Read about using fractal indicator in trading. Our experts explained a possible fractal trading strategy for your best outcomes. Learn how to trade with fractals on the Index Fundings Blog.

Forex is the most liquid market in the world, with a daily turnover of over $6.6 trillion. The market pools together various market participants, from retail traders to institutional investors and big corporations mostly made up of banks.

Market participants speculate on various currencies as corporations enable exchanges on international trade. Trading occurs through spread betting or contracts for difference, both leveraged financial instruments.

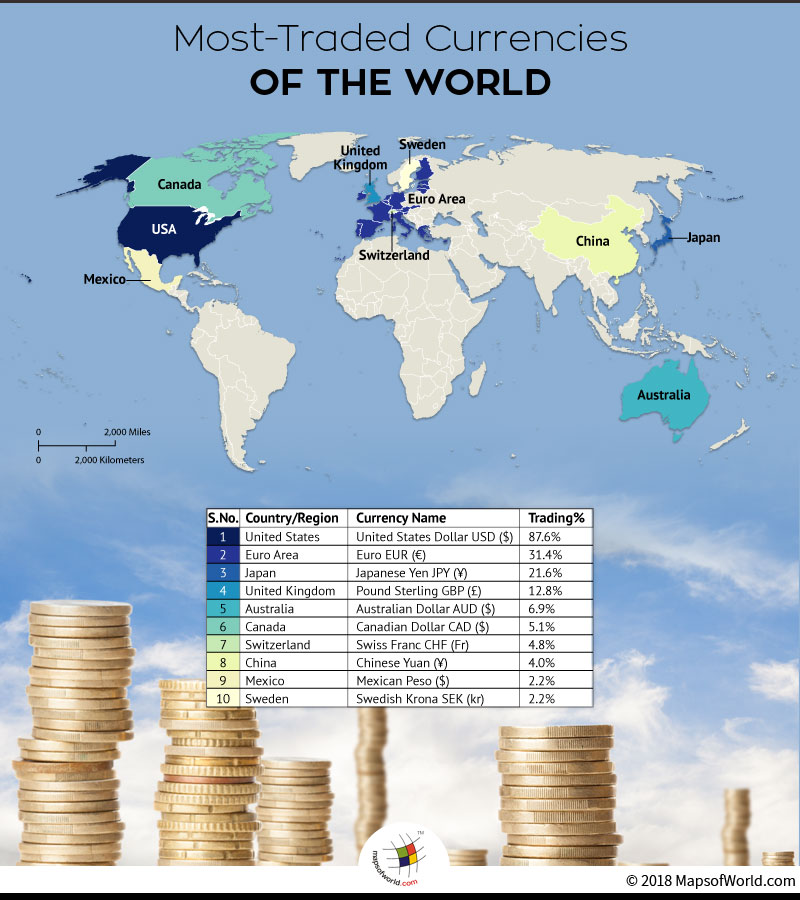

While dozens of currencies are speculated in the forex market, some stand out for their liquidity and ability to provide unique trading opportunities. Below are some of the most traded currencies.

The U.S. dollar is the most valuable currency in the world. It is also the most popular and traded currency in the trillion-dollar marketplace. As a global reserve and safe haven, it attracts a daily average trading volume of over $2.9 trillion.

Source: Mapsofworld.com

Its vast popularity has to do with the fact that it is the currency of the world's largest economy. Additionally, it is the global reserve currency held by central and commercial banks worldwide for enabling international trade. Commodities are also priced in dollars, providing another avenue for attracting trading volume.

Readily available data for gauging the health of the U.S. economy also makes the dollar a preferred currency pair for speculation. Consequently, traders are always looking for economic releases such as Non-Farm Payroll, Consumer Price index, and Retail sales that help gauge the health of the U.S. economy, thus, U.S. dollar strength.

The euro is the second most popular traded currency on the forex market and the official currency of the European Union trading block. The currency attracts a trading volume of over $1.1 trillion daily.

Its popularity as a speculation instrument on the forex market stems from the scale and economic clout of the European Union. In addition, readily available financial data from the trading block and geopolitical developments make it easy for speculators to gauge the euro's strength compared to other currencies.

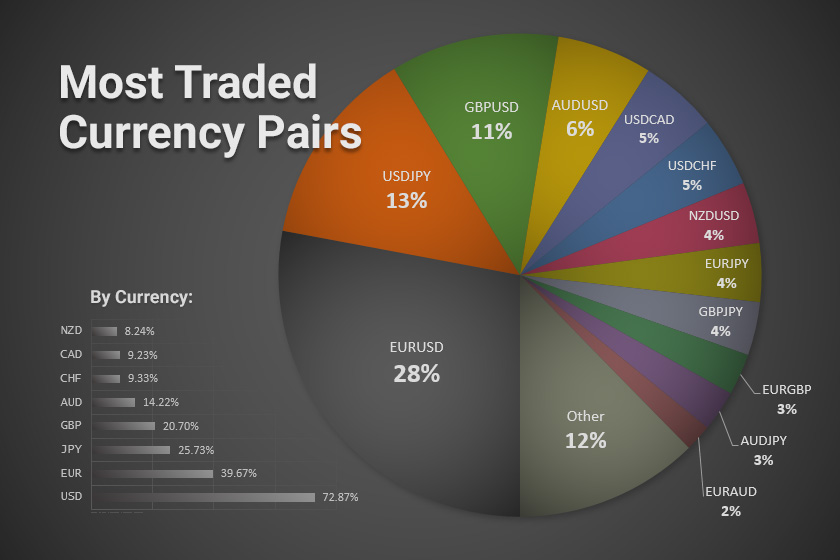

Source: Fxssi.com

Economic releases influencing Euro strength include gross domestic data, employment data, and national and EU-wide elections. Moreover, the euro is the second largest reserve currency after the dollar, which translates to strong demand for it when it comes to finalizing international trade between countries.

When EUR is paired with USD, it gives rise to EURUSD, one of the major currency pairs and the most traded.

The Japanese yen is the third most valuable currency in the world and the forex market, accounting for an average trading volume of about $554 billion. Ranked the third biggest global reserve currency, it accounts for about 4.9% of global reserve currencies.

The currency stands out, backed by the Japanese economy, one of the strongest in the world, going by the strength of the manufacturing sector. Consequently, the health of the Japanese economy influences the yen's strength against other major currencies.

Demand for the yen on the forex market increases as demand for vehicles, electronics, machine tools, and textiles increases. Additionally, monetary policies by the Bank of Japan influence the yen price action in the market in addition to economic data such as GDP and employment numbers.

When paired with the U.S. dollar, USDJPY emerges as one of the forex major pairs. It is also one of the most volatile currencies in the world.

The Sterling pound, the official currency of the United Kingdom is the fourth most-traded currency with a daily average volume of about $420 billion. It also accounts for about 4.5% of global reserves, making it vital to international trade.

The pound's value on the currency market comes down to the U.K.'s economic performance, focusing on GDP data, employment data, inflation, and retail sales numbers. Additionally, traders and institutions closely watch monetary policies by the Bank of England that paints a clear picture of the health of the U.K. economy.

When paired with the US dollar, GBPUSD emerges as one of the forex major pairs and one of the most traded currencies in the world.

The Australian dollar summarizes the five top-traded currencies in the world. It accounts for about $200 billion in traded volume daily on the forex market and accounts for about 1.8% of global reserves by value.

Commodities, Australia's biggest exports, influence the strength of the Australian dollar. The AUD tends to appreciate and gain strength against other major currencies whenever commodity prices increase. The country's biggest exports include coal, iron, and copper.

Additionally, the Reserve Bank of Australia's monetary policies affects the AUD's strength against other currencies. Economic releases such as GDP data, CPI, and retail sales also influence currency fluctuations on the forex market.

AUDUSD is one of the major currency pairs and one of the most traded currencies in the world.

The Canadian dollar is another popular currency on the forex market that moves in step with commodity prices. Crude oil, precious metals, and minerals remain Canada's biggest exports influencing the CAD standing against other major currencies.

Traders and institutions trade the Canadian dollar as a way of speculating on the movements of commodities.

While the forex market plays host to dozens of currencies, the major currency pairs account for more than 80% of traded volume daily. Forex major pairs involving the U.S. dollar attract the most trades, thus volume. Consequently, the most traded currencies include EURUSD, GBPUSD, USDJPY, AUDUSD, and CADUSD, as they tend to give rise to unique trading opportunities daily due to their high liquidity.

Read about using fractal indicator in trading. Our experts explained a possible fractal trading strategy for your best outcomes. Learn how to trade with fractals on the Index Fundings Blog.

Are you thinking about using the breakout strategy? Check out tips on breakouts trading from our experts on Index Fundings Blog. Read about false breakouts and build your winning strategy.

Read about news impact on Forex. How to understand forex news? Explore how to trade the news in Forex market: trading strategy from our experts on the Index Fundings Blog.

What is a stop-loss and how to use it? How to determine stop-loss and where to set it? Difference between the stop loss and stop limit on the Index Fundings Blog.

Read about emotions in trading and check out how can you master your trading psychology. Build your trading confidence with our tips on trading psychology.

Check out the best indicators for swing trading in our article and trade with maximum profits. Top technical indicators for swing trading on the Index Fundings Blog.

Indicators and tools that forex traders use to identify the direction of the trend. Read how to determine whether a currency pair is in a trending market on the Index Fundings Blog.

Day trading with $1000: how to start day trading with 1000 dollars, tips on how not to lose, and how much can you make. Strategy for small day traders on the Index Fundings Blog.

What is range trading? How to identify the range? What range trading strategy to choose? Find the answers to these questions on the Index Fundings Blog.

How to be a successful scalper? Check out our scalping tips and techniques. Read our Do's and Dont's and scalp successfully with Index Fundings.

Notifications