade the news in Forex market: trading strategy from our experts on the Index Fundings Blog.

What is a stop-loss and how to use it? How to determine stop-loss and where to set it? Difference between the stop loss and stop limit on the Index Fundings Blog.

Read about emotions in trading and check out how can you master your trading psychology. Build your trading confidence with our tips on trading psychology.

Check out the best indicators for swing trading in our article and trade with maximum profits. Top technical indicators for swing trading on the Index Fundings Blog.

Indicators and tools that forex traders use to identify the direction of the trend. Read how to determine whether a currency pair is in a trending market on the Index Fundings Blog.

Day trading with $1000: how to start day trading with 1000 dollars, tips on how not to lose, and how much can you make. Strategy for small day traders on the Index Fundings Blog.

What is range trading? How to identify the range? What range trading strategy to choose? Find the answers to these questions on the Index Fundings Blog.

How to be a successful scalper? Check out our scalping tips and techniques. Read our Do's and Dont's and scalp successfully with Index Fundings.

Notifications